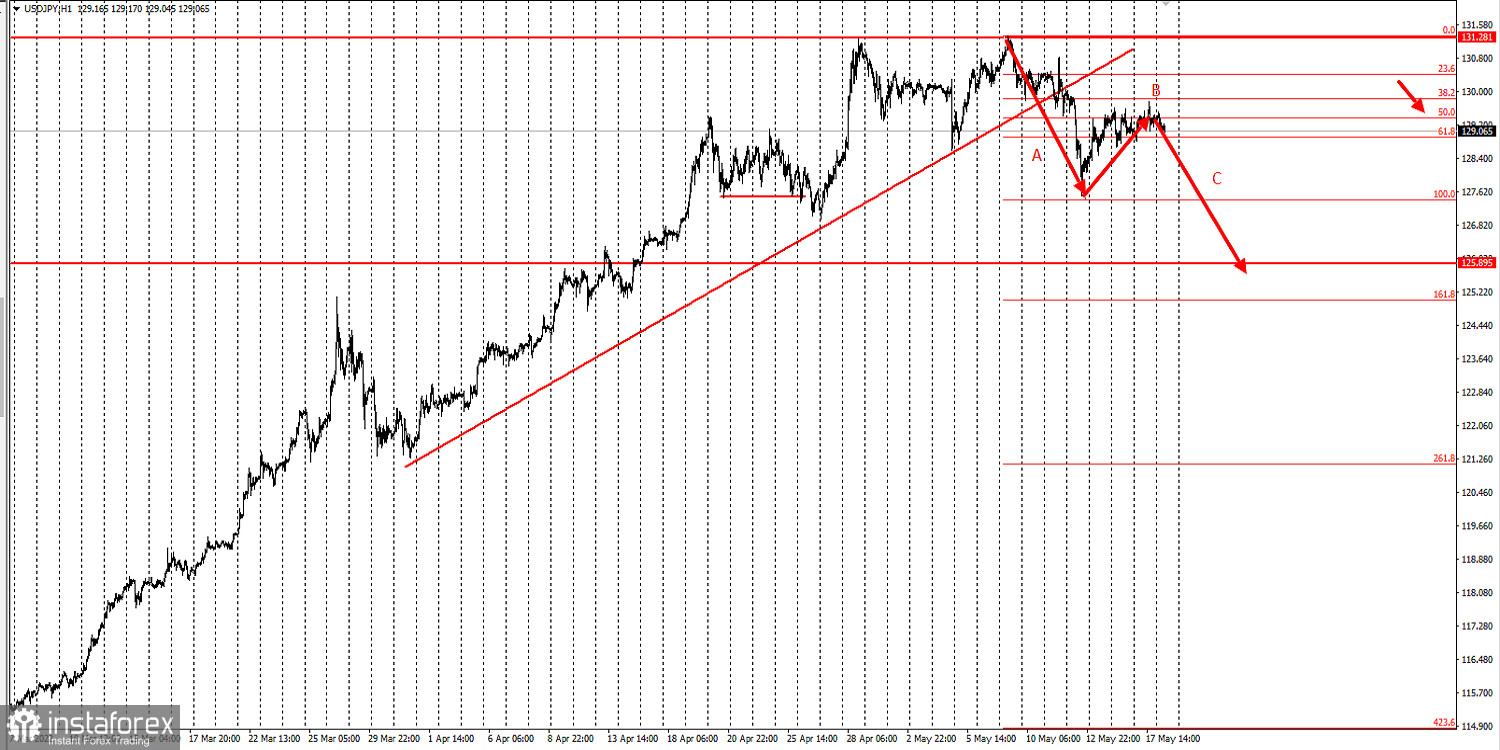

The bullish trend in USD/JPY broke on May 12, but the market tried to recover for the following days.

