GBP/USD 5M

The GBP/USD currency pair also showed impressive growth on Tuesday. What does all this movement fit in a few hours of the European trading session. Again, traders had a formal reason to buy the British pound. Yesterday morning, three positive reports were released at once in Great Britain (on unemployment, on applications for unemployment benefits and on wages). Moreover, the beginning of the growth coincides in time with the beginning of the pound's growth. Only the strength of this movement is doubtful, because now it is quite difficult to even remember the last time these three reports provoked a movement of 180 points. Even the reaction to the outcome of the US Federal Reserve or Bank of England meeting is usually much weaker. Therefore, we believe that the technical factor also played a role. After all, the pound also fell for quite a long time and significantly, and also had to correct at least a bit. The technical picture for the pound is more attractive than for the euro. Firstly, the pound overcame the Senkou Span B line yesterday. This means that it received grounds for further growth. Secondly, it updated its latest local highs, which also increases its chances to continue moving up.

As for trading signals, they, unfortunately, were late on Tuesday. The first was formed when the 1.2405-1.2410 area was overcome. At that time, the pair had already gone up about 80 points. This buy signal could be worked out. The price subsequently overcame the Senkou Span B line on the first attempt and stayed above it for the rest of the day. Thus, there was no signal to cancel long positions and the deal had to be closed manually. Profit on it amounted to at least 50 points.

