The GBP/USD pair crashed in the short term as expected as the Dollar Index registered a strong rally. Now, it was trading at 1.2295 at the time of writing. The price seems very heavy, so a further drop is possible.

Fundamentally, the UK reported poor data today. On the other hand, the US data was disappointing as well. CB Consumer Confidence index came in at 107.1 versus the 109.1 expected and below 109.0 in the previous reporting period. Also, the US Chicago PMI came in at 44.3 points versus the 45.1 points expected. Surprisingly or not, the greenback remained very strong, but it remains to see how it will reach in the upcoming hours, ahead of the FOMC.

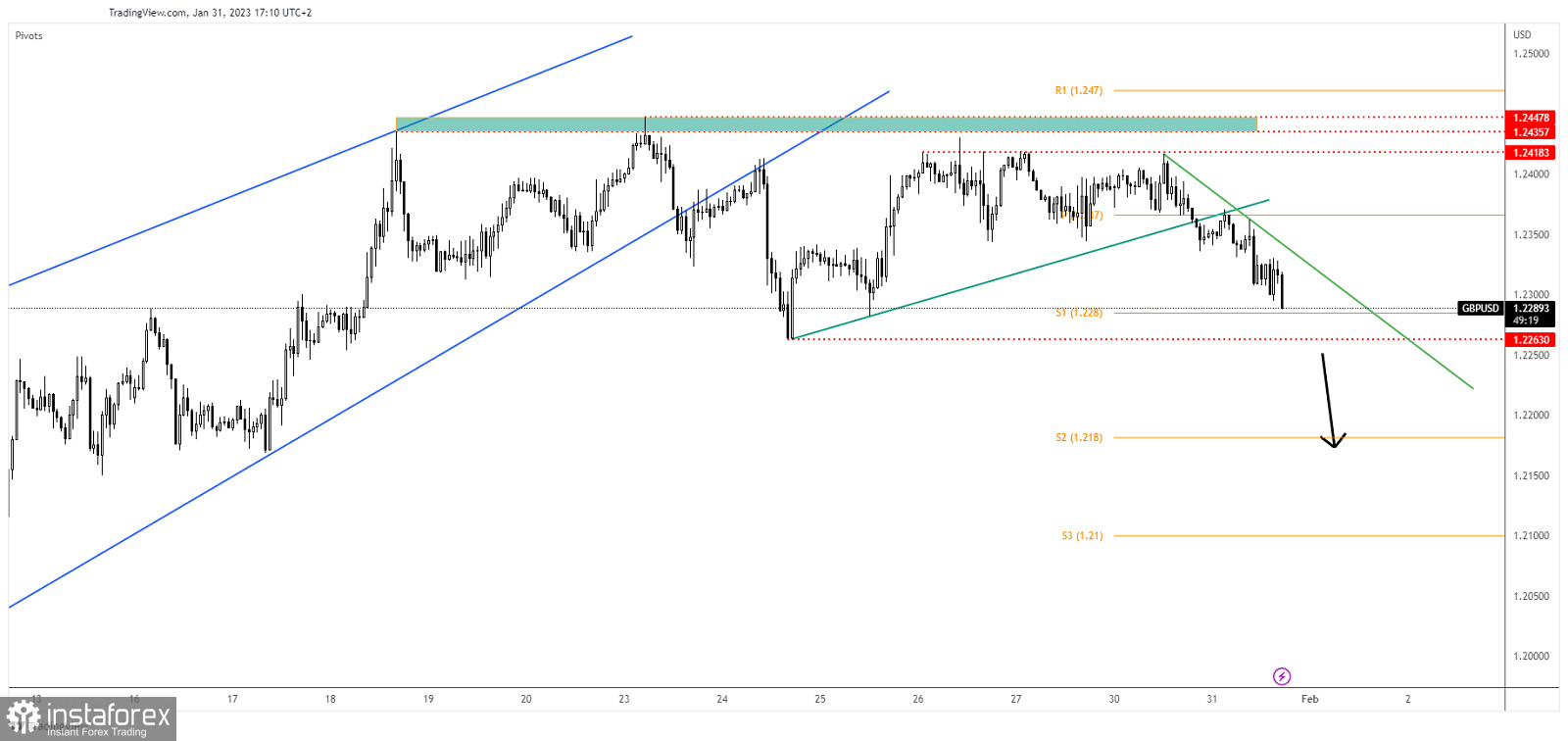

GBP/USD New Downtrend!

Technically, you knew from my former analysis that GBP/USD could develop a strong downside movement if it takes out the uptrend line. It has registered a valid breakdown below the uptrend line and through the weekly pivot point of 1.2370.

Now, it has reached the weekly S1 (1.2280) which stands as a downside obstacle. 1.2263 represents static support as well.

GBP/USD Forecast!

Personally, I've drawn a minor downtrend line as a dynamic resistance. A new lower low, a valid breakdown below 1.2263 activates more declines and brings new selling opportunities. As long as it stays below the new downtrend line, the rate could approach and reach new lows.