As you remember, last week, we once again noted the ultra-soft monetary policy that the Bank of Japan adheres to. Let me remind you that the head of the Bank of Japan, Kuroda, applied negative interest rates for the first time back in 2016. First of all, this was due to the prevention of the appreciation of the national currency, which is traditionally in demand on the market as a protective asset. In the current situation, the Bank of Japan continues to declare a soft monetary policy, but the analytical departments of some large commercial banks do not exclude that the BoJ may change its rhetoric and resort to raising rates. To tell the truth, such a development of events seems extremely unlikely, but it has also happened on the market, so nothing can be completely ruled out.

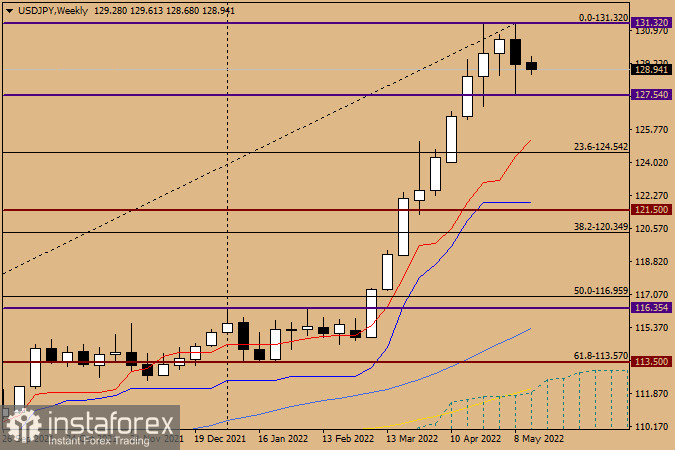

Weekly

I do not know if such information affected the price dynamics of the USD/JPY currency pair, only at the auction on May 9-13, did the pair suspend growth and showed a decline. Most likely, this is just a coincidence, since, after such strong and prolonged growth, the correction was asking for itself. As a result of the trading of the last five days, such a pullback occurred, and the pair fell to a strong technical level of 127.55. Another confirmation of the strength of this level was a significant rebound from it and the closing of weekly trading at 129.18. Thus, although the previous bullish candle closed above the important psychological and historical mark of 130.00, the bulls could not repeat such success for this trading instrument. I would like to draw your attention to the maximum values of the last candle, shown at 131.32, and the already mentioned lows at 127.54. This factor indicates very high volatility with which the dollar/yen was traded at the auctions of the past five days. Now about the very last candle. In my opinion, it causes quite contradictory impressions. A strong rebound from 127.54, which resulted in such an impressive lower shadow, indicates that bullish sentiment is persisting and quite significant. On the other hand, if the bearish body was a little smaller and the lower shadow was longer, this candle could be characterized as a reversal pattern of "Hanged". The main question now is whether the market will perceive the last candle as a reversal signal and whether it will win back. Naturally, we will find out the answer to this burning question only after the actual closing of the current weekly trading. By the way, I do not exclude at all that now for some time USD/JPY trading will take place in the range of 127.54-131.32. In other words, an adjustment in the sidewall is likely.

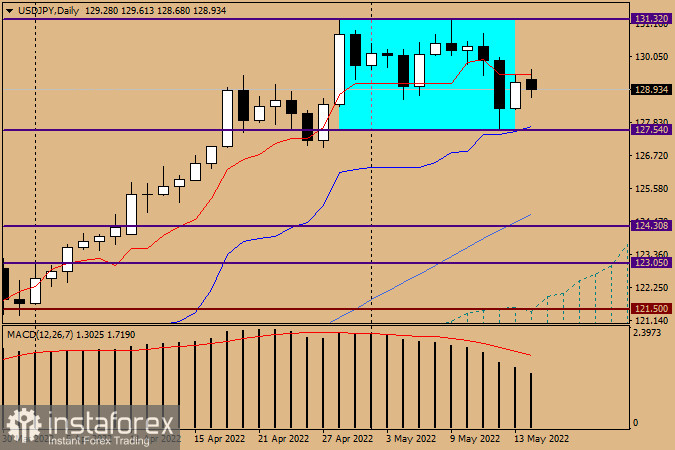

Daily

As you can see, this is exactly what is already happening on the daily chart. The pair is firmly entrenched in the range indicated above, the exit from which will determine the further direction of the course. At the same time, the return of the price above the red Tenkan line of the Ichimoku indicator with an indispensable fixation above it will create prerequisites for subsequent growth towards the upper limit of the 131.32 range. If the support at 127.54 is broken, along with the blue Kijun line, there will be a probability of a deeper corrective pullback, the goals of which will be determined after the pair goes down from the range of 131.32-127.54. With trading recommendations, despite the ongoing upward trend, not everything is so clear. However, for now, I will give my preference to opening positions according to the trend, that is, purchases. I recommend considering the possibility of opening long positions after the breakdown of the Tenkan red line, on a rollback to it, or after the price drops to the support area 127.60-127.50. I believe that this week we will return to the consideration of this currency pair and, if the situation changes, we will make the necessary adjustments to the current trading recommendations.