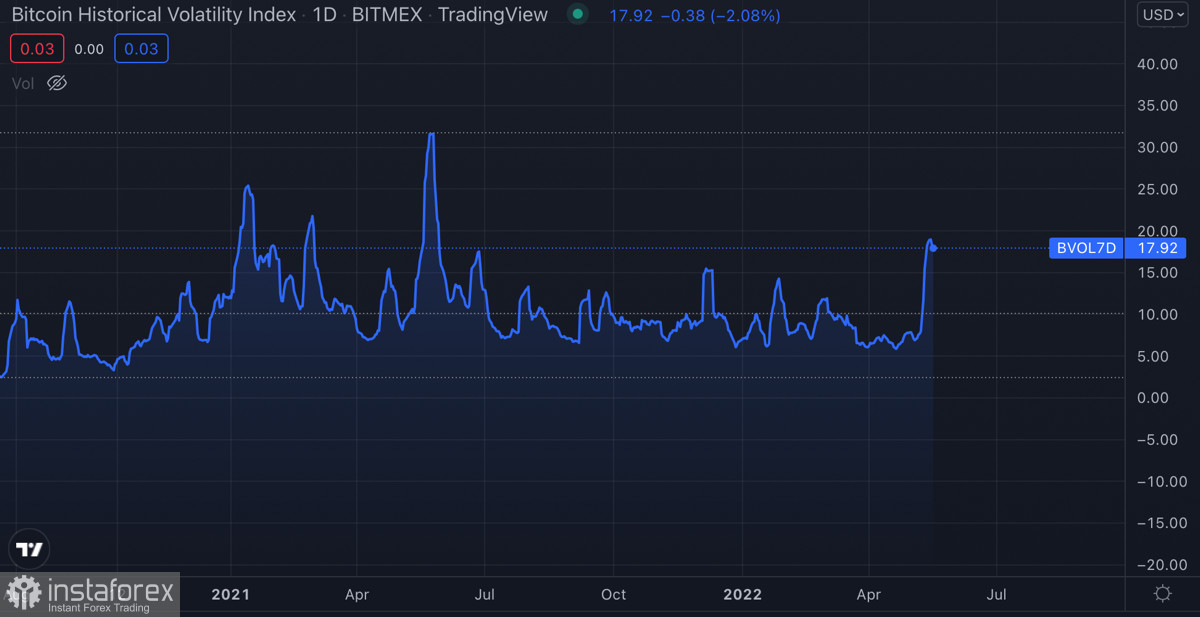

The cryptocurrency market is starting to stabilize after a powerful bearish week. Quotes of the main assets have fixed in the area of local support zones and are trying to consolidate. At the same time, market volatility falls, and investors begin to accumulate cryptocurrency coins. However, there is reason to believe that soon the situation will escalate again due to the speech of the head of the Fed, Jerome Powell.

During this speech, key theses regarding the future monetary policy, the rate, as well as the start of the quantitative tightening (QT) program will be announced. The market reacted with hostility to the previous increase in the key rate by 50 basis points, which resulted in the largest liquidation in recent months. At the June meeting, a rate hike of another 0.5% is planned. However, the market is alarmed by the possibility of a more radical tightening of monetary policy. Concerns are connected with the recent publication of reports on the growth of consumer prices.

