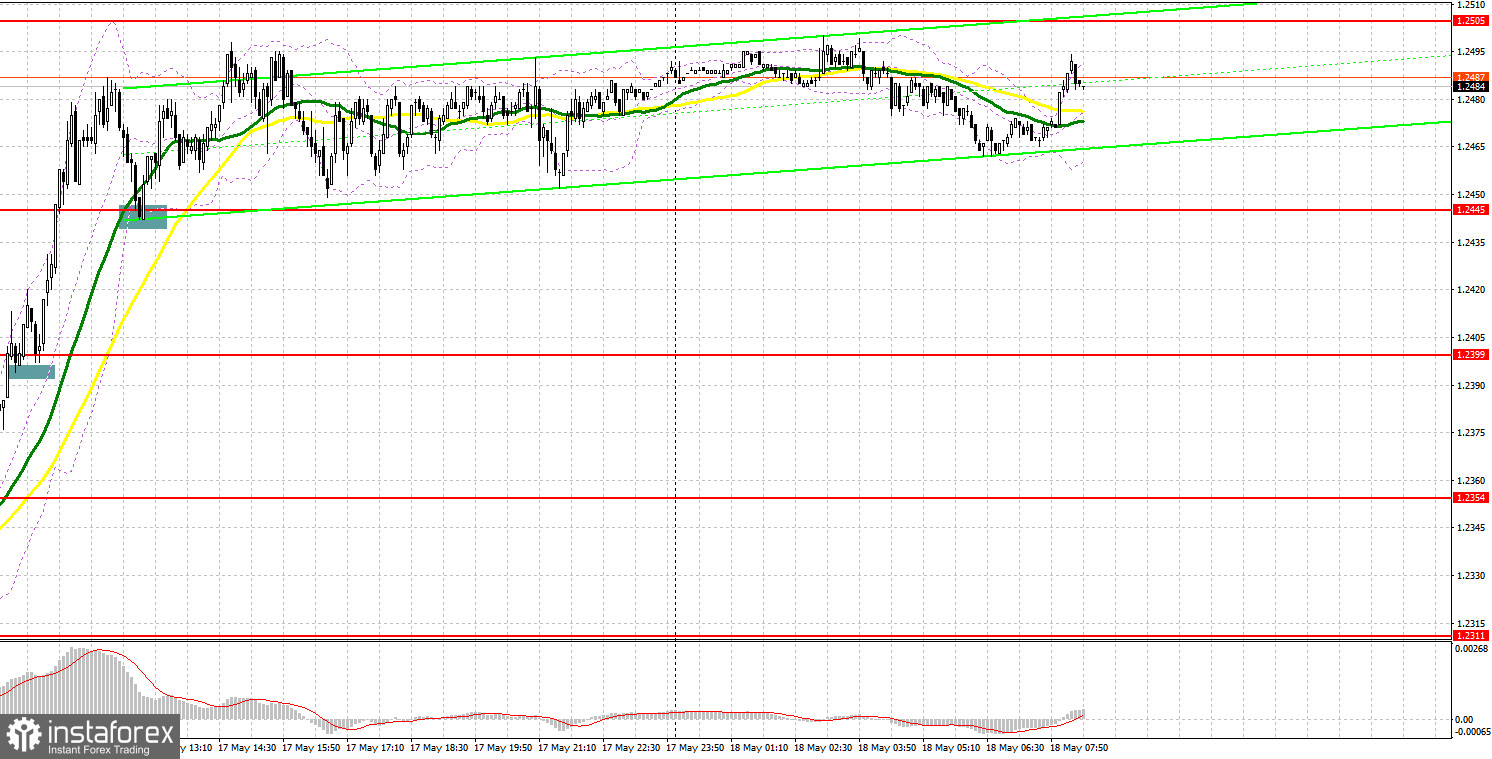

Yesterday the market entry signals were formed only in the first half of the day. Let's take a look at the 5-minute chart and see what happened. The British pound has made one of the strongest upward spurts in recent times. In my morning forecast, I paid attention to the levels of 1.2396 and 1.2445 and advised you to make decisions on entering the market from them. The decline in the number of applications for unemployment and a sharp increase in the level of average earnings in the UK have become catalysts for the growth of the British pound in anticipation of important reports on the US economy.

