The EUR/USD currency pair remained in one place almost all day on Friday. The market is tired after another rather active week, during which the euro currency showed another drop. But, what is very remarkable, an upward correction did not begin on Friday. Recall that on Friday traders like to fix some positions to leave quietly for the weekend. Therefore, a corrective movement is often observed. But this option is not currently available to the euro. The pair has not been able to correct for a very long time, which continues to signal that the bears are not going to leave the market and give the initiative to the bulls. With this scenario, the European currency can calmly continue to fall. It is already near its 20-year low, but what does it matter for traders? There is a strong trend, you can work and earn good money. Therefore, although we believe that the European currency has already been oversold very much and is below its real position, it can continue to fall further.

Separately, it should be noted that the geopolitical and fundamental backgrounds now play a much smaller role in exchange rate formation than a couple of months ago. The military conflict in Ukraine seems to have completely moved into the "positional phase". This means that fighting will continue for a long time almost along the entire front line, but the market needs news, not about the ongoing battles, but about peace talks, about the escalation or de-escalation of the conflict. There are simply no such people now. The same goes for the fundamental background. The market has had the opportunity to work out the difference in the monetary approaches of the ECB and the Fed 10 times already since this information has not been a secret for anyone in the last six months. But we would like to note that a lower rate of one Central Bank is not a reason for the eternal fall of the currency of this Central Bank. That is, the euro cannot fall all the time while the ECB rate is lower than the Fed rate. And, from our point of view, the factor of divergence of rates has been worked out a long time ago. We believe that now the euro and the pound continue to fall simply by inertia because a strong downward trend persists.

The EU calendar for the new week is full of important data, but in fact, it is not.

To be honest, it doesn't make much sense to pay attention to "macroeconomics" now. It can provoke a market reaction and a local reaction of the pair, but it does not affect the overall trend. A very important point: The GDP of the European Union in the first quarter was +0.2%, and in the US -1.4%, but the dollar is still growing. Thus, if you are trading intraday, then you need to pay attention to macroeconomic publications. There will be quite a lot of them this week. Let's see what is planned in the European Union.

On Tuesday, the report on GDP in the first quarter will be published in the second estimate. It is the "second assessment" that does not give reason to expect that at least some reaction will follow this report at all. In quarterly terms, the indicator will be almost one hundred percent 0.2%, as in the first estimate, so the market has already "digested" this value. Also on this day, ECB President Christine Lagarde will give a speech. It is Lagarde's speech that may be the most important event of the week, as increased attention is now focused on her. The market is waiting for Lagarde to give clear answers to the questions: what is the ECB planning, how many times is it ready to raise the rate, when will the QT program start, and when will the rate be raised for the first time? Inflation for April will be released on Wednesday, but in the final estimate. That is, the market is again already ready for the value of 7.5% y/y. These are all the events for this week in the EU. As you can see, only Lagarde's speech will be worth paying attention to, but even it may not cause any market reaction. Recently, the head of the ECB has openly evaded direct answers, and it is not worth counting on Luis de Guindos alone: we do not know what the mood is inside the ECB monetary committee. We believe that there may well not be an increase in July, since now a lot will depend on geopolitics, which tends to change very quickly.

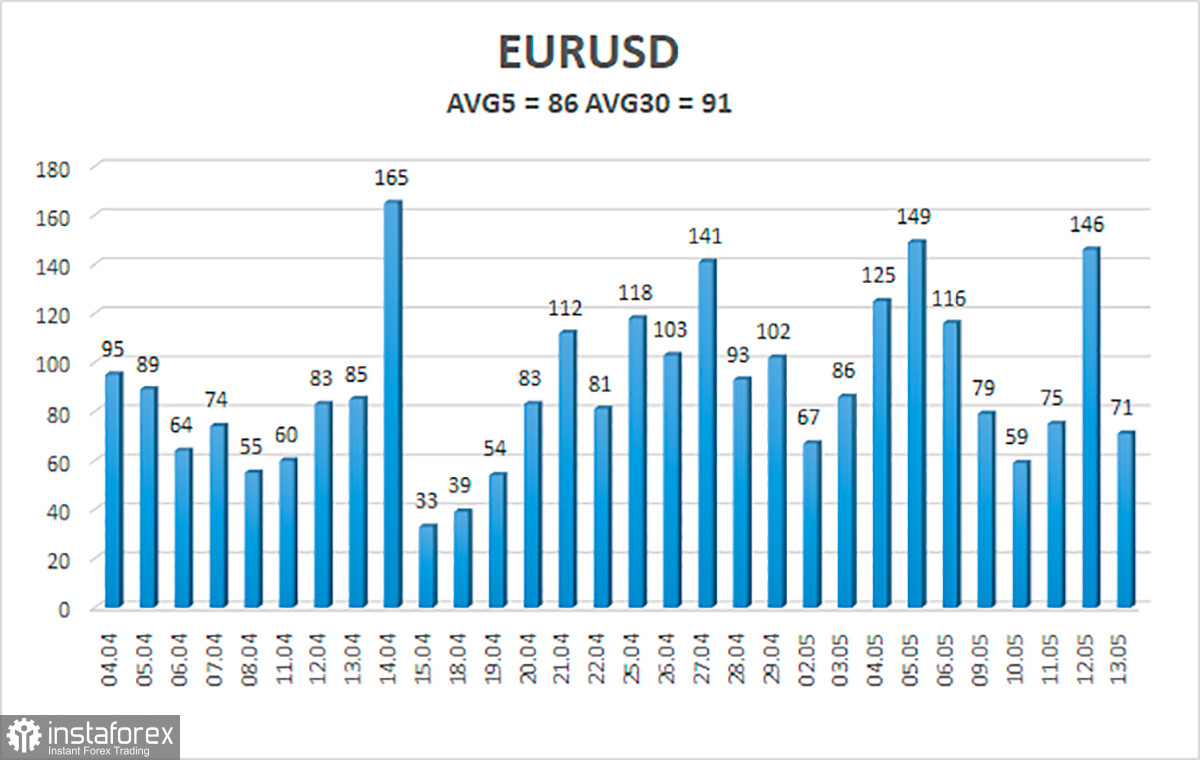

The average volatility of the euro/dollar currency pair over the last 5 trading days as of May 16 is 86 points and is characterized as "high". Thus, we expect the pair to move today between the levels of 1.0327 and 1.0499. A reversal of the Heiken Ashi indicator upwards will signal a new attempt to correct it.

Nearest support levels:

S1 – 1.0376

S2 – 1.0254

S3 – 1.0132

Nearest resistance levels:

R1 – 1.0498

R2 – 1.0620

R3 – 1.0742

Trading recommendations:

The EUR/USD pair continues to form a downward trend. Thus, now we should stay in short positions with targets of 1.0327 and 1.0254 until the Heiken Ashi indicator turns up. Long positions should be opened with a target of 1.0620 if the price is fixed above the moving average.

Explanations of the illustrations:

Linear regression channels - help to determine the current trend. If both are directed in the same direction, then the trend is strong now.

Moving average line (settings 20.0, smoothed) - determines the short-term trend and the direction in which trading should be conducted now.

Murray levels - target levels for movements and corrections.

Volatility levels (red lines) - the likely price channel in which the pair will spend the next day, based on current volatility indicators.

CCI indicator - its entry into the oversold area (below -250) or into the overbought area (above +250) means that a trend reversal in the opposite direction is approaching.