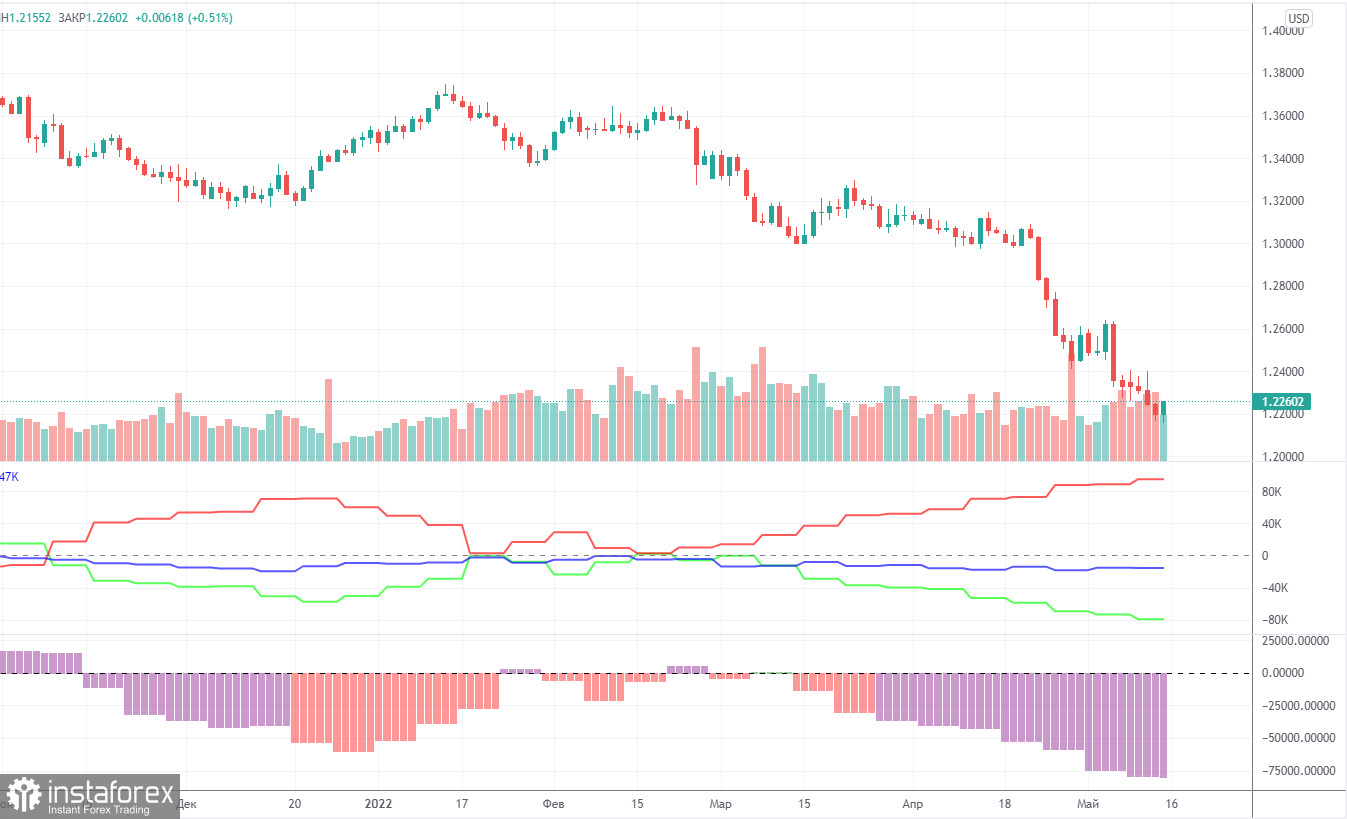

COT report:

The latest Commitment of Traders (COT) report on the British pound has witnessed a new increase in bearish sentiment among professional traders. During the week, the non-commercial group closed 4,000 long positions and opened 1,700 short positions. Thus, the net position of non-commercial traders decreased by another 5,700. The net position has been falling for three months already, which is perfectly visualized by the green line of the first indicator in the illustration above. Or the histogram of the second indicator. The non-commercial group has already opened a total of 109,000 shorts and only 29,000 long s. Thus, the difference between these numbers is already fourfold. This means that the mood among professional traders is now "pronounced bearish" and this is another factor that speaks in favor of the continuation of the fall of the British currency. Note that in the case of the pound, the data from the COT reports very accurately reflects what is happening in the market. Traders are "strongly bearish" and the pound has been falling against the US dollar for a very long time. We do not yet see concrete signals for the end of the downward trend, however, usually a strong divergence of the red and green lines of the first indicator signals the imminent end of the trend and the beginning of another. Therefore, the conclusion is that an upward trend may begin in the near future, but it is dangerous to try to catch its beginning at the lowest point. The pound may well fall another 200-400 points.

We recommend to familiarize yourself with:

Overview of the EUR/USD pair. May 18. Euro - "resurrection from the dead".

Overview of the GBP/USD pair. May 18. The pound follows the euro. Or vice versa? Has the technical correction begun?

Forecast and trading signals for GBP/USD on May 18. Detailed analysis of the movement of the pair and trading transactions.

