Analysis of Tuesday deals:

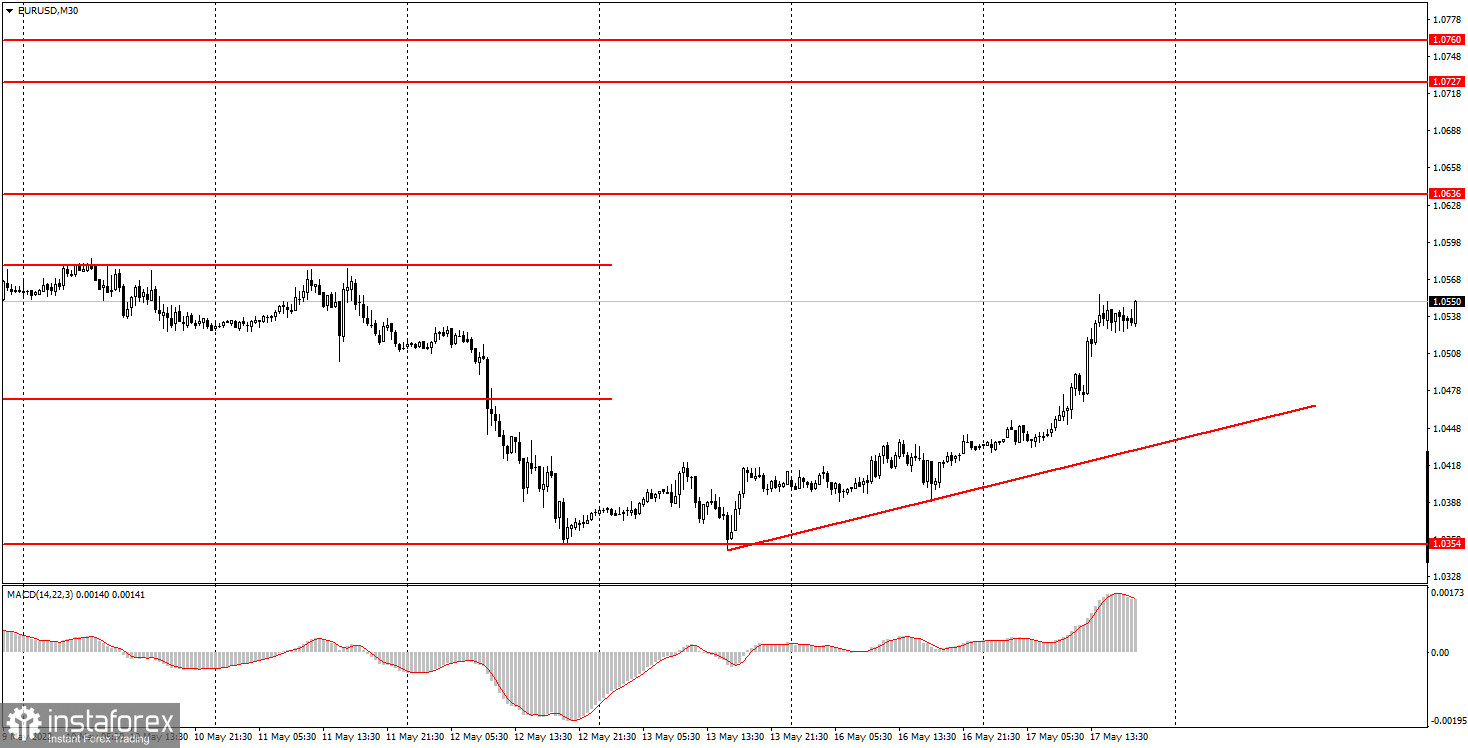

30M chart of the EUR/USD pair

The EUR/USD currency pair showed a fairly strong growth on Tuesday. On the one hand, one can try to link this growth with macroeconomic statistics, which were in abundance on Tuesday. And on the other hand, we are more inclined to believe that the market is tired of selling the pair and the "technical factor" of the need to correct from time to time has worked. Consider macroeconomics. In the morning, the European Union published a report on GDP for the first quarter in the second assessment. If the first assessment recorded an increase of 0.2%, then in the second assessment this figure increased and amounted to 0.3%. The difference is small, but still the market had formal reasons for buying the euro. After lunch, two "medium" reports were published in the United States. While retail sales rose 0.9% in April, just 0.1% below the forecast, industrial production rose 1.1%, up 0.7% from the forecast. Thus, in the second half of the day there were grounds for the dollar's growth, although rather weak. The dollar failed to grow, so we tend to conclude that the reasons for the euro's growth were purely technical. An ascending trend line has already been formed, which supports bulls. For the first time in a long time, the euro has a real chance of growth.

