Analysis of EUR/USD and trading tips

Yesterday, traders of the euro continued suffering losses. In the first part of the day, the price tested the level of 1.0471 when the MACD indicator significantly rose from the zero level, thus capping the upward potential of the euro/dollar pair. That is why I did not open long positions and waited for the implementation of scenario 2, featuring sell orders on the euro. Some time later, the pair tested 1.0471 for the second time. At that moment, the MACD indicator was in the overbought area, thus giving a perfect sell signal. However, the euro continued gaining in value and traders sustained losses. Sell orders from 1.0514 aimed at a rebound failed to bring profit. Traders did not face losses, as the pair did not reverse as expected.

Yesterday, Italy published its trade balance and consumer price index data. However, the market ignored both reports. Meanwhile, the eurozone GDP data for the first quarter of the year made traders go long, thus boosting the pair. The market also paid zero attention to the US retail sales figures for April. In addition, the indicator's reading was well below the forecast. On the one hand, this is good for the Federal Reserve. On the other hand, it is a first sign that the US economy is entering recession amid high inflation.

Early today, the eurozone is going to disclose its CPI and core CPI data. The ECB takes into account only core CPI since it excludes prices on volatile goods. If the prices increase, the central bank is likely to start raising the benchmark rate earlier than planned. Theoretically, this fact may act as a buy signal. In the second part of the day, the US will disclose its building permits and housing starts reports. However, they will hardly affect the currency market, especially in the short term. At the end of the day, FOMC Member Patrick T. Harker will provide a speech. A more dovish stance of the FOMC member may increase pressure on the US dollar, thus causing a surge in demand for risk assets.

Signals to buy EUR/USD

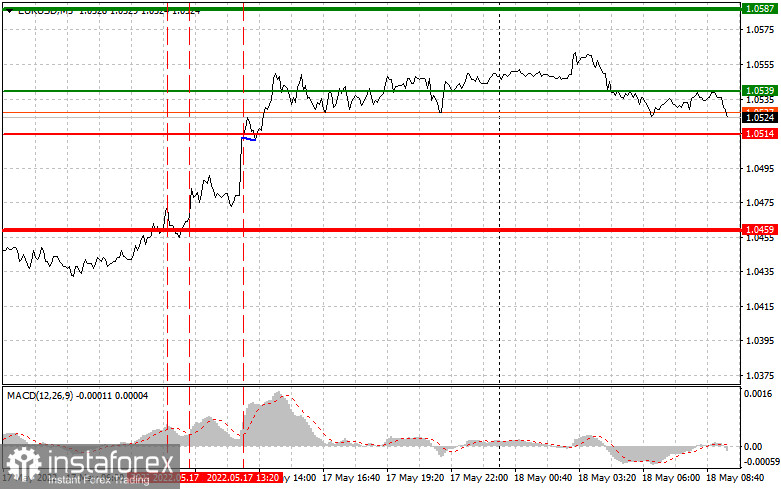

Scenario 1: Today, traders could buy the euro if it hits 1.0539 (a green line on the chart), expecting a rise to 1.0587. At this level, it is recommended to leave the market and open an opposite order, expecting a change of 30-35 pips. The euro may show a jump in the first part of the day but only amid strong statistical reports from the eurozone. Notably, before you start opening buy positions, make sure that the MACD indicator is above the zero level and begins rising from it.

Scenario 2: Traders may also go long if the price reaches the level of 1.0514. At this moment, the MACD indicator should be in the oversold area, thus limiting the downward potential of the pair and causing its upward reversal. The pair may climb to 1.0539 and 1.0587.

Signals to sell EUR/USD

Scenario 1: Traders may open short positions on the euro, if it touches the level of 1.0514 (a red line on the chart). The target is located at 1.0459, where it is recommended to close the position and open a buy order, expecting a rise of 20-25 pips. Pressure on the euro will return if buyers fail to be active after the price hits a new local low. Be very cautious when opening buy positions. Today, the euro may slump like yesterday. Notably, before starting to sell the euro, make sure that the MACD indicator is below the zero level and begins dropping from it.

Scenario 2: It is also possible to sell the euro if it hits 1.0539. At this moment, the MACD indicator should be in the overbought area, thus capping the upward potential of the pair and spurring its reversal. The pair may slide to 1.0514 and 1.0459.

What we see on the trading charts:

A thin green line is the entry price at which you can buy a trading instrument.

A thick green line is the estimated price where you can place a take-profit order or lock in profits by yourself, since the price will hardly go above this level.

A thin red line is the entry price at which you can sell the trading instrument.

A thick red line is the estimated price where you can place a take-profit order or lock in profits by yourself, since the price is unlikely to decline further.

The MACD indicator. When entering the market, it is important to take into account overbought and oversold zones.

Beginning traders should be very cautious when making decisions to enter the market. It is better to open positions ahead of the publication of important reports in order to avoid price fluctuations. If you decide to enter the market amid the news release, place stop orders to minimize losses. Otherwise, you may lose all your funds, especially if you do not use money management and trade big volumes.Please remember that successful trading requires an accurate trading plan similar to the one described above. Knee-jerk decisions made amid the current market situation is a losing strategy of an intraday trader.