What is needed to open long positions on EUR/USD

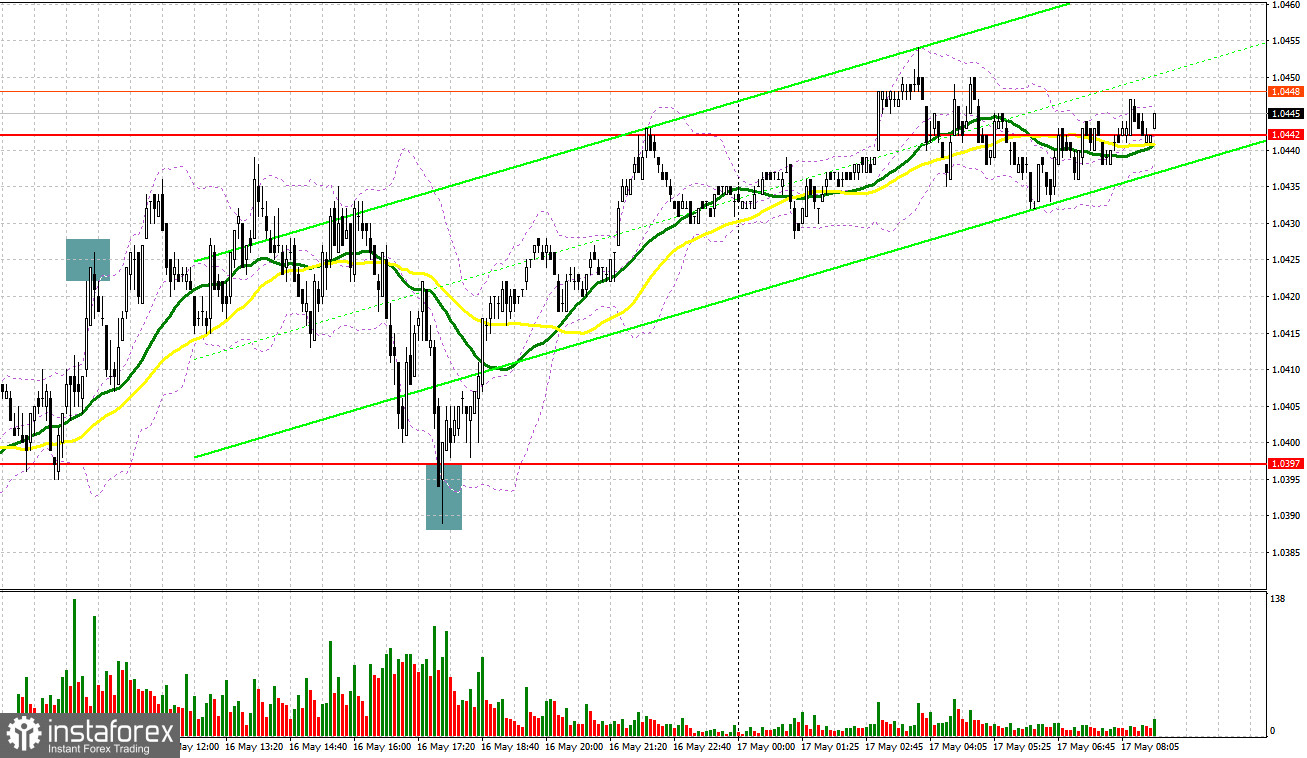

The currency pair created a few market entry signals yesterday. Let's take a look at the 5-minute chart and try to figure out what has actually happened. In the morning review, I highlighted the level of 1.0424 and recommended making decisions on market entry with this level in focus. The euro bulls managed to assert themselves amid the empty economic calendar in the first half of the day and expectations of more aggressive moves from the ECB. In fact, the bulls didn't receive as much support as they wanted. The price grew and made a false breakout at 1.0424 according to the morning scenario which created a good point for opening short positions. However, the price didn't make a large downward move. After the pair had slipped 15 pips, the bulls began buying the euro enabling the second test of 1.0424 and a revision of the technical picture. In the second half of the day, the euro weakened against the US dollar. A test and a false breakout of support at about 1.0387 generated a buy signal. As a result, the pair moved more than 40 pips upward and halted at around resistance of 1.0442.

