The EUR/USD currency pair fell into the abyss during the fourth trading day of the week. The pair resumed its fall almost out of the blue, although this was not preceded by anything that could provoke this movement. We have said in previous articles that almost the only growth factor for the euro currency may now be the need to adjust from time to time. However, it seems that in reality, things are exactly the opposite. It is precise because of the inability to adjust at this time that the pair resumed almost a landslide fall. It should be noted that the last few days have become "black" for the US stock market and the cryptocurrency market. We have seen record falls that cannot even be considered completed yet. Therefore, against the general background, the new fall of the euro and the pound no longer even looks scary. Nevertheless, we stand by our opinion: the current fall of the euro is already absolutely illogical, the market continues to sell out simply by inertia, speculators are attacking, since the trend is strong and more and more new participants who want to make money from this collapse are joining it.

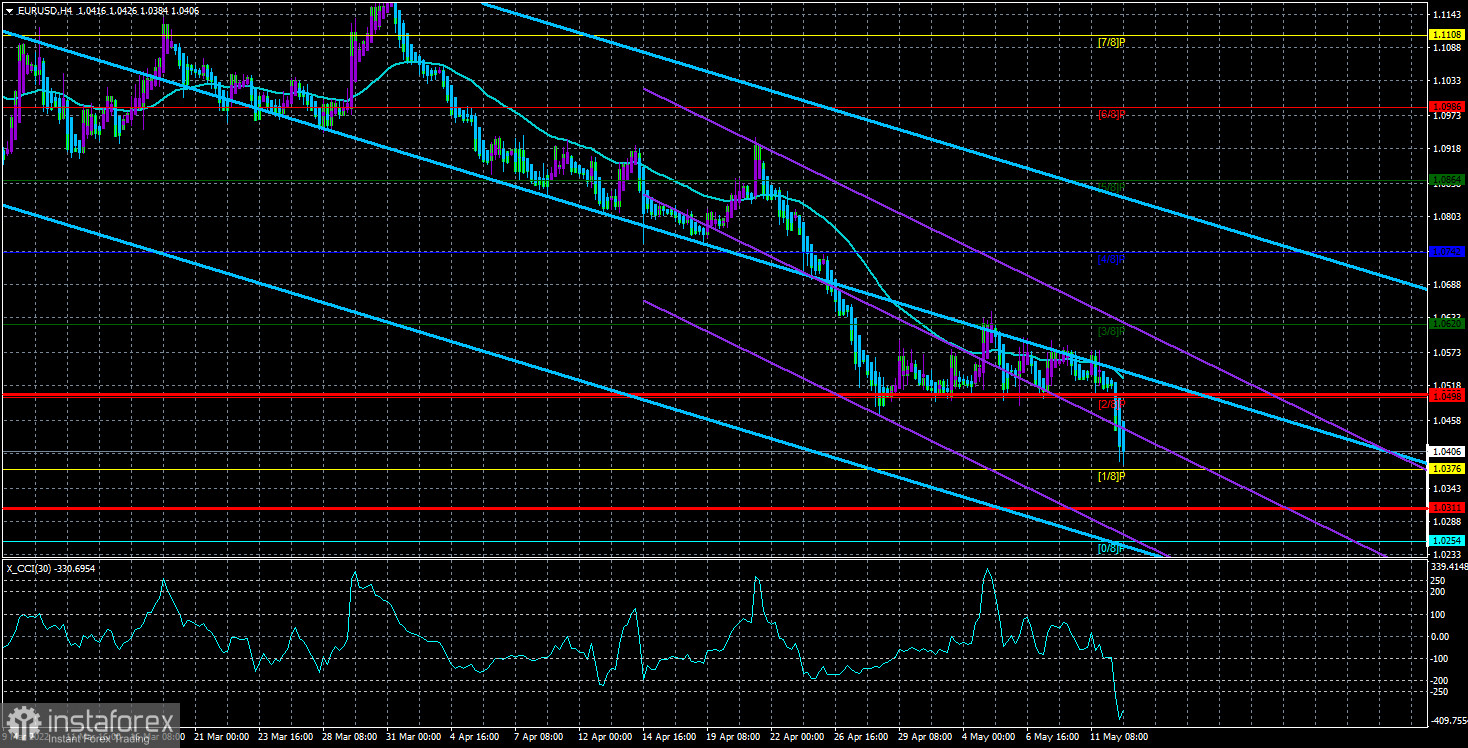

Also note that from a technical point of view, everything comes out almost perfectly. The illustration above clearly shows that the pair first traded near the Murray level of "3/8"-1.0620 - the closest level to the price at that time. And then it couldn't overcome even the moving, which was generally located several dozen points away from her. That is, we did not see a correction, but even a rollback to the top. Well, since there are simply no bulls on the market, then a new drop-in quote is quite logical. Now the euro currency is at arm's length from its 20-year lows and it may update them in the coming days. And then the price parity is just around the corner. We thought that the goal of 1.0000 was an actual goal for 2022. In practice, this level can be worked out already in late May-early June. The CCI indicator is now in the oversold area, well below the -250 level. This is usually a signal to buy.

Finland and Sweden were not afraid of the Kremlin's threats.

Well, let's digress a little from the macroeconomic theme, full of negativity, and pay attention to geopolitics, full of negativity. There is not much to say about the military conflict in Ukraine yet, but there is something to say about world geopolitics. In the last two months, we have repeatedly drawn the attention of traders to the fact that military actions may well spill out beyond the territory of Ukraine. Recall that the Kremlin called the main reason for the introduction of Russian troops into Ukraine the unwillingness to have NATO military bases on its border (at that time Kyiv wanted to apply for membership in the bloc). The Kremlin will receive the same NATO bases just on the other border. On the border with Finland, which is much longer than with Ukraine.