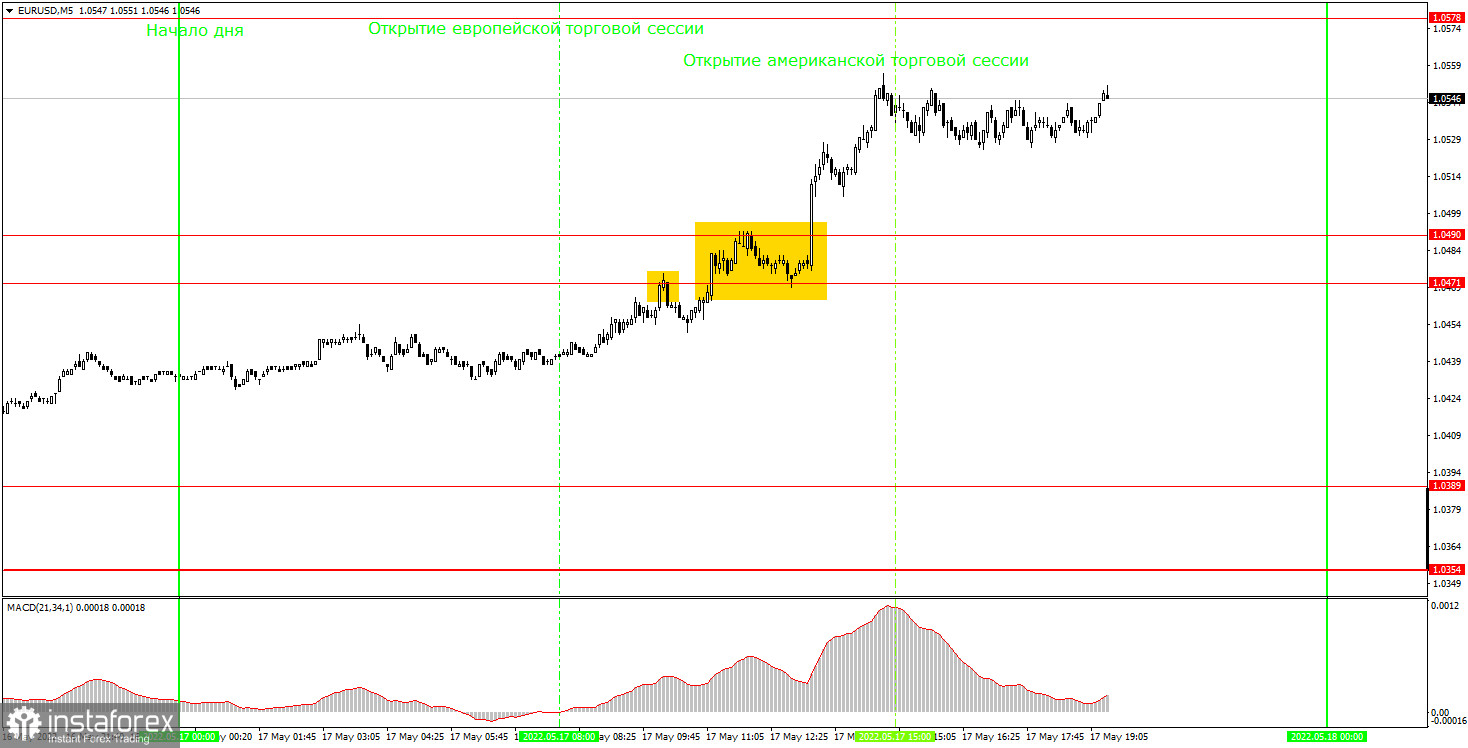

5M chart of the EUR/USD pair

The technical picture is still very simple on the 5-minute timeframe. However, there was a good trend movement on Tuesday, unlike Monday. Unfortunately, it was not possible to get a big profit, but they still managed to earn something. The main problem was that the upward movement could not be determined immediately. The first signal was for short positions, when the price rebounded from the level of 1.0471. Therefore, initially novice traders could open a short position and receive a small loss on it. The next signal for longs was already correct, but formed rather late. Plus, the candle on which it finally formed turned out to be very strong and closed much above the level of 1.0490. Nevertheless, it was still possible to work out this signal. Since the pair failed to reach the target level of 1.0578 until the very evening, the deal had to be closed manually. The profit on it was about 25 points, which is not much more than the loss on the first trade.

How to trade on Wednesday:

A new ascending trend line has formed on the 30-minute timeframe. Therefore, in the near future we can count on continued strengthening of the European currency. We do not see that this currency is supported by a fundamental or macroeconomic background, but the pair can easily go up 200-300 just as part of a technical correction. On the 5-minute TF, it is recommended to trade at the levels of 1.0354, 1.0389, 1.0471-1.0490, 1.0578-1.0593. When passing 15 points in the right direction, you should set Stop Loss to breakeven. On Wednesday, the European Union will publish the consumer price index (inflation) for April. This is again the second, final estimate of the indicator, and it may differ slightly from the first. However, we do not believe that the market reacted today only to the GDP report, so tomorrow the reaction to the inflation report is unlikely to be strong. On the other hand, only minor reports will be published in America.

Basic rules of the trading system:

1) The signal strength is calculated by the time it took to form the signal (bounce or overcome the level). The less time it took, the stronger the signal.

2) If two or more deals were opened near a certain level based on false signals (which did not trigger Take Profit or the nearest target level), then all subsequent signals from this level should be ignored.

3) In a flat, any pair can form a lot of false signals or not form them at all. But in any case, at the first signs of a flat, it is better to stop trading.

4) Trade deals are opened in the time period between the beginning of the European session and until the middle of the American one, when all deals must be closed manually.

5) On the 30-minute TF, using signals from the MACD indicator, you can trade only if there is good volatility and a trend, which is confirmed by a trend line or a trend channel.

6) If two levels are located too close to each other (from 5 to 15 points), then they should be considered as an area of support or resistance.

On the chart:

Support and Resistance Levels are the Levels that serve as targets when buying or selling the pair. You can place Take Profit near these levels.

Red lines are the channels or trend lines that display the current trend and show in which direction it is better to trade now.

The MACD indicator (14,22,3) consists of a histogram and a signal line. When they cross, this is a signal to enter the market. It is recommended to use this indicator in combination with trend lines (channels and trend lines).

Important speeches and reports (always contained in the news calendar) can greatly influence the movement of a currency pair. Therefore, during their exit, it is recommended to trade as carefully as possible or exit the market in order to avoid a sharp price reversal against the previous movement.

Beginners on Forex should remember that not every single trade has to be profitable. The development of a clear strategy and money management are the key to success in trading over a long period of time.