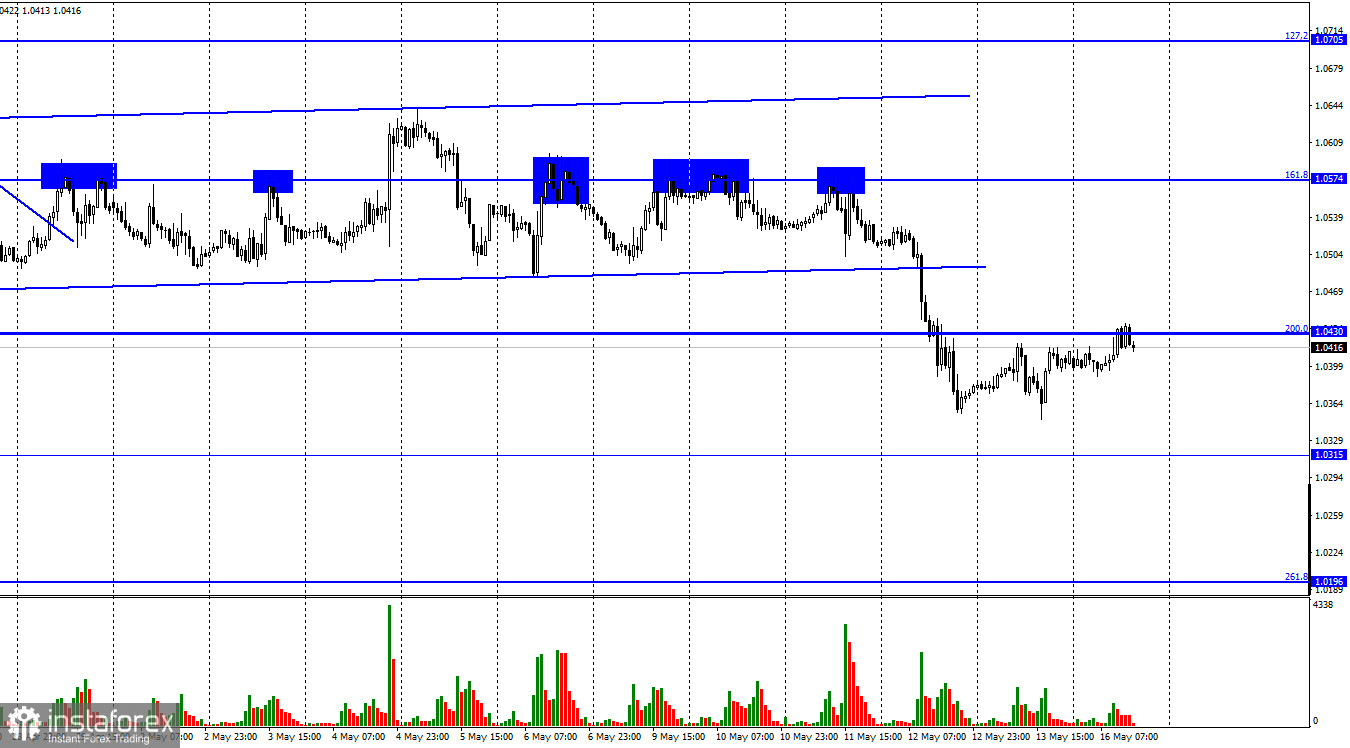

Good afternoon, dear traders! The EUR/USD pair returned to the Fibonacci correction level of 200.0% - 1.0430 on Friday. On Monday, it broke through this level. If the pair rebounds from 1.0430, the US dollar may strengthen against the euro. If so, the euro may decline to the level of 1.0315. Closing above the 1.0430 level will signal a further rise to the Fibo correction level of 161.8% - 1.0574. The euro looks weak to resume an upward movement. In the last two weeks, almost all crucial economic reports have been related to the central banks' monetary policies and key economic reports. In my opinion, they did not significantly affect the mood of traders. However, there were quite important reports, events, etc. Besides, geopolitical tensions are still exerting pressure on the euro. It has been dropping for several months largely due to geopolitical woes. Until February 24, the euro and the pound sterling were in a downtrend. After February 24, they decreased dramatically. What is happening now in Ukraine and how could it impact the further movement of the euro and the pound sterling?