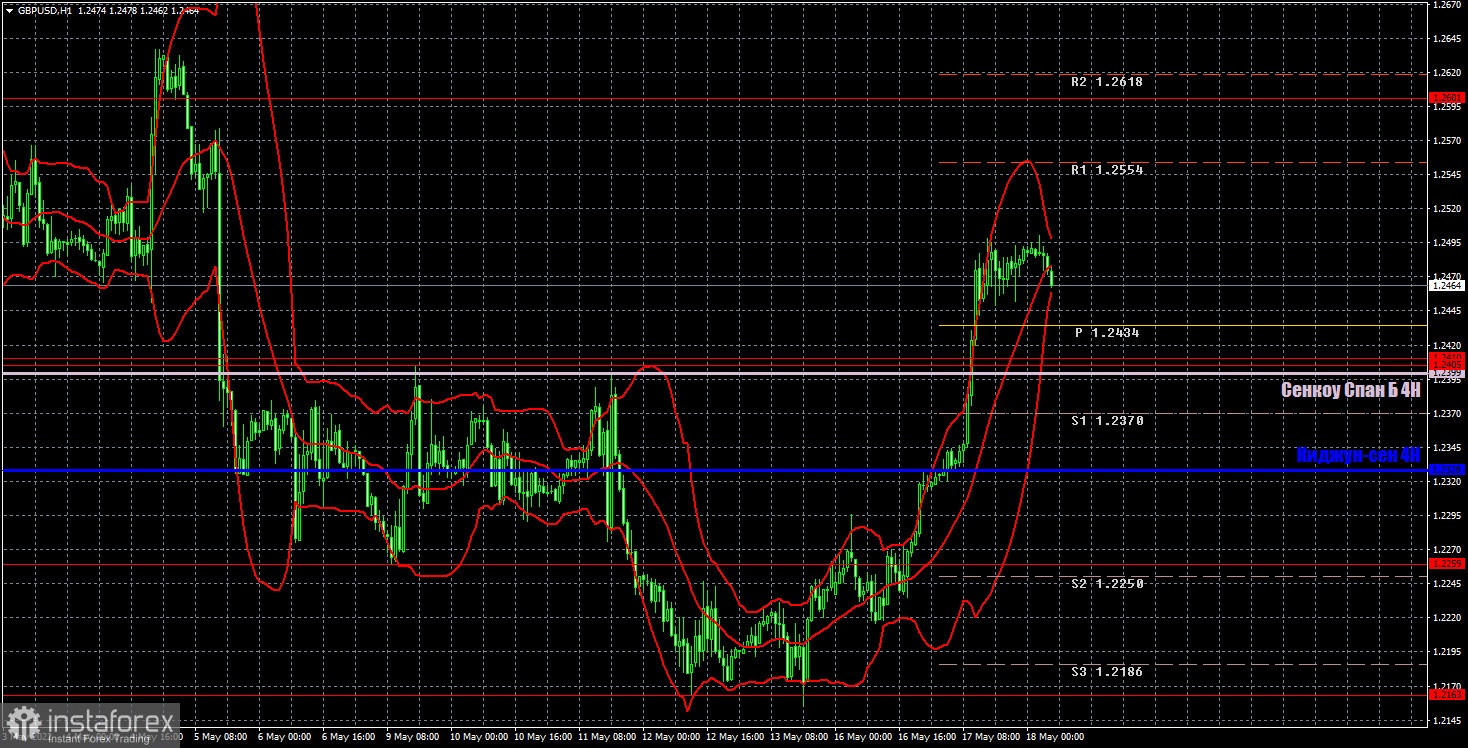

GBP/USD 1H

It is clearly seen on the hourly timeframe that the pound has changed quite a lot in just a day. Now its chances for succeeding growth are already higher than for the resumption of decline. But it is also very important to stay above the Ichimoku cloud, that is, above the Senkou Span B line. Without this, the pair can very quickly return to its favorite activity in recent weeks - falling. We highlight the following important levels on May 18: 1.2073, 1.2163, 1.2259, 1.2405-1.2410. Senkou Span B (1.2399) and Kijun-sen (1.2328) lines can also be sources of signals. Signals can be "rebounds" and "breakthroughs" of these levels and lines. The Stop Loss level is recommended to be set to breakeven when the price passes in the right direction by 20 points. Ichimoku indicator lines can move during the day, which should be taken into account when determining trading signals. The chart also contains support and resistance levels that can be used to take profits on trades. The most important publication of this week, the inflation report, is scheduled for Wednesday in the UK. Forecasts suggest that the consumer price index may rise to 9%, which will significantly increase the likelihood of new increases in the key rate by the BoE. Perhaps even that is why (partly) yesterday the pound showed such a strong growth. If so, then a downward rollback should follow today, since the inflation report has already been worked out. There will be no interesting information in the US today.

Explanations for the chart:

Support and Resistance Levels are the levels that serve as targets when buying or selling the pair. You can place Take Profit near these levels.

Kijun-sen and Senkou Span B lines are lines of the Ichimoku indicator transferred to the hourly timeframe from the 4-hour one.

Support and resistance areas are areas from which the price has repeatedly rebounded off.

Yellow lines are trend lines, trend channels and any other technical patterns.

Indicator 1 on the COT charts is the size of the net position of each category of traders.

Indicator 2 on the COT charts is the size of the net position for the non-commercial group.