Stocks in Europe fluctuated and US stock futures fell as traders weighed in on China's latest measures to support its economy after bad data raised concerns about the global outlook.

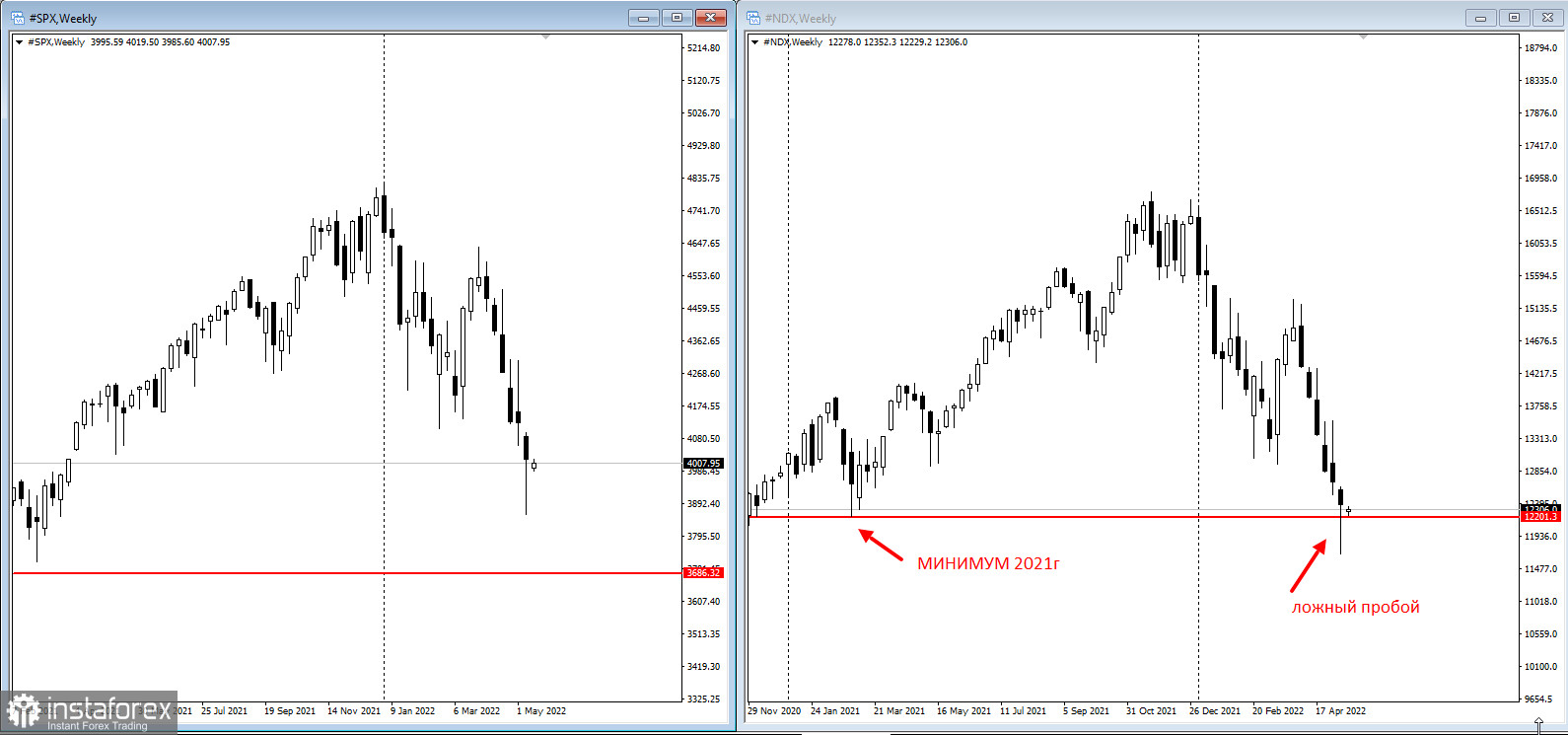

The S&P 500 and Nasdaq 100 hit monthly lows last week and the Nasdaq traded below last year's minimum:

