The EUR/USD currency pair made an impressive upward leap on Tuesday. At the end of the day, the price was fixed above the moving average line, which has not happened to it for a long time. More precisely, from time to time, the euro made some efforts to overcome the moving average, sometimes even successfully, but even in the second case, the growth almost immediately ended. What changed on Tuesday? From our point of view, nothing. Yes, in the morning, quite important reports on the state of their economies were published in Britain and the EU. But remember how many such reports there have been recent? In particular, the market did not pay due attention to much more important reports on NonFarm Payrolls or the level of GDP in the United States. In the first case, the dollar did not show growth, and in the second, it did not fall, although the GDP value was a failure. And here is one report on Eurozone GDP. In the second, the value of which was not very different from the first one, and immediately the euro currency grew by more than 100 points. Thus, we believe that macroeconomic statistics have absolutely nothing to do with it.

One could assume that the geopolitical situation in Ukraine has improved dramatically, but no, nothing like that has happened. On the contrary, the fighting in the Donbas continues, in Kyiv, they openly declare that they are accumulating NATO weapons for a counteroffensive. This means that a few more months of military operations are guaranteed. Presidential adviser Oleksiy Arestovych said that Ukraine will be able to accumulate enough military potential to go on the offensive only in the middle of summer. At the same time, Moscow said that the peace talks with Ukraine had failed and would not be resumed. Then what kind of optimism can we talk about? We believe that the sharp growth of the euro and the pound is provoked by only one factor - they need to adjust from time to time. We have already said earlier that this factor is almost the only one that supports the growth of European currencies now. Naturally, it is impossible to predict when bears will start taking profits on open short positions, and bulls will start increasing longs. This happened on Tuesday, but even a fairly noticeable increase in both currencies cannot be considered the beginning of a new upward trend. So far, this is only a small correction. The euro currency has not even been able to update its previous local maximum, which is near the Murray level of "3/8"-1.0620.

Geopolitics continues to deteriorate.

Unfortunately, now the time has come again when all the conversations concern only the topic of geopolitics. From the latest news: Hungary has blocked the oil embargo, but negotiations are underway with it; the States have approved lend-lease for Ukraine and the flow of weapons will soon increase several times; Turkey has blocked Finland and Sweden from joining NATO, but negotiations are already underway to reverse this decision; Washington has approved $ 40 billion in aid to Ukraine; rocket attacks on some Ukrainian cities continue, in particular, rockets were fired at Lviv yesterday. Thus, we believe that there is no question of any de-escalation of the conflict now. Moreover, geopolitics can either shift from Ukraine, or expand its activities to other territories. Now there is a lot of unrest in Transnistria, there is talk of a new possible conflict in Georgia, and an open confrontation between Russia and Finland may begin. It is also bad that the European Union continues to creak, putting pressure on its throat, to push through sanctions for the oil and gas sector of the Russian Federation. This means that the energy crisis is approaching, and the food crisis is already practically secured since it is Ukraine and Russia that supply significant amounts of food and agricultural products to the EU. In general, the situation is not only difficult but also threatens to worsen. Against this background, the euro currency, along with the pound, absolutely could not show growth. Therefore, only the option with technical correction remains. So now we should figure out what it is: a correction or the beginning of a new trend? After all, both European currencies have been getting cheaper for a very long time, maybe the bears have finally had enough and now the bulls will come to the forefront?

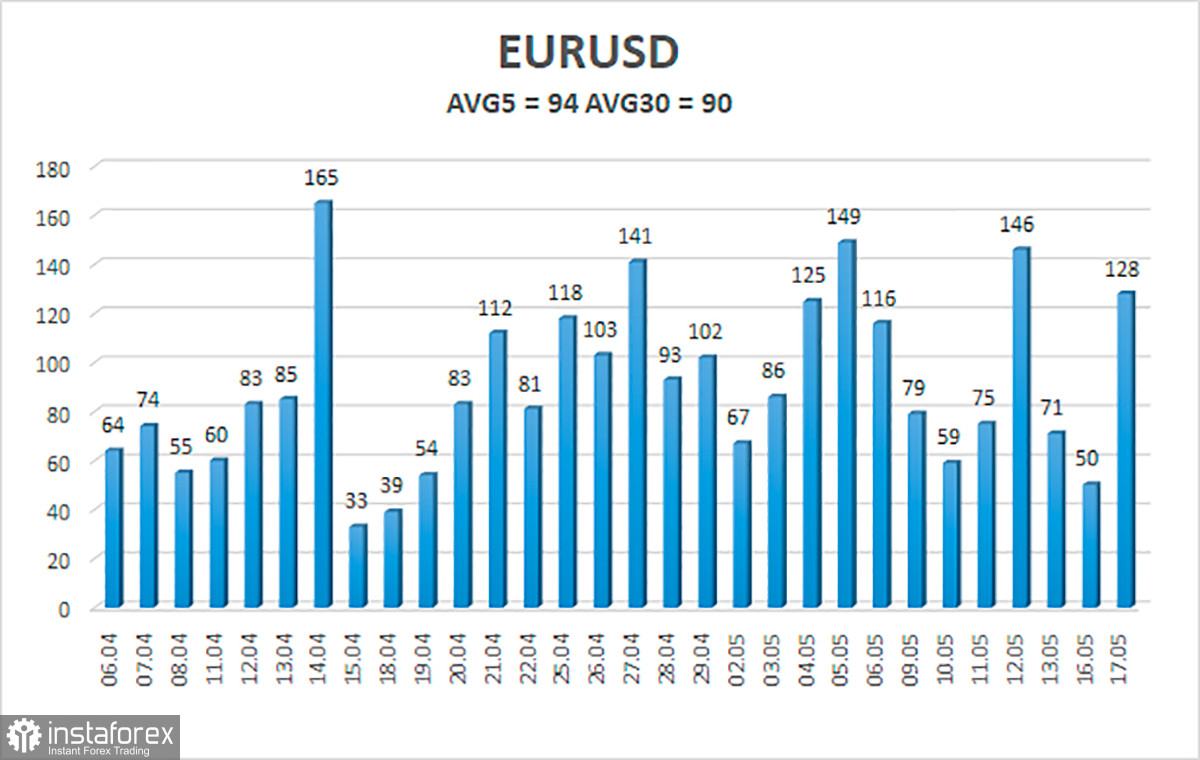

The average volatility of the euro/dollar currency pair over the last 5 trading days as of May 18 is 94 points and is characterized as "high". Thus, we expect the pair to move today between the levels of 1.0430 and 1.0618. A reversal of the Heiken Ashi indicator back down will signal a possible resumption of the downward movement.

Nearest support levels:

S1 – 1.0498

S2 – 1.0376

S3 – 1.0254

Nearest resistance levels:

R1 – 1.0620

R2 – 1.0742

R3 – 1.0864

Trading recommendations:

The EUR/USD pair has consolidated above the moving average and can now begin to form an uptrend. Thus, now you should stay in long positions with targets of 1.0618 and 1.0742 until the Heiken Ashi indicator turns down. Short positions should be opened with targets of 1.0430 and 1.0376 if the price is fixed below the moving average.

Explanations of the illustrations:

Linear regression channels - help determine the current trend. If both are directed in the same direction, then the trend is strong now.

Moving average line (settings 20.0, smoothed) - determines the short-term trend and the direction in which you should trade now.

Murray levels - target levels for movements and corrections.

Volatility levels (red lines) - the likely price channel in which the pair will spend the next day, based on current volatility indicators.

CCI indicator - its entry into the oversold area (below -250) or overbought area (above +250) means that the trend reversal in the opposite direction is approaching.