Analysis of Monday deals:

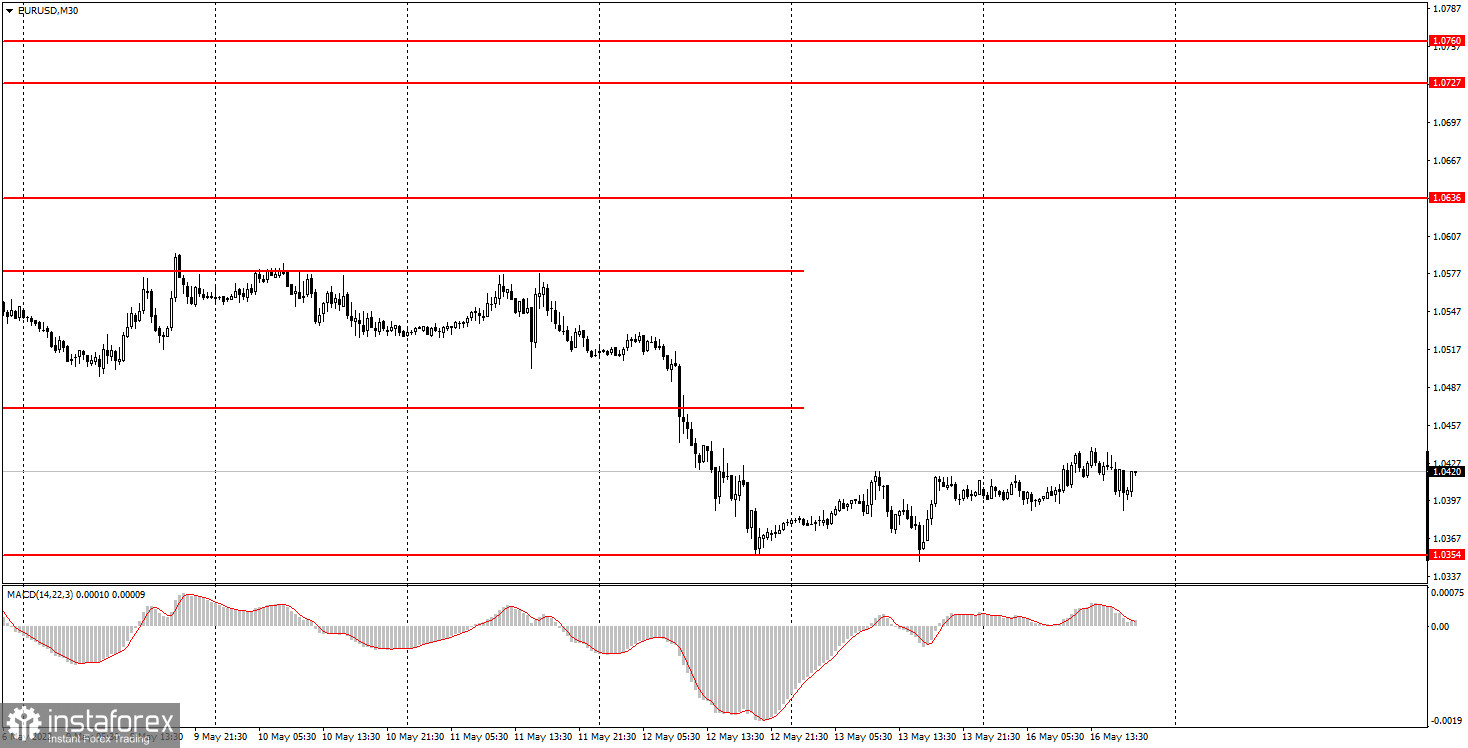

30M chart of the EUR/USD pair

The EUR/USD currency pair did not show anything special on Monday. In principle, this is not surprising, since important events were not planned for this day either in the US or in the EU. However, we should recall that the pair's volatility has been quite high lately, and the pair is actively traded not only on days when there is a strong macroeconomic background. Thus, today we could well become witnesses of quite strong movements. But they didn't. The price continued to move away from the level of 1.0354 all day long, which was worked out twice in the last two trading days. This level is just 14 points from the pair's 20-year lows. So far, traders have not been able to overcome it, however, the strength of the upward correction that we are currently observing so far makes it clear only one thing: the downward trend will resume. The euro still has nothing to oppose the US currency, and there are simply no bulls on the market. Moreover, no such important events are expected this week that could reverse the downward trend.