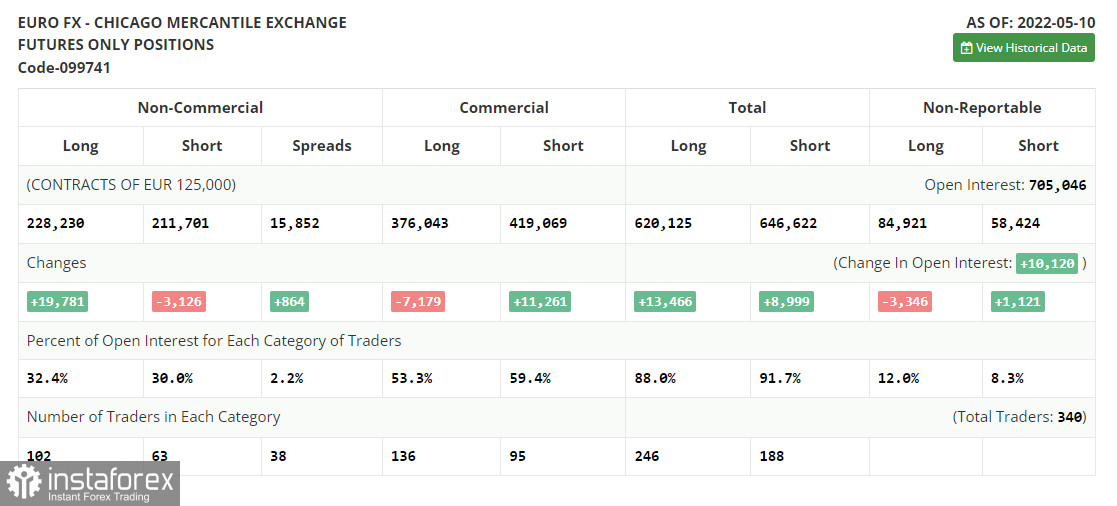

Before we discuss further prospects of EUR/USD, let's see what's going on in the futures market and what has changed in the COT report from May 10. The report shows a sharp increase in long positions and contraction in short ones. The euro's overbought status indicates interest from traders and investors. Recent statements from ECB policymakers arouse optimism in hope that the euro will be able to develop an upward cycle. The ECB governing board will increase the deposit rate by 0.25% as early as July 2022. The next rate hikes will follow in September and in December. The deposit rate will stand at 0.25% at the year-end.

Besides, the key interest rate will be raised in September and in December from the current zero level to 0.5%. Such a hawkish policy will allow the euro buyers to touch the bottom in the near future. Nevertheless, the US Fed alongside escalating geopolitical jitters might derail such plans. Let me remind you that the US Fed intends to pursue aggressive monetary tightening. There are rumors that the FOMC could lift interest rates by 0.75% at a time at the next policy meeting. This scenario gives a clear signal to buy the US dollar in the medium term.

The COT report reads that long non-commercial positions jumped rapidly by 19,781 from 208,449 to 228,230. At the same time, short mom-commercial positions dropped by 3,126 from 214,827 to 211,701. I noted that the low rate of the euro makes it more attractive for traders. Currently, we see that more buyers are entering the market. The overall non-commercial net positions rose to 16,529 at the end of the last week against the negative -6,378 a week ago. EUR/USD closed last week almost flat at 1.0546 against 1.0545 in the previous week.