A breakthrough and reverse test from top to bottom gave a signal for you to open long positions in anticipation of a continuation of the upward correction, which led to a breakthrough of 1.2445 and growth to the 1.2491 area, showing an upward movement of more than 90 points. The reverse test of the 1.2445 level from top to bottom made it possible to get another signal for long positions, from which the pair went up for about 50 more points. Given that the technical picture had slightly changed in the afternoon, it was not possible to reach the levels that I mentioned. Accordingly, there were no signals to enter the market.

When to go long on GBP/USD:

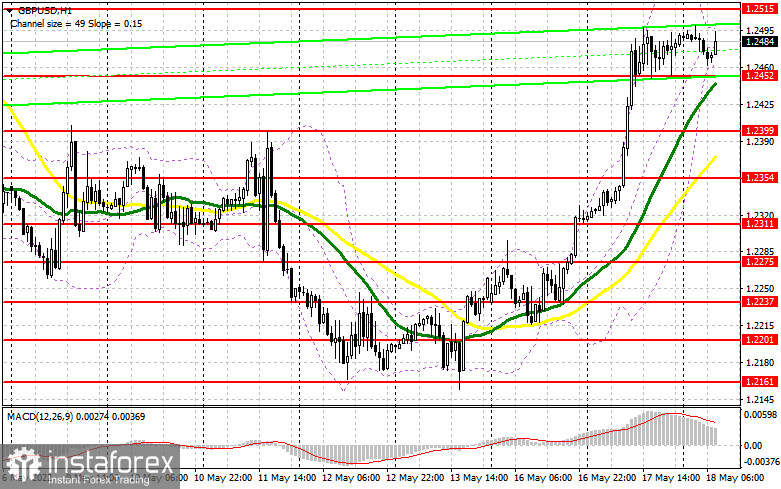

From a technical point of view, almost nothing has changed this morning. Today, in order to continue the pound's growth, one can only count on inflation going beyond economists' forecasts. Only this stimulates the Bank of England to act more aggressively, which will return the pound bulls to the market. If the data coincides with the forecasts, it is unlikely that there will be those who want to continue buying the pound at current highs without a new portion of good macroeconomic reports. If the pressure on the pound returns after the data is released, I advise you to focus on the nearest support at 1.2452, as yesterday afternoon it held back the pound and where the moving averages play on the bulls' side. Therefore, only a false breakout there will lead to a new signal to open long positions, counting on the continuation of the bull market with growth to the new resistance at 1.2515.

You can expect a sharper movement, but only if we receive strong data and big players react to them. Consolidating above 1.2515 with a reverse test from top to bottom by analogy with those that I analyzed - all this will lead to a buy signal with subsequent movement to the 1.2574 area. I recommend taking profit there. A more distant target will be the area of 1.2633. In case the pound falls and the bulls are not active at 1.2452, a rather unpleasant situation may occur when the bears hit the bears' stop orders, which will quickly pull down the pound. Therefore, I advise you not to rush into long positions. It is best to enter the market after a false breakout at 1.2399. You can buy GBP/USD immediately on a rebound from the low of 1.2354, or even lower - in the area of 1.2311, counting on correcting 30-35 points within the day.

When to go short on EUR/USD:

If you look at the chart, then in the current realities, protecting 1.2515 will help the bears to somehow rehabilitate, which will lead to a downward correction and return the pair to the 1.2452 area. With a test of 1.2515, which may occur after the release of data on inflation in the UK, only false breakouts and the presence of divergence on the MACD indicator will be an ideal condition for building up short positions, counting on a breakthrough and consolidation below 1.2452. A breakthrough and reverse test from the bottom up of this range generates a signal for short positions, which can quickly block all of the pound's "fake" growth from yesterday, supposedly on expectations of a return in demand for risky assets. In this case, you should immediately aim for 1.2399, where I recommend taking profits.

The 1.2354 level is more of a distant target, testing it will cast doubt on the pair's succeeding growth in the near future. Hopes for implementing this scenario is possible only after the speeches of the Federal Reserve representatives and their more hawkish statements regarding interest rates and future monetary policy. In case GBP/USD grows and traders are not active at 1.2515, another upsurge may occur against the background of bearish stop orders being dismantled. In this case, I advise you to postpone short positions until the next major resistance at 1.2574. I also advise you to open shorts there only in case of a false breakout. You can sell GBP/USD immediately on a rebound from 1.2633, based on the pair's rebound down by 30-35 points within the day.