Unfortunately, there is practically no positive news. Both parties are unwilling to start negotiations. There are no events that could lead to a de-escalation of the conflict. Military actions are unfolding. The Russian army is trying to expand the borders of the Luhansk and Donetsk regions. So, the fiercest battles take place there. Meanwhile, NATO allies continue to transfer the weapons to Ukraine.

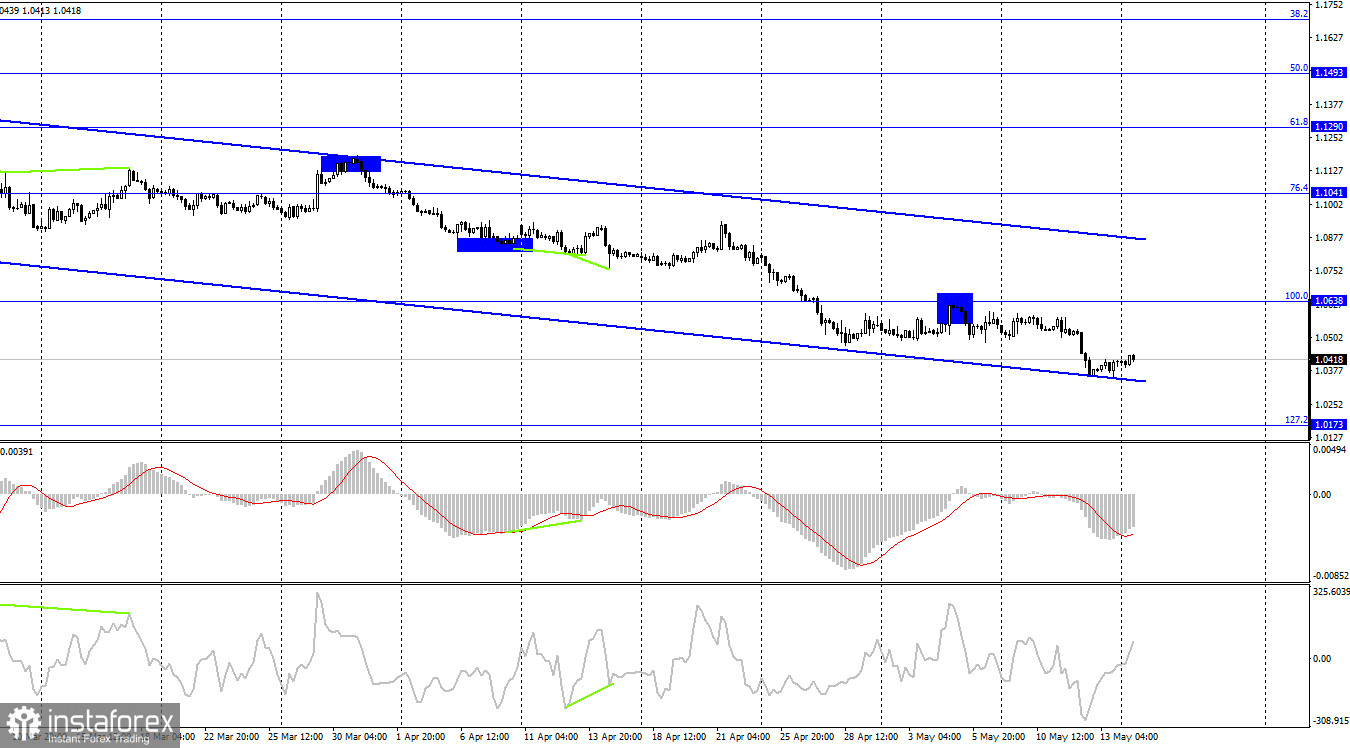

On the 4H chart, the pair rebounded from the Fibonacci correction level of 100.0% - 1.0638. As a result, the US dollar managed to strengthen. The pair dipped to the next Fibo correction level of 127.2% - 1.0173 with the bears remaining in control. Consolidation above the level of 1.0638 will signal growth to the upper border of the downward range.

