The EUR/USD pair dropped like a rock in the short term as the Dollar Index rebounded. Now, it's trading at 1.0926 above today's low of 1.0885. The pair extended its growth yesterday as expected. The US reported some poor data while the FOMC increased the Federal Funds Rate by 25 bps as expected.

As you already know, the ECB and BOE delivered 50 bps hikes as expected. The European Central Bank is expected to increase the Main Refinancing Rate by 50 bps in March again. Tomorrow, the US data could be decisive. The NFP is expected at 193K in January below 223K in the previous reporting period, the Unemployment Rate may increase from 3.5% to 3.6%, Average Hourly Earnings could increase by 0.3%, and ISM Services PMI could jump to 50.50 signaling expansion. Positive US data should lift the greenback while poor data will bring new USD depreciation.

EUR/USD Found Demand Again!

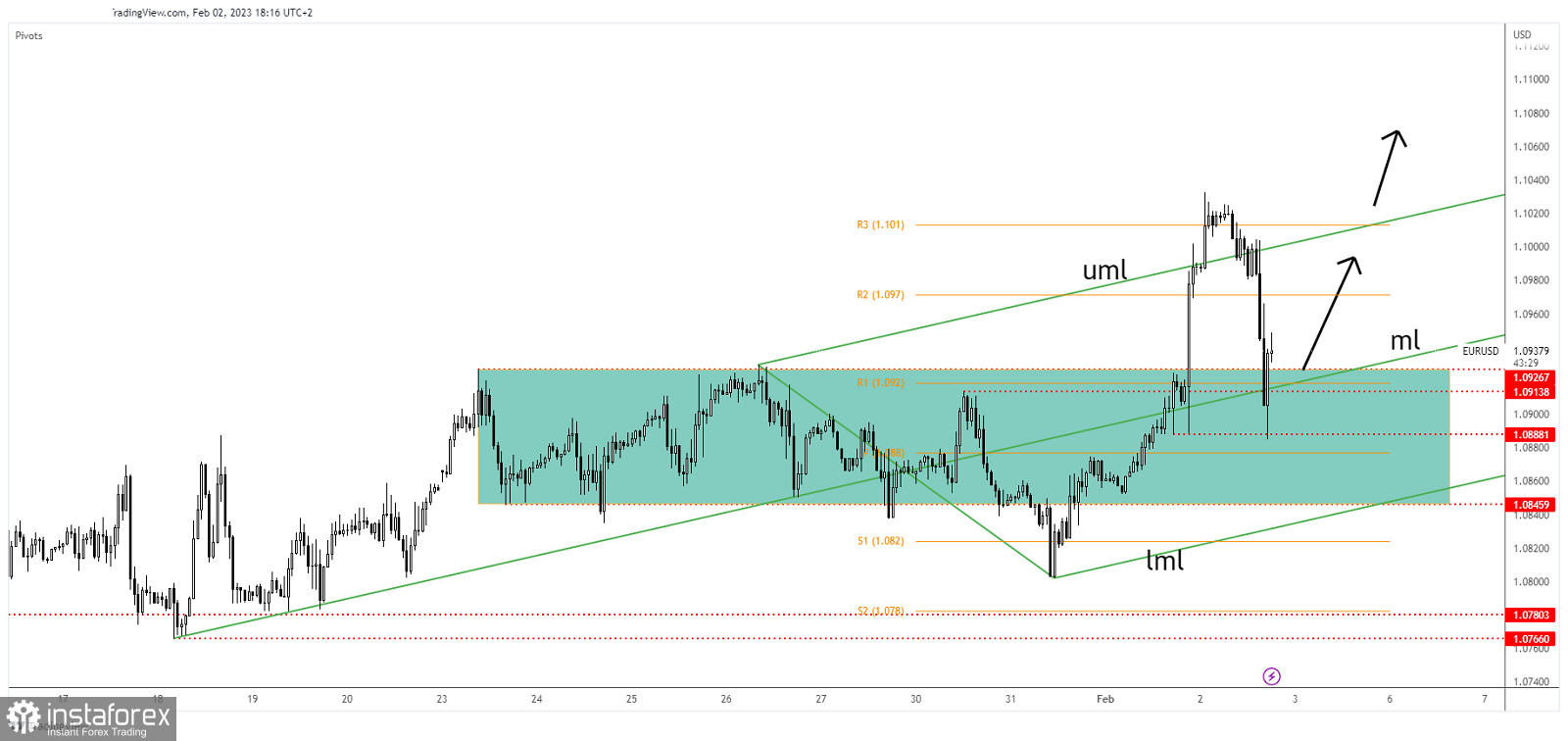

EUR/USD found resistance right above the R3 (1.1010) and failed to stay above it and above the ascending pitchfork's upper median line (uml) indicating an overbought.

Now, it has found support on the 1.0888 former lows and it has invalidated its breakdown below the median line (ml), 1.0913, and below the R1 (1.0920). Still, the rate could come back to test and retest these levels.

EUR/USD Outlook!

Testing and retesting the median line (ml) and the 1.0913 - 1.0926 zone, false breakdowns below these downside obstacles should announce a new bullish momentum. Staying above these downside obstacles and making a bullish closure above 1.0948 activates an upside movement toward the R3 (1.1010) again. This is seen as a buying signal.