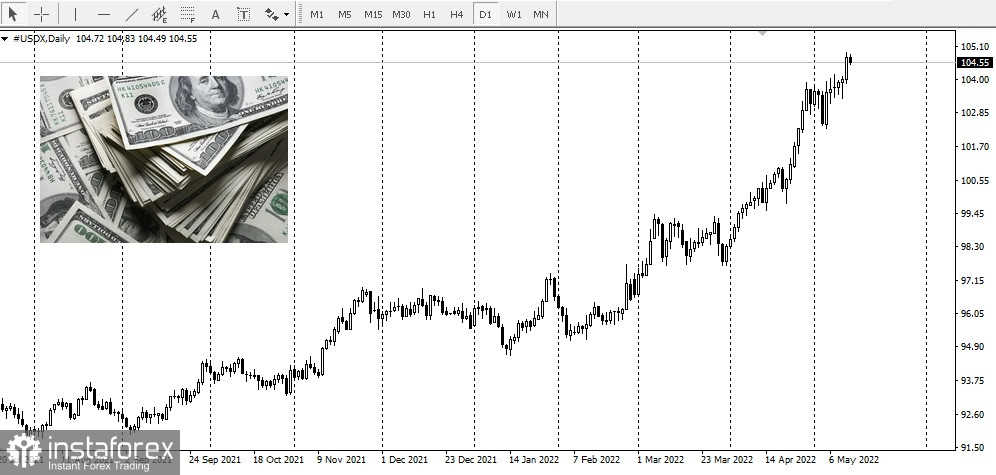

Gold prices stay near a three-month low, attracting little investor interest, even as inflationary pressures remain elevated.Many commodity analysts say gold is having a hard time as it faces significant bullish momentum from the US dollar, which continues to trade at its highest levels in 20 years.The US dollar index last traded at 104.73 points, up 0.41% for the day.

Meanwhile, last time gold traded at $1821.78 an ounce, falling by 0.81% for the day.

Meanwhile, last time gold traded at $1821.78 an ounce, falling by 0.81% for the day.

According to some currency analysts, the precious metal could still face headwinds as the US dollar trend will not change, at least until the summer.

According to some currency analysts, the precious metal could still face headwinds as the US dollar trend will not change, at least until the summer.

CIBC Capital Market North America head of currency strategy Bipan Rai said that there were several factors that would support the US dollar over the next few months. First and foremost is that the Fed is hawkish and plans for a long-term rate hike. Secondly, the US dollar is stronger than the currencies of other countries, where policy options are adapting more slowly or diverging.However, in the longer term, Rai said that the US dollar would not be able to maintain its current momentum.Looking ahead, currency analysts at Capital Economics suggest that the US dollar index could rise to 108 in the coming months, a 3% increase from current levels.

It is not only the aggressive monetary policy plan of the Federal Reserve that is supporting the US dollar. The growing risk of a global economic downturn is also giving the dollar a solid buying impetus. The balance of risks is heavily tilted in favour of the dollar. Should the global economy slow more than the pessimistic forecasts suggest, and even if the Fed eases the tightening cycle, the dollar is likely to continue to rise as demand for safe haven increases. Economists at Capital Economics said the only thing that could slow the US dollar was a recovery in the global economy and an improved balance between growth and inflation.

It is not only the aggressive monetary policy plan of the Federal Reserve that is supporting the US dollar. The growing risk of a global economic downturn is also giving the dollar a solid buying impetus. The balance of risks is heavily tilted in favour of the dollar. Should the global economy slow more than the pessimistic forecasts suggest, and even if the Fed eases the tightening cycle, the dollar is likely to continue to rise as demand for safe haven increases. Economists at Capital Economics said the only thing that could slow the US dollar was a recovery in the global economy and an improved balance between growth and inflation.

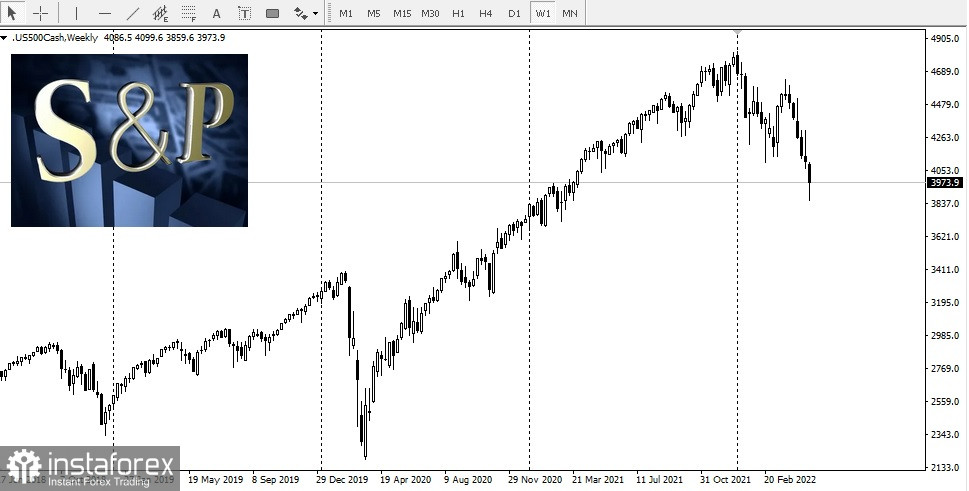

Despite the fact that the US dollar is creating a challenging environment for gold, commodity analysts are not yet ready to give up on the precious metal. Many of them note that gold continues to perform quite well compared to other assets.While gold is flat for the year, the S&P 500 is down about 17%.

All of these factors should encourage institutional investors to maintain their existing gold positions as insurance against uncertainty. This could prevent a strong sell-off in the gold market.

All of these factors should encourage institutional investors to maintain their existing gold positions as insurance against uncertainty. This could prevent a strong sell-off in the gold market.