GBP/USD 5M

The GBP/USD currency pair was falling again on Thursday morning. It was not a very strong movement and the volatility of the fourth trading day of the week was twice as low for the pound than for the euro. Nevertheless, the British currency still renewed its 2-year lows, which means it continues to fall against the US currency. The UK published quite important reports on GDP and industrial production in the morning. The second is less important. Even one report on GDP, in principle, would be enough for the pound to continue to fall. However, the irony lies precisely in the fact that the pound fell mainly before the release, but not after. Thus, formally the market had the right to sell the pound yesterday and worked out the statistics from Great Britain, but in fact this is a very controversial statement. Most likely, the market again ignored the macroeconomic reports, as it has happened more than once in recent weeks. There is practically no geopolitical news from Ukraine now, only political ones. The foundation was missing on Thursday. Therefore, the question again arises, and on the basis of what the pound continues to fall???

No trading signals were formed on Thursday. Even the day before yesterday, the pair overcame the extreme level of 1.2259, since then it has not even approached any important level or line. The Ichimoku indicator lines are now much higher, and there are very few extreme levels at current price values, since the price was last here two years ago.

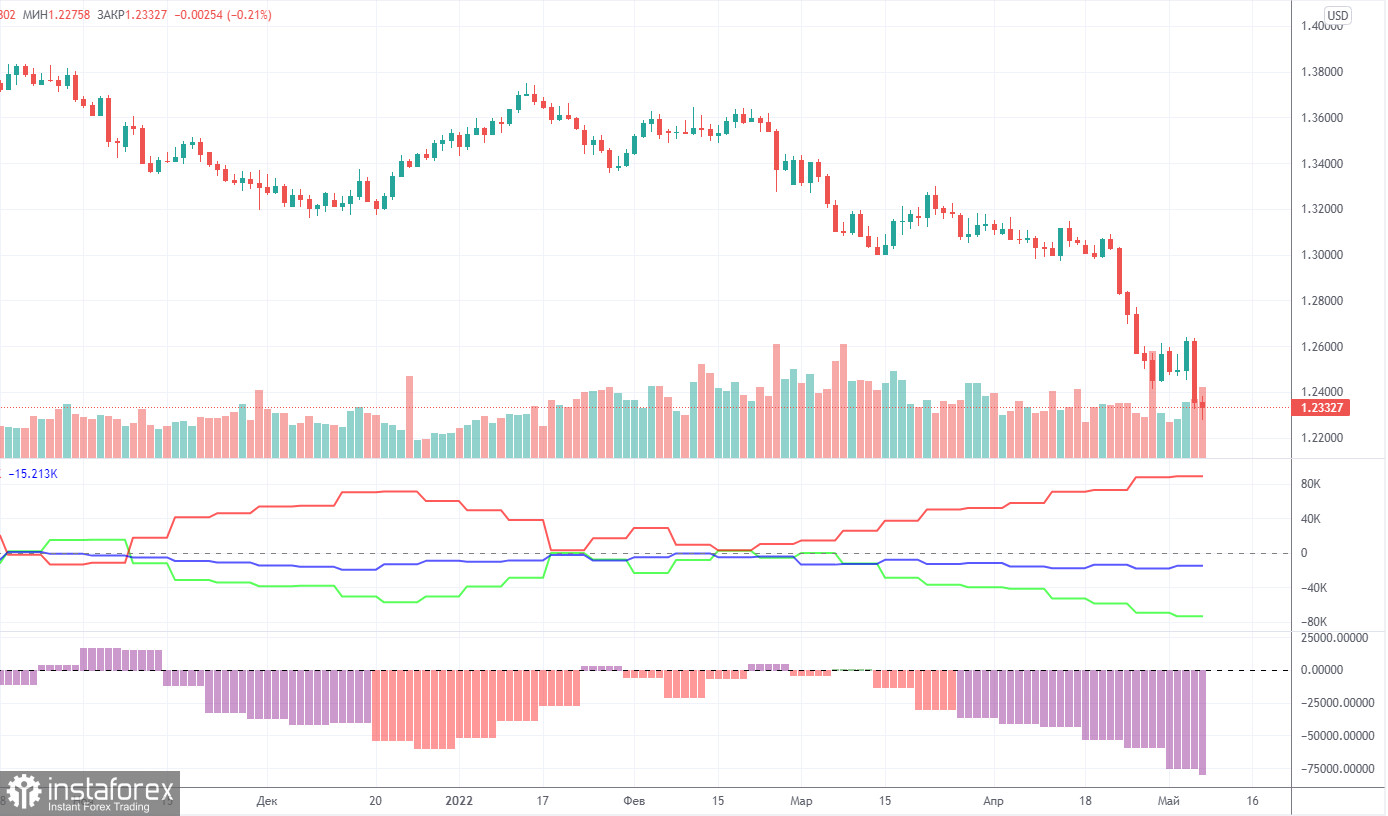

COT report:

The latest Commitment of Traders (COT) report on the British pound has witnessed a new increase in bearish sentiment among professional traders. During the week, the non-commercial group closed 6,900 long positions and 2,700 short positions. Thus, the net position of non-commercial traders decreased by another 4,000. The net position has been falling for 2.5 months already, which is perfectly visualized by the green line of the first indicator in the chart above. The non-commercial group has already opened a total of 107,000 short positions and only 33,500 long positions. Thus, the difference between these numbers is threefold. This means that the mood among professional traders is now "pronounced bearish" and this is another factor that speaks in favor of the continuation of the fall of the British currency. Note that in the pound's case, the data from the COT reports very accurately reflects what is happening in the market. Traders are "strongly bearish" and the pound is also falling strongly against the US dollar. Assume the end of the downward trend, we do not see any reason. COT reports, foundation, geopolitics, macroeconomics, technique, all speak in favor of the fall of the pound and the rise of the dollar. Of course, the fall of the pound/dollar pair cannot continue forever, there must be at least upward corrections, but so far, there is not a single signal about the beginning of one.

