When Britain becomes the world's epicenter of stagflation, the pound is not to be envied. The most serious cost-of-living crisis and the BoE monetary tightening cycle put the UK economy on the brink of recession and push the GBPUSD quotes to a 2-year bottom. And this is not the limit. Most of the 191 respondents to the MLIV Pulse survey, including traders, economists, asset managers, risk managers, believe that the pair would rather sink to 1.15 than rise to 1.35. The last time it was seen at such a low level was at the peak of the 2020 recession. Even during the hottest times of the Brexit epic, sterling held higher.

GBPUSD Expert Forecasts

With the pandemic and war in Ukraine disrupting supply chains, the entire civilized world is facing the highest inflation in decades and slowing GDP growth. In Britain, the situation is aggravated by the break in relations with the EU. And now the problem of Brexit is again on the radar of investors.

At one time, the movement of goods across the borders of Northern Ireland was the main stumbling block in the negotiations between London and Brussels. Due to serious problems in trade that are fueling a political crisis in the region, Britain intends to unilaterally rewrite the terms of the agreement, which the EU naturally does not like. According to UK Prime Minister Boris Johnson, if Brussels refuses to reform the protocol, the time will come for London to act. The conflict starts to smell like a trade war, which does not benefit the "bulls" either in GBPUSD or in EURUSD.

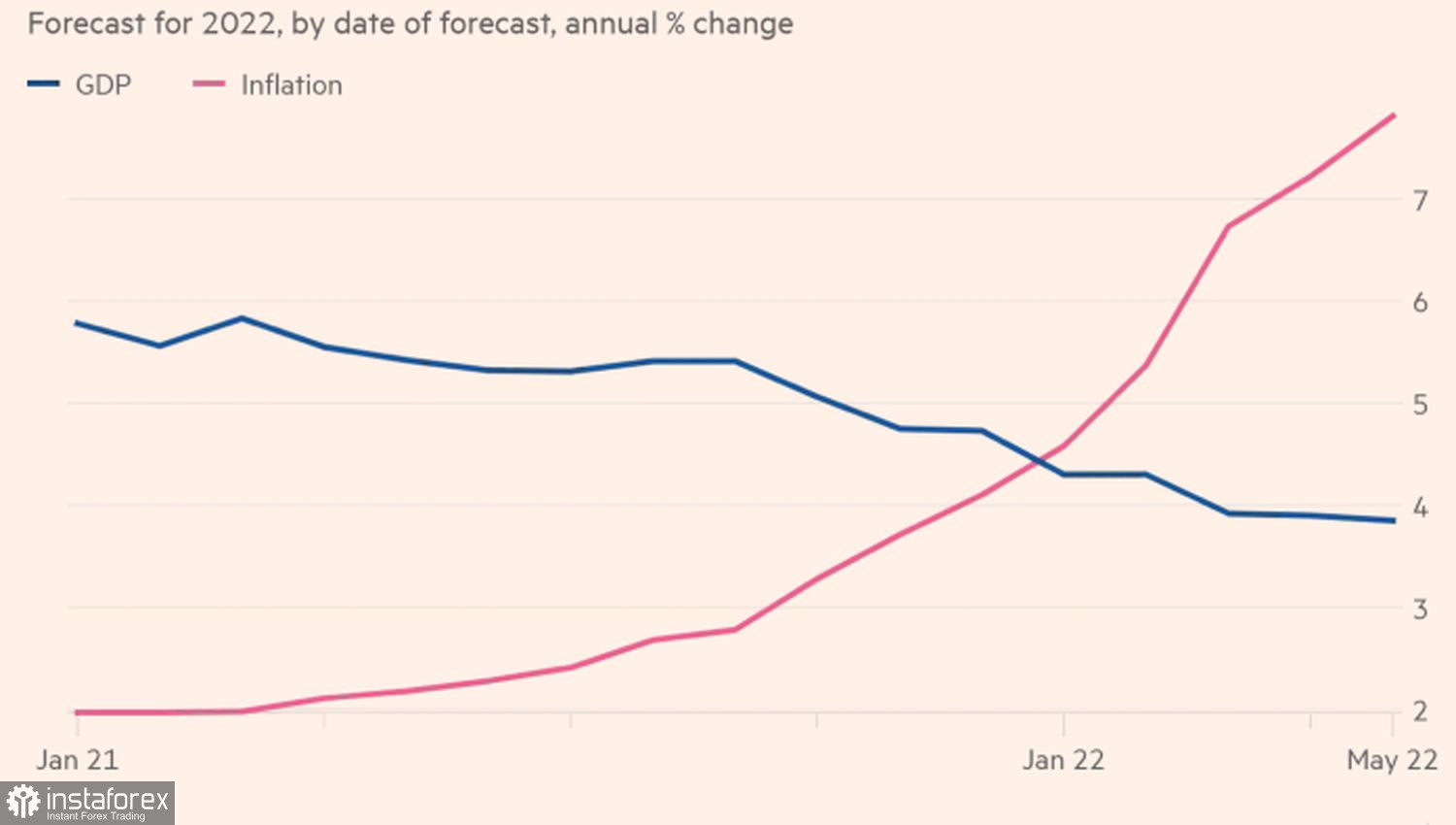

The growth of political risks makes the work of the Bank of England even more difficult. Governor Andrew Bailey and his colleagues have faced a hail of criticism from lawmakers, as they previously tried to convince the public of the temporary nature of high inflation. Say, it will peak at 5%, and then begin to decline by itself. Currently, consumer prices are rising by 7% and due to higher electricity bills, according to Bloomberg experts, they could jump above 9% as early as April. BoE adjusted its forecast to more than 10% by the end of the year and did not even apologize for the notorious 5%.