Finland and Sweden have been thinking for several weeks, but now they have made a final decision - within a week both countries are applying for membership in NATO. The Kremlin has already reacted to this message, once again threatening the countries with "consequences." Dmitry Peskov said that joining NATO of the aforementioned countries will not add to security on the continent. Dmitry Medvedev openly wrote in his telegram channel that NATO military exercises near the borders of Russia could provoke a Third World War in which there would be no winners. Finnish President Sauli Niinisto also replied to the Russian authorities that they pushed his country to join NATO and that joining the military alliance would not pose a threat to Russia. "We are thinking about how to protect our country. If we want to take care of our safety, no one can forbid us to do it. It can't hurt anyone that someone wants to protect themselves," Niinisto said. "Moscow has long said that the non-aligned status of Finland and Sweden guarantees stability in the Baltic region. However, at the end of last year, they announced that Finland and Sweden could not join NATO. This statement completely changed everything. We and Sweden were non-aligned countries by choice. But the statement of the Russian Federation means that we cannot decide the fate of our countries ourselves. This change made us think," Niinisto summed up.

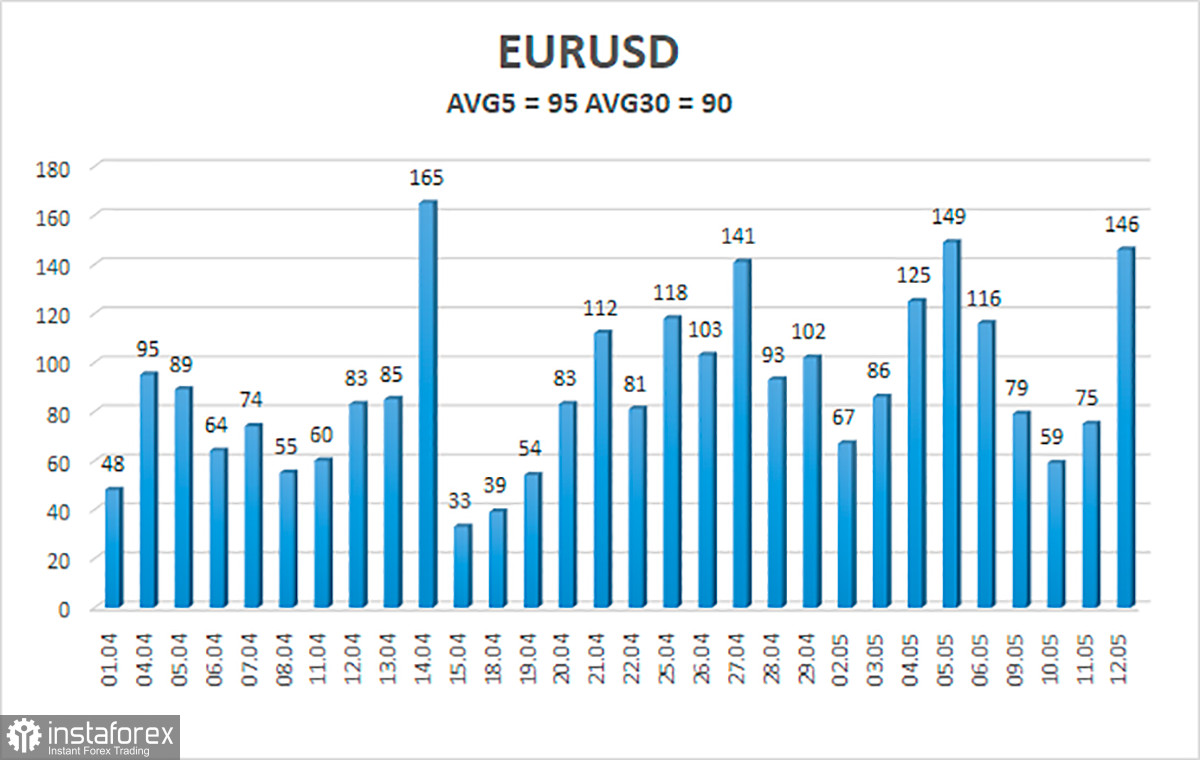

The average volatility of the euro/dollar currency pair over the last 5 trading days as of May 13 is 95 points and is characterized as "high". Thus, we expect the pair to move today between the levels of 1.0311 and 1.0501. The upward reversal of the Heiken Ashi indicator will signal a new attempt to correct it.

Nearest support levels:

S1 – 1.0376

S2 – 1.0254

S3 – 1.0132

Nearest resistance levels:

R1 – 1.0498

R2 – 1.0620

R3 – 1.0742

Trading recommendations:

The EUR/USD pair continues to form a downward trend. Thus, now you should stay in short positions with targets 1.0311 and 1.0254 until the Heiken Ashi indicator turns up. Long positions should be opened with a target of 1.0620 if the price is fixed above the moving average.

Explanations of the illustrations:

Linear regression channels - help determine the current trend. If both are directed in the same direction, then the trend is strong now.

Moving average line (settings 20.0, smoothed) - determines the short-term trend and the direction in which trading should be conducted now.

Murray levels - target levels for movements and corrections.

Volatility levels (red lines) - the likely price channel in which the pair will spend the next day, based on current volatility indicators.

CCI indicator - its entry into the oversold area (below -250) or into the overbought area (above +250) means that a trend reversal in the opposite direction is approaching.