We recommend to familiarize yourself with:

Overview of the EUR/USD pair. May 13. Finland and Sweden will apply for NATO membership within a week.

Overview of the GBP/USD pair. May 13. New absolutely groundless fall of the pound. Even despite the weak GDP.

Forecast and trading signals for GBP/USD on May 13. Detailed analysis of the movement of the pair and trading transactions.

GBP/USD 1H

You can clearly see on the hourly timeframe that the pound has left the horizontal channel and resumed the downward trend. At this time, there is still no trend line or channel, as the movements remain rather jagged. However, this does not prevent the pound from regularly losing ground against the US currency. The British currency has not been able to properly correct against the last fall of 800 points. We highlight the following important levels on May 13: 1.2073, 1.2259, 1.2405-1.2410. Senkou Span B (1.2285) and Kijun-sen (1.2445) lines can also be sources of signals. Signals can be "rebounds" and "breakthrough" of these levels and lines. The Stop Loss level is recommended to be set to breakeven when the price passes in the right direction by 20 points. Ichimoku indicator lines can move during the day, which should be taken into account when determining trading signals. The chart also contains support and resistance levels that can be used to take profits on trades. Nothing particularly interesting in the UK or in the US on Friday. The University of Michigan Consumer Sentiment Index is unlikely to provoke a strong market reaction. However, given the mood of the market, we will not be at all surprised if the pound finds grounds for a new fall tomorrow. The nearest target is the 1.2073 level, the low of May 18, 2020.

Explanations for the chart:

Support and Resistance Levels are the levels that serve as targets when buying or selling the pair. You can place Take Profit near these levels.

Kijun-sen and Senkou Span B lines are lines of the Ichimoku indicator transferred to the hourly timeframe from the 4-hour one.

Support and resistance areas are areas from which the price has repeatedly rebounded off.

Yellow lines are trend lines, trend channels and any other technical patterns.

Indicator 1 on the COT charts is the size of the net position of each category of traders.

Indicator 2 on the COT charts is the size of the net position for the non-commercial group.