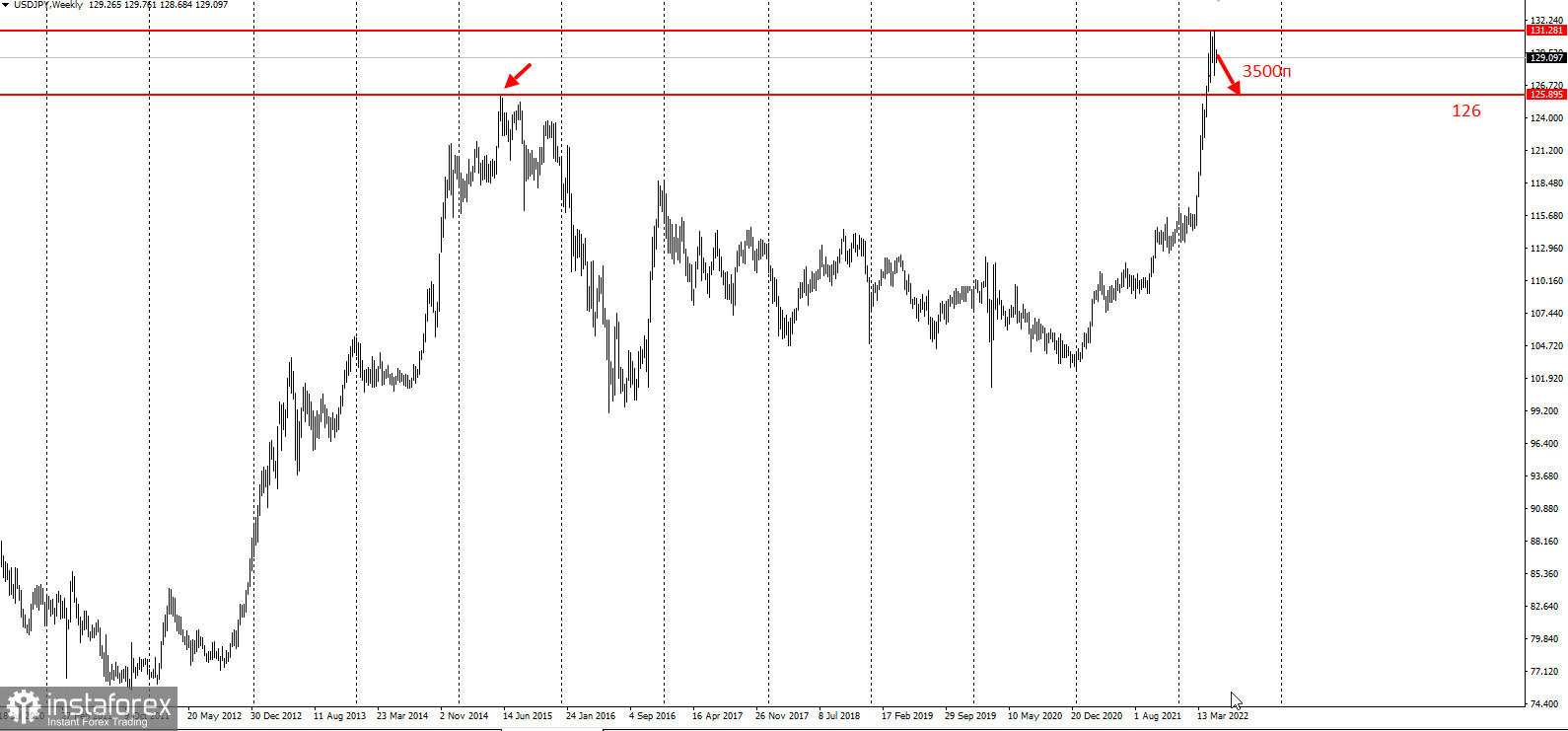

Most likely, the price will return to the 2015 low in the weekly chart, especially if the pair moves 3,500 pips or more.