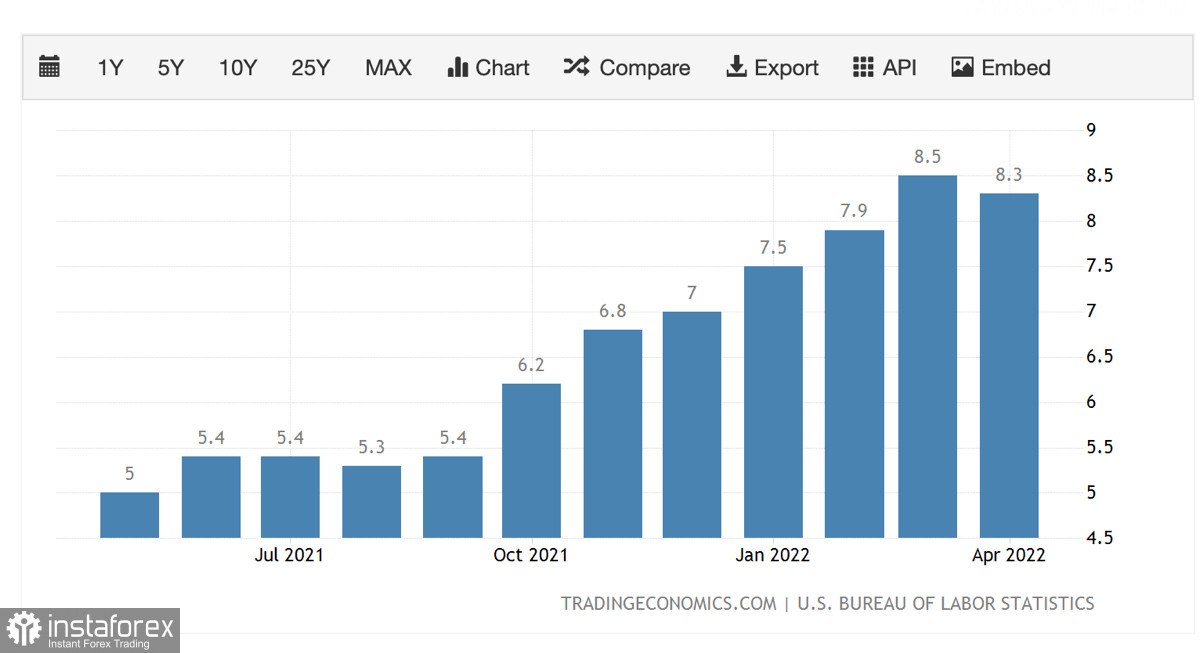

According to the report, the inflation index was at the level of 8.3% against the expected 8.1%. The problem and concern is that after the May meeting, Powell said that the Fed controls inflation growth and has all the necessary tools to stop it. However, a few weeks later, the inflation index turns out to be higher than expected. In this regard, Powell may announce tougher measures, such as an increase in the key rate by 0.75%. This will avoid the collapse that occurred in the markets after the Fed meeting. In addition to gestures regarding the key rate, the agency may tighten the timing and volume of reduced liquidity under the QT program.

At the same time, it is important to understand that Powell has established himself as a liberal official. The May meeting turned into a massive collapse in both crypto and the stock market. In this regard, the Fed may leave the key points of the strategy to combat inflation unchanged, and this will be the best solution for the cryptocurrency market. Thanks to this solution, Bitcoin and the digital asset market will get the pause necessary to stabilize quotes. There is no question of the emergence of an upward trend, since the increase in the key rate was not the most painful blow to the crypto market and Bitcoin.

The quantitative tightening program will start in June, and it is the forced withdrawal of liquidity that will become the main pain for Bitcoin. It is important to understand that the market reacts moderately to negative news, but the manipulations of individual large players provoke large sales. In other words, "whales" are squeezing "weak hands" out of the crypto market.

Bitcoin has fallen 63% from its all-time high and is now at a crossroads. If market manipulation ends after the start of the QT program, this will mean the final stage of investors' adaptation to new realities. After all, the strategy of the "whales" is to "shave off" uncertain players to create a springboard for the upward movement of Bitcoin. However, a growth stage should be expected after the next stage of increased volatility and a sell-off provoked by the launch of the QT program.

Bitcoin continues to stabilize after a massive crash. The price starts the local stage of consolidation in a narrow range of $28.1k–$31.6k. The charts signal that after a massive sell-off, the exchanges have again begun to show an outflow of coins. This directly points to the strategy of squeezing "weak hands." The process of large accumulation has started, but this does not mean that sharp price fluctuations are not expected. Technical indicators of Bitcoin show local signals for growth, but the positions of buyers are still weak. The first stage of knocking out small investors has been completed, but the whole campaign is just getting underway.