Hello, dear traders!

Yesterday's data on the UK labor market allowed the pound sterling to rise against the US dollar. Notably, in most dollar pairs we see signals of the greenback's depreciation. Judging by the recent weekly candlestick formed by the pound/dollar pair, the British pound is among those currencies that may change their trends.In fact, for the recent few days, including yesterday, traders have been showing interest in risk assets. This fact could be explained by weaker quarantine measures in China. In addition, yesterday's positive data on the UK labor market may encourage the Bank of England to switch to a more aggressive approach to its monetary policy tightening. Thus, a technical picture of the pound/dollar pair may change significantly. Now, let us take a look at the daily chart.

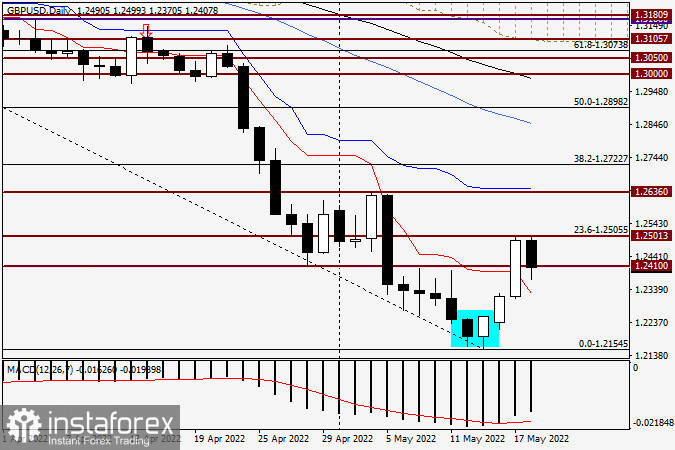

Daily

The pound/dollar pair climbed to 1.2490, where it closed on Tuesday. As a result of the upward movement, the quote jumped above the earlier broken support level of 1.2410 and a red Tenkan line. Today, the pair might have tested the most important psychological level of 1.2500, but traders began selling off the British pound. At the moment, the pair is trading below 1.2410, whereas the key resistance level is located at 1.2500. It is clearly seen that bulls have been trying to break this level for several days, but all in vain. The support level is located at 1.2327 and is represented by the red Tenkan line. It is highly likely that a break of the important level of 1.2500 will push the price higher to 1.2600-1.2650, where there is a technical level of 1.2600. I suppose that sell orders could be considered near 1.2500 and (or) from 1.2600-1.2650, if the pair hits these levels. It is recommended to open buy positions closer to 1.2330, near the red Tenkan line. Buying the pound sterling at the current market prices or after a drop to 1.2365 is riskier. Since the market situation is rather unclear, it is better not to place a take-profit order far from the entry point. In general, judging by the chart, I can say that the greenback may start losing its positions. At least, most dollar pairs may show correction in the near future.

I wish you success and profitable trading!