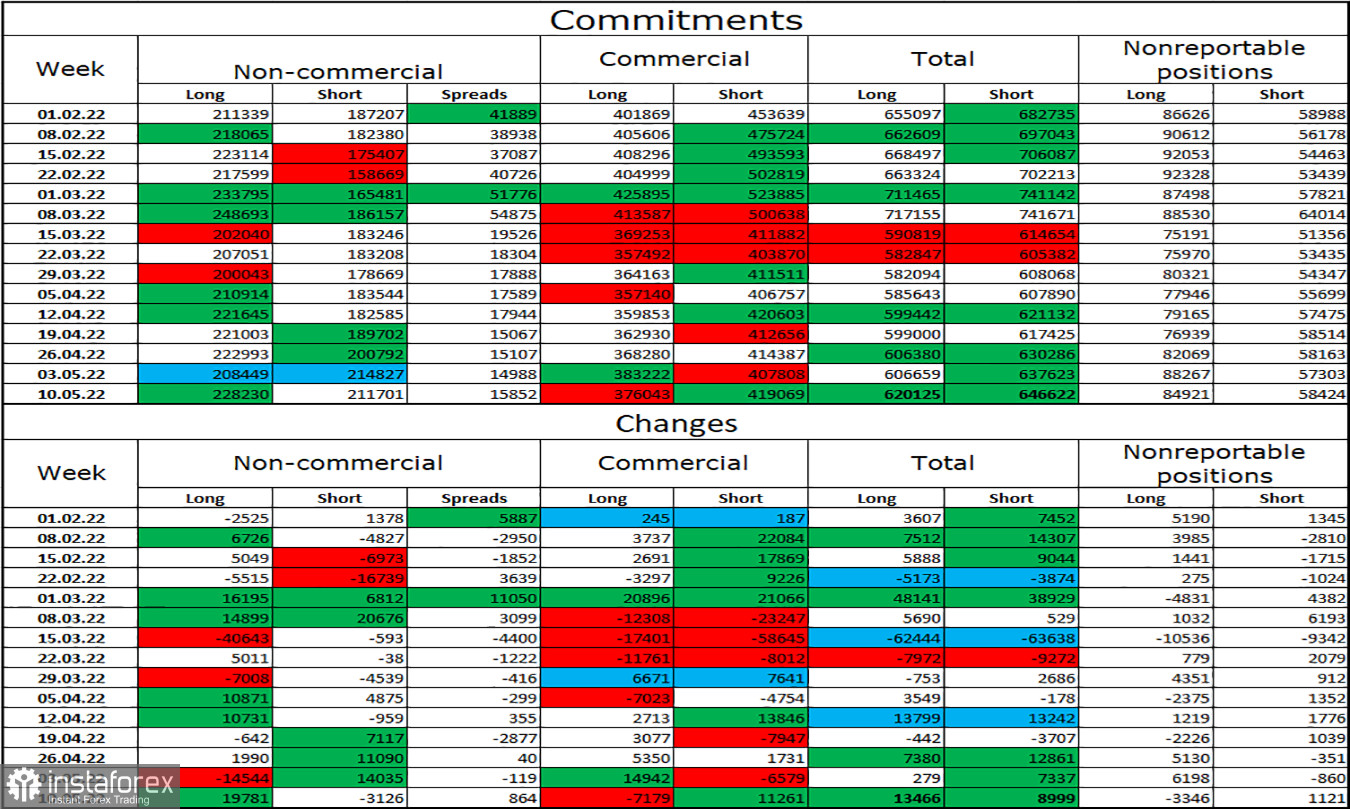

Commitments of Traders (COT):

Last week, traders opened 19,781 Long contracts and closed 3,126 Short contracts. It means that the bullish sentiment has strengthened once again. The total number of Long contracts amounts to 228,000 and the number of Short contracts totals 211,000. The difference between these figures is insignificant. So, from this data, one will be puzzled that the euro is unable to climb by 100 pips. In recent months, the sentiment in the euro has mostly remained bullish, while the currency itself has been constantly falling. Thus, now the situation is approximately the same. The COT report continues to indicate that retail investors are buying euros, while the euro is, on the contrary, dropping. Therefore, COT reports and the real market situation do not coincide.

The economic calendar for the US and the EU:

On May 16, the economic calendars for the European Union and the United States do not contain any interesting reports. Thus, fundamental factors will not have any effect on the market sentiment.

Outlook for EUR/USD and trading recommendations:

It is better to open short positions if the pair retreats from the 1.0430 level on the 1H chart with a downward target of 1.0315. It is recommended to open long positions if the pair closes above 1.0430 on the 1H chart with an upward target of 1.0574.