At the same time, the 0.1% MoM decline in GDP in March confirms the assumption of the Bank of England that the economy at the end of 2022 will be smaller than last year. In the first quarter, it expanded by 0.8% QoQ, which is slower than Bloomberg's consensus forecast of 1%.

Highest inflation since 1989 and slowdown in GDP. This is the very stagflation that scares the GBPUSD bulls. It is quite possible that Britain has already fallen into it.

Dynamics of inflation and GDP in Britain

The busy economic calendar of the week by May 20 makes the pound a favorite for the role of the most interesting monetary unit of the five-day period. Statistics on the labor market and inflation may support it for some time, but not everything is so smooth with retail sales.

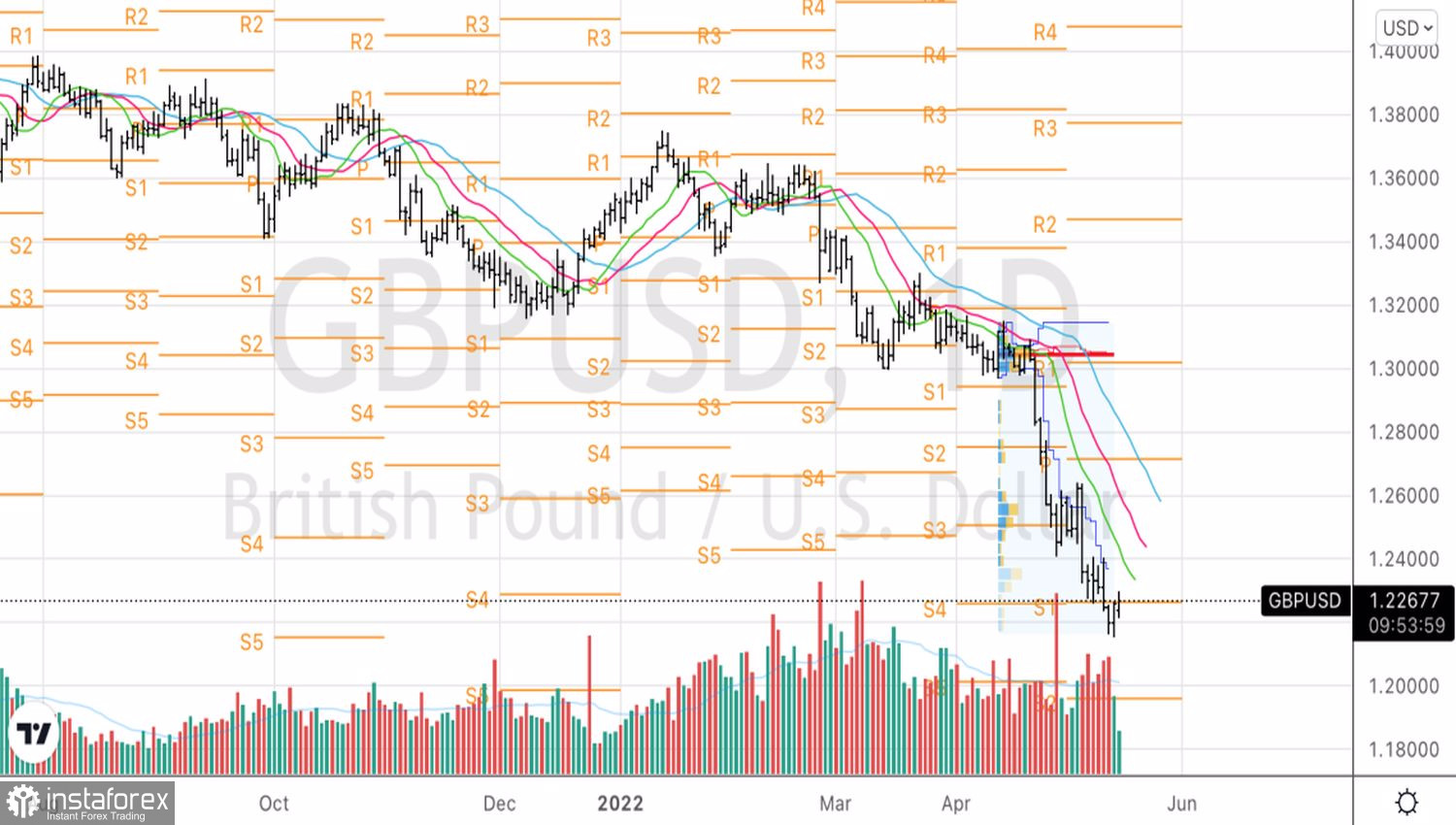

Technically, closing the day above the pivot point at 1.226 will increase the risks of GBPUSD pullback towards 1.236 and 1.2435, where the pair should be sold in the conditions of a pronounced downward trend with a target at 1.2.

GBPUSD, Daily chart