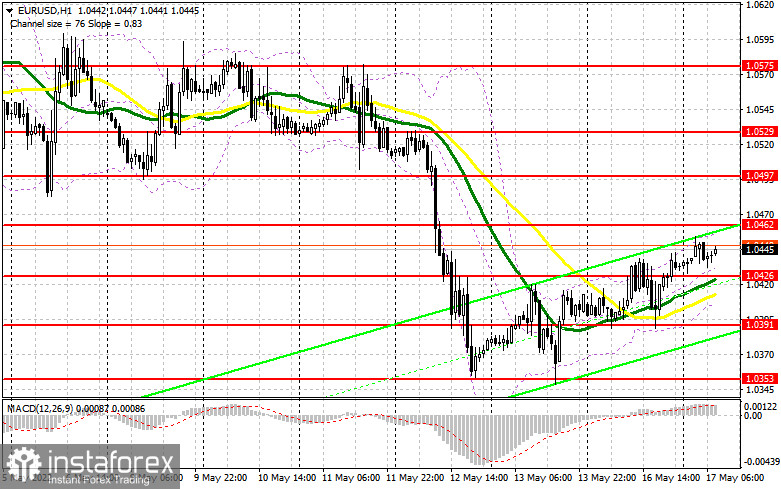

EUR bulls are eager to push the price to new one-week highs, having approached resistance at 1.0462. Today a series of macroeconomic data is due in the EU that might pave the way for EUR/USD's further growth in the first half of the day. Obviously, the market is riveted to US retail sales for April. Further price action will depend on how the bulls will behave at 1.0462. They will be able to push the price above the resistance of 1.0462 in case of strong EU GDP data and a decline in the unemployment rate. It will be a challenge for them because an upward correction could be over in that area. EUR/USD will break and make the opposite test of this area downward on the condition of upbeat on Italy's trade balance and consumer price index. So, the pair will generate the first buy signal with the target at large resistance of 1.0497 which will cap the bullish momentum. A climb above 1.0497 will trigger stop orders of the bears that will cancel a short-term bearish trend and shape a bullish trend with prospects of updating highs of 1.0529 and 1.0575.

However, such growth will be possible in case of weak US retail sales data which is due in the second half of the day. If the pair goes down, the first task for the bears will be the defence of 1.0426. Moving averages are passing slightly below this level, benefiting the buyers. The pair might drop anytime soon because traders are poised to express risk aversion. Negative data for the Eurozone will assure traders to push the price immediately to 1.0426. So, it would be better to cancel long positions. The reasonable long scenario would be opening long positions after a false breakout of the low at 1.0391. We could buy EUR/USD immediately at a dip from 1.0353 or lower at 1.0306 bearing in mind an upward correction of 20-25 pips intraday.

What is needed to open short positions on EUR/USD

Yesterday the sellers failed to fulfil their tasks. Now they have to make efforts to defend the nearest resistance at 1.0462. As long as the pair settles below this level, the odds are that the euro will go down. However, the bears have to see a false breakout before they can enter the market. Weak EU GDP data and Italy's inflation will push EUR/USD back to 1.0426, the level to struggle for. Abreakout and the opposite test of this level upwards will create an extra signal to sell the euro. Even this price action will hardly terminate the upward correction. The final hope for the bulls will be 1.0391 where the lower border of the upward correction channel is passing. If the price settles above this level and with a similar test upwards, the market will generate a sell signal with a downward target at 1.0353 where I recommend profit-taking. A lower target is seen at 1.0306. If the euro fails to grow and bears lack activity at 1.0462, the bulls will try to add more long positions at nearly 1.0497. Market sentiment today will depend on Christine Lagarde's statements in the second half of the day. The reasonable scenario will be short positions in case of a false breakout at 1.0529. We could sell EUR/USD immediately at a bounce from 1.0575 or higher from 1.0638 bearing in mind a downward 25-30 pips correction intraday.

Indicators' signals:The currency pair is trading above the 30 and 50 daily moving averages. It indicates a further upward correction of EUR/USD.

Moving averages

Note: The period and prices of moving averages are considered by the author on the H1 hourly chart and differ from the general definition of the classic daily moving averages on the daily D1 chart.

Bollinger BandsA breakout of the indicator's lower border at 1.0410 will be bearish for the euro. Alternatively, a breakout of the indicator's upper border at 1.0460 will encourage the euro's growth.

Description of indicators Moving average (moving average, determines the current trend by smoothing out volatility and noise). Period 50. It is marked yellow on the chart. Moving average (moving average, determines the current trend by smoothing out volatility and noise). Period 30. It is marked green on the chart. MACD indicator (Moving Average Convergence/Divergence — convergence/divergence of moving averages) Quick EMA period 12. Slow EMA period to 26. SMA period 9 Bollinger Bands (Bollinger Bands). Period 20 Non-commercial speculative traders, such as individual traders, hedge funds, and large institutions that use the futures market for speculative purposes and meet certain requirements. Long non-commercial positions represent the total long open position of non-commercial traders. Short non-commercial positions represent the total short open position of non-commercial traders. Total non-commercial net position is the difference between short and long positions of non-commercial traders.