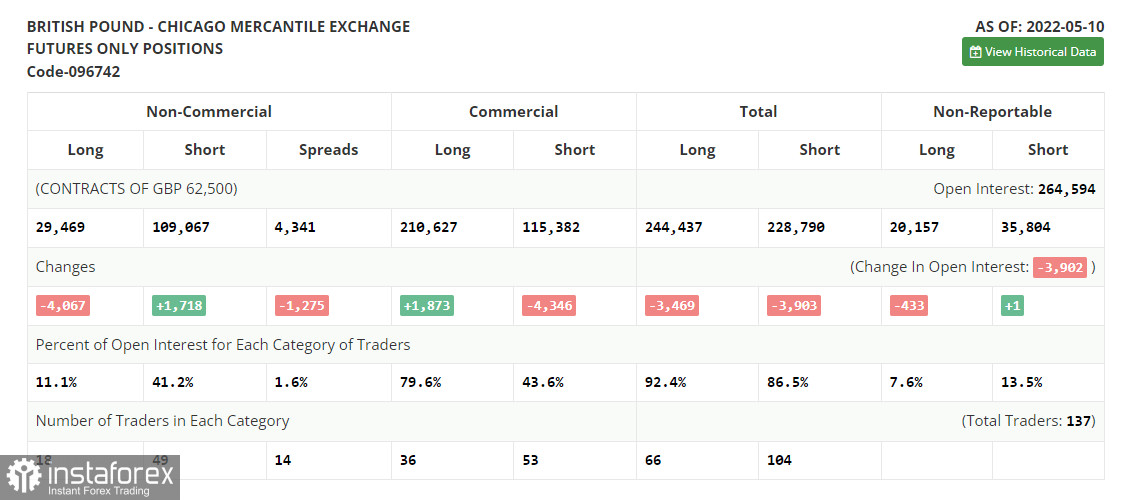

COT report:

The Commitment of Traders (COT) report for May 10 showed that long positions decreased while short positions had increased, which caused the negative delta to increase further. The presence of a number of problems in the economy and a rather difficult situation with inflation are forcing investors to get rid of the British pound, which is very seriously losing its appeal against the backdrop of demand for safe haven assets and more profitable instruments. The monetary policy of the Federal Reserve, aimed at tightening the cost of borrowing, will continue to support the US dollar, pulling the British pound lower and lower. The actions of the Bank of England to raise interest rates have not yet brought the desired result, and talk that, due to serious economic difficulties, the central bank may even suspend the normalization of monetary policy, scare investors even more. As I have repeatedly noted, future inflationary risks are now quite difficult to assess also because of the difficult geopolitical situation, but it is clear that the consumer price index will continue to rise in the coming months. The situation in the UK labor market, where employers are forced to fight for each employee, offering ever higher wages, is also pushing inflation higher and higher. The May 10 COT report indicated that long non-commercial positions decreased by -4,067 to 29,469, while short non-commercial positions rose by 1,718 to 109,067. This led to an increase in the negative value of the non-commercial net position from - 73,813 to -79,598. The weekly closing price fell from 1.2490 to 1.2313.

Indicator signals:

Moving averages

Trading is above the 30 and 50-day moving averages, which indicates an attempt by the bulls to build a correction.

Note: The period and prices of moving averages are considered by the author on the H1 hourly chart and differs from the general definition of the classic daily moving averages on the daily D1 chart.

Bollinger Bands

In case of a decline, the lower border of the indicator around 1.2452 will act as support.

Description of indicators

- Moving average (moving average, determines the current trend by smoothing out volatility and noise). Period 30. It is marked in green on the chart.

- MACD indicator (Moving Average Convergence/Divergence — convergence/divergence of moving averages) Quick EMA period 12. Slow EMA period to 26. SMA period 9

- Bollinger Bands (Bollinger Bands). Period 20

- Non-commercial speculative traders, such as individual traders, hedge funds, and large institutions that use the futures market for speculative purposes and meet certain requirements.

- Long non-commercial positions represent the total long open position of non-commercial traders.

- Short non-commercial positions represent the total short open position of non-commercial traders.

- Total non-commercial net position is the difference between short and long positions of non-commercial traders.