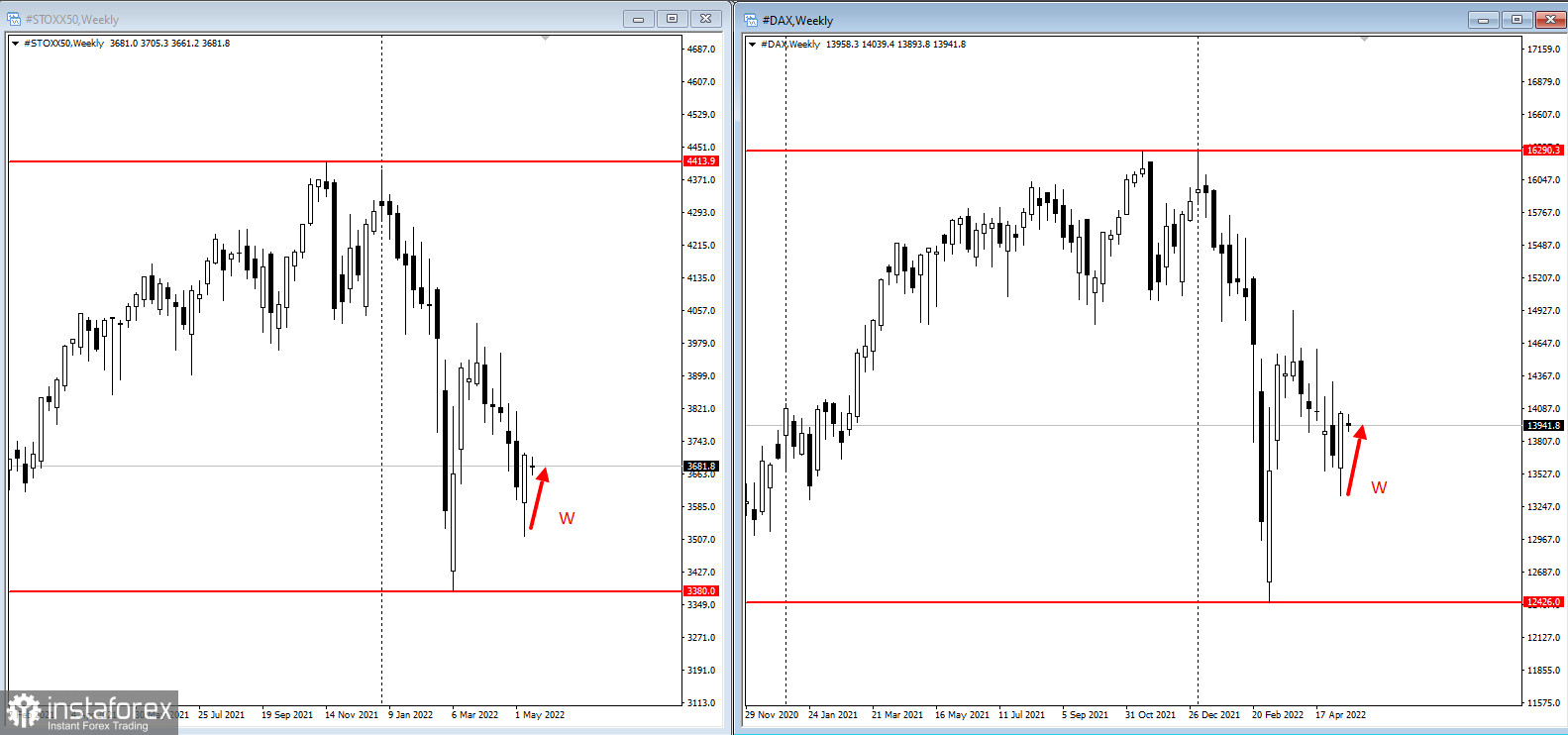

The Stoxx50 and Dax index closed the week in positive territory, but in a bearish trend. Telecoms also advanced as Vodafone Group Plc climbed after Emirates bought a 9.8% stake.

Meanwhile, China's industrial output and consumer spending hit the worst levels since the pandemic began, hurt by Covid lockdowns. Officials are taking deliberate steps to help the economy: China is cutting the interest rate on new mortgages to support the ailing housing market, but the annual loan rate was left unchanged on Monday.

On the bond market, the yield on 10-year US bonds is unchanged, around 2.93%. The key question is whether economic worries will help stem the Treasury sell-off this year, which has been driven by inflation and a tightening of US monetary policy. European bond yields have risen.

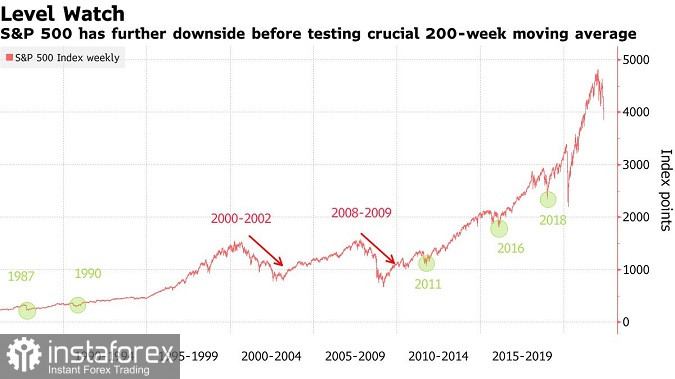

The risk of an economic downturn amid price pressures and rising borrowing costs remains the major worry for markets. Goldman Sachs Senior Chairman Lloyd Blankfein urged companies and consumers to gird for a US recession, saying it's a "very, very high risk." Traders remain wary of calling a bottom for equities despite a 17% drop in global shares this year, with Morgan Stanley warning that any bounce in US stocks would be a bear-market rally and more declines lie ahead.

Food and fuel prices are feeding into rising costs. Wheat jumped by the exchange limit on India's move to curb exports while oil was held around $110 a barrel. Shanghai is close to the necessary threshold for loosening its six-week lockdown, a development that could spur bets on rising energy demand.

Traders are also watching efforts by Finland and Sweden to join the North Atlantic Treaty Organization. A shift in the European security alliance could exacerbate tensions with Russia.

What to watch this week:

- New York Fed President John Williams speaks on Monday

- Fed Chair Jerome Powell among slate of Fed speakers Tuesday

- Reserve Bank of Australia releases minutes of its May policy meeting Tuesday

- G-7 finance ministers and central bankers meeting Wednesday

- Eurozone, UK CPI Wednesday

- Philadelphia Fed President Patrick Harker speaks Wednesday