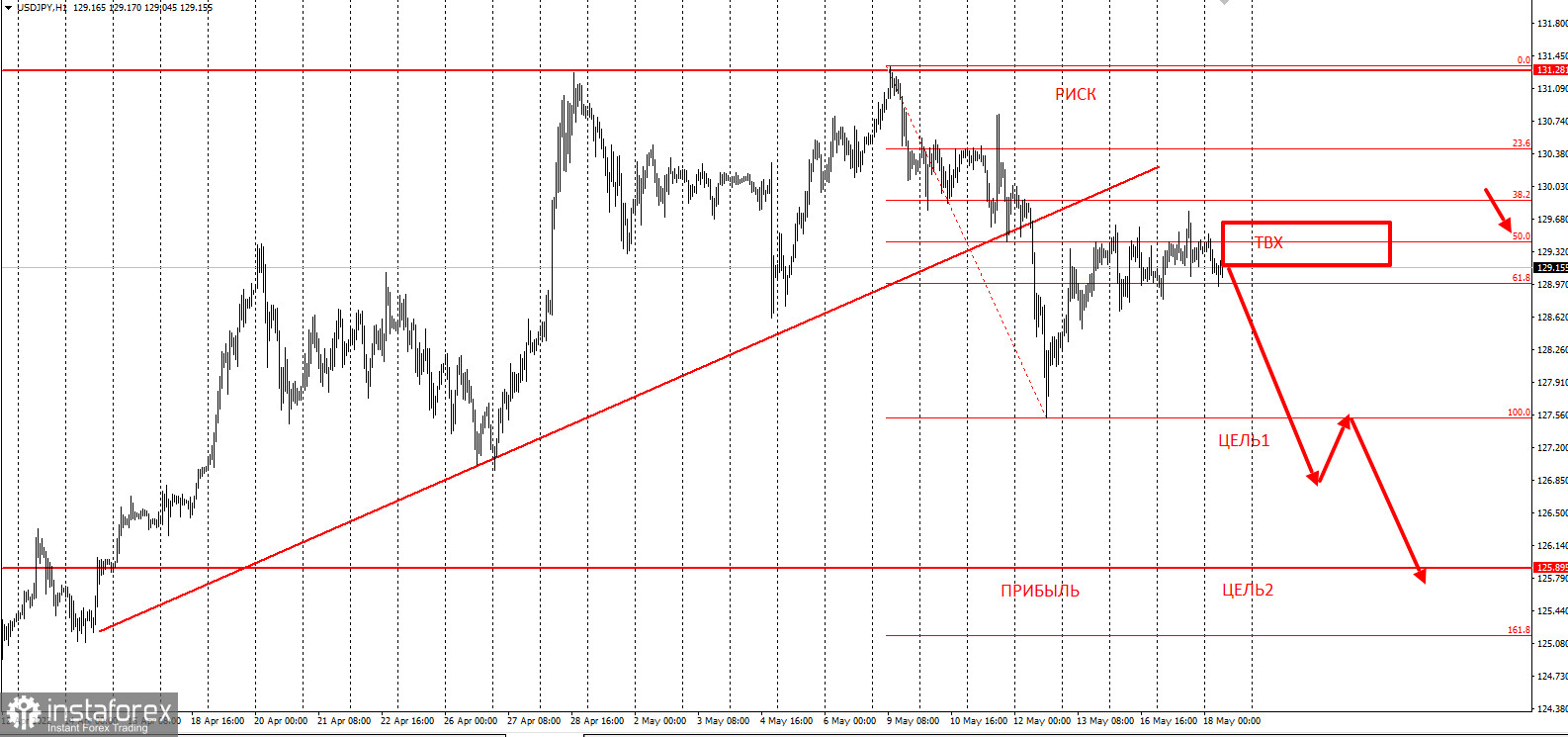

This means that on the one hand, the bullish momentum is finished, while on the other hand, there is a good potential movement. In this situation, the best move is to take short positions, following this plan:

Since there is a three-wave pattern (ABC), where wave A represents the selling pressure on May 12, traders can open short positions up to the 50% retracement level of the current prices. Place stop loss at 131, and take profit on the breakdown of 126.

This idea is based on the "Price Action" and "Stop Hunting" strategies.

Good luck and have a nice day!