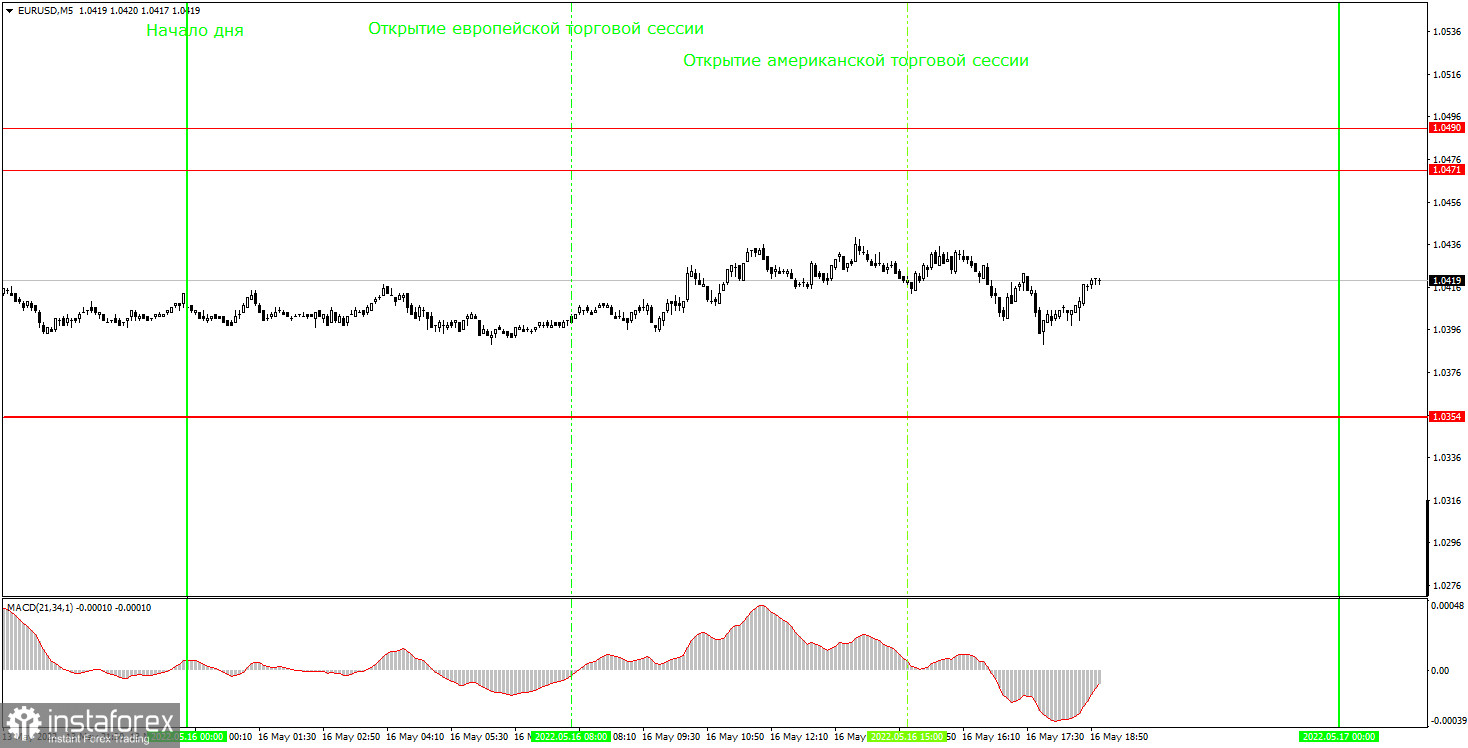

5M chart of the EUR/USD pair

The technical picture on the 5-minute timeframe already looks as simple as possible. The price was between the levels of 1.0354 and 1.0471 for the entire day, not even trying to get close to either of them. The volatility of the day was about 50 points, which is very little. Therefore, not a single trading signal was formed during the day, which is clearly for the better. The movement was weak in ascending, almost flat. And false signals can form in a flat. And in any case, with a volatility of 50 points, it was extremely difficult to count on a good profit. So now you have to wait. Wait for the market to start actively trading the pair again. As of today, it was possible to form two more levels (low and high), but at the moment it is still completely unclear where these lows and highs will be located. Therefore, novice traders will have to put them on the chart on their own. At the same time, the price extremum should be just an extremum, and so far none is visible on the chart. Therefore, it is quite possible that no highs and lows will be needed.

How to trade on Tuesday:

The trend remains downward on the 30-minute timeframe, and the price has left the horizontal channel. Despite the fact that the level of 1.0354 was not overcome from two attempts, the euro could fall almost at any moment. The market is stubbornly unwilling to start an upward correction, and the "foundation" and "macroeconomics" cannot currently support the euro. On the 5-minute TF, it is recommended to trade at the levels of 1.0354, 1.0471-1.0490, 1.0578-1.0593. When passing 15 points in the right direction, you should set Stop Loss to breakeven. The European Union is set to publish a report on GDP for the first quarter in the second assessment. We believe that there will be no market reaction to it. In America, the publication of reports on industrial production and retail sales for April will take place. There is a little more chance of provoking a reaction from traders here. In general, Tuesday can be just as boring as Monday.

Basic rules of the trading system:

1) The signal strength is calculated by the time it took to form the signal (bounce or overcome the level). The less time it took, the stronger the signal.

2) If two or more deals were opened near a certain level based on false signals (which did not trigger Take Profit or the nearest target level), then all subsequent signals from this level should be ignored.

3) In a flat, any pair can form a lot of false signals or not form them at all. But in any case, at the first signs of a flat, it is better to stop trading.

4) Trade deals are opened in the time period between the beginning of the European session and until the middle of the American one, when all deals must be closed manually.

5) On the 30-minute TF, using signals from the MACD indicator, you can trade only if there is good volatility and a trend, which is confirmed by a trend line or a trend channel.

6) If two levels are located too close to each other (from 5 to 15 points), then they should be considered as an area of support or resistance.

On the chart:

Support and Resistance Levels are the Levels that serve as targets when buying or selling the pair. You can place Take Profit near these levels.

Red lines are the channels or trend lines that display the current trend and show in which direction it is better to trade now.

The MACD indicator (14,22,3) consists of a histogram and a signal line. When they cross, this is a signal to enter the market. It is recommended to use this indicator in combination with trend lines (channels and trend lines).

Important speeches and reports (always contained in the news calendar) can greatly influence the movement of a currency pair. Therefore, during their exit, it is recommended to trade as carefully as possible or exit the market in order to avoid a sharp price reversal against the previous movement.

Beginners on Forex should remember that not every single trade has to be profitable. The development of a clear strategy and money management are the key to success in trading over a long period of time.