The pound reacted negatively to the latest data on inflation growth in the UK. The release really came out in the red zone, although it reflected a record increase in the consumer price index. However, in my opinion, in this case, the point is not that the inflation report did not reach the forecasted values - the traders' concern was rather caused by a significant increase in the CPI against the backdrop of a rather weak growth of the British economy. The market is again talking about the risks of stagflation, as if continuing a correspondence discussion with the head of the Bank of England, Andrew Bailey, who recently voiced pessimistic rhetoric on this issue.

Let me remind you that the results of the BoE's May meeting also put pressure on the pound, despite the fact that the central bank raised the interest rate by 25 basis points. However, investors ignored this event, focusing on Bailey's comments and further prospects. And they, in turn, turned out to be far from rosy - the members of the central bank worsened the forecast for GDP growth this year, while inflation is growing at the same time.

The meeting took place on May 5, and after this date, key reports were published in the field of inflationary growth and the overall economy of Britain. These releases actually confirmed the fears of the members of the central bank - the price pressure is increasing, the volume of GDP is declining. Thus, the UK economy in the first quarter of this year grew by only 0.8% Q/Q, with a growth forecast of up to 1.0% and the previous value of 1.3%. On a monthly basis, the situation is even worse: for the first time since December last year, the indicator fell into the negative area (-0.1%) with a forecast of zero growth, as in the previous month. The volume of industrial production in March fell by 0.2%, while experts expected a minimal increase of 0.1%. The processing industry showed similar dynamics, decreasing by 0.2% (the forecast was at the level of 0.0%).

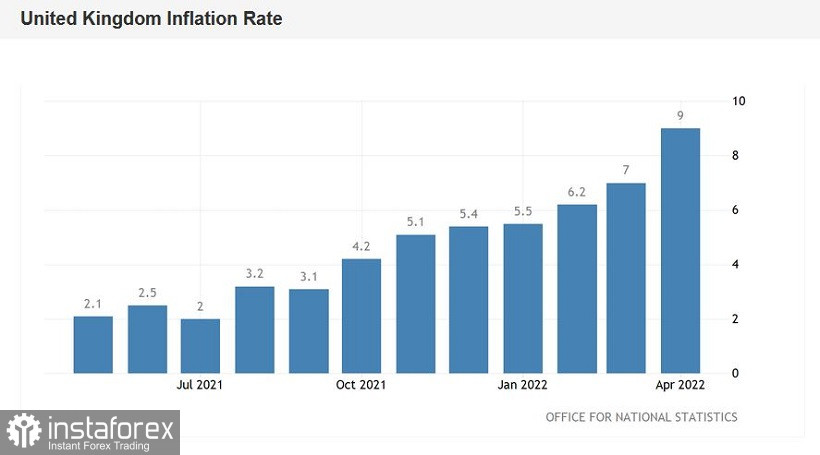

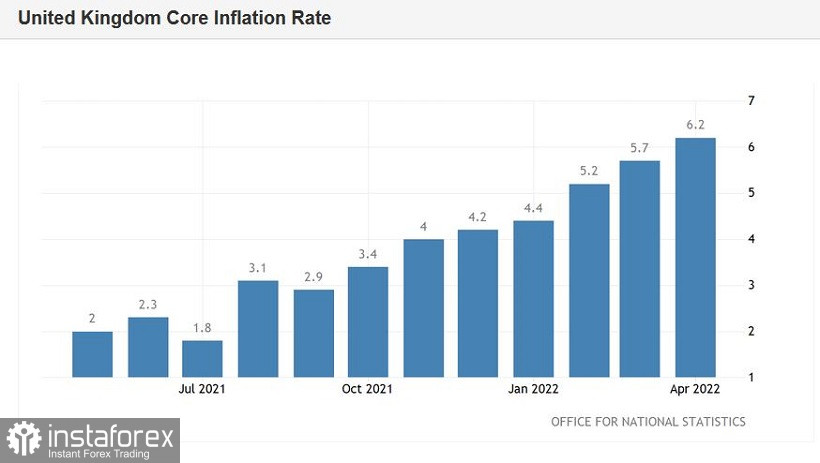

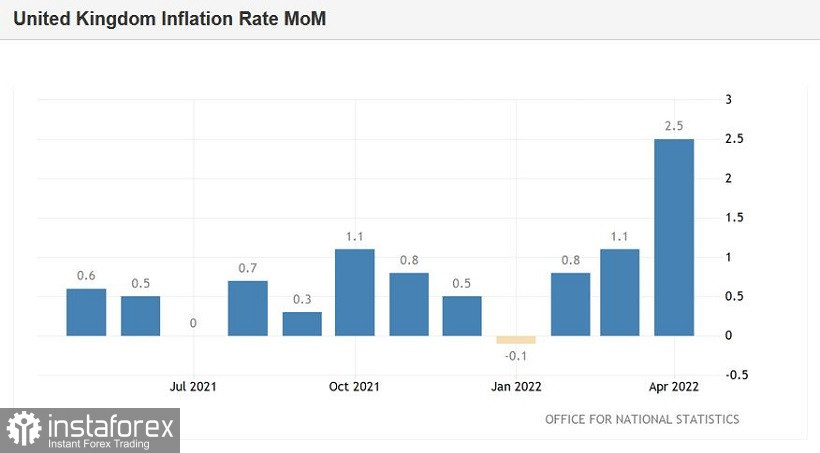

Key data on inflation growth in Great Britain were published today. The overall consumer price index on a monthly basis came out at 2.5%. This is the strongest growth rate in 31 years - in May 1991, this component jumped by 3.4%. The indicator has been consistently growing for the third consecutive month, but the April result can be called a breakthrough. In annual terms, the consumer price index also showed a jumpy growth, being at around 9.0% (in the previous month it was at the level of 7.0%). This is already a 40-year record: the indicator showed the strongest growth rate since April 1982. Core inflation showed similar dynamics. The core consumer price index jumped to 6.2% (this result is also a multi-year record).

In general, the spike in inflation is due to rising energy prices in the European wholesale markets. The British energy regulator raised the upper limit on household energy prices by 54%, after which petrol and diesel prices jumped. Food prices rose by 6.7%, for recreation - by 5.9% (this is a 16-year record).

Taking into account recent releases, the BoE again faced a choice: either the central bank actively raises the interest rate, fighting inflationary growth (but at the same time pushing the economy into recession), or it resigns itself to further inflation, hoping for an increase in GDP or at least stagnation. According to some experts, the British central bank may slow down the pace of tightening monetary policy - if the members of the Committee come to the conclusion that inflation peaked in April (based on the fact that most of the increase in inflation in the previous month was due to the fact that the British energy the regulator raised the upper limit on energy prices). In this scenario, the BoE will focus on supporting economic growth, rather than curbing inflationary growth.

Apparently, this explains such a restrained reaction of traders to the latest inflationary release. Britain's GDP growth is likely to slow down in the second quarter as well, while inflation rises, reducing the purchasing power of the population. There are also certain prerequisites for increased inflationary growth, in particular, due to problems with supply chains and logistics, due to geopolitical tensions and a wave of lockdowns in China.

Such general conclusions put pressure on the British currency, including in pair with the US dollar.

From a technical point of view, bulls on the GBP/USD pair could not overcome the resistance level of 1.2500 (the middle line of the Bollinger Bands indicator on the D1 timeframe), despite the two-day siege of this milestone. If traders fail to settle above this target in the medium term, the bears will seize the initiative again, bringing the price back to at least the support level of 1.2320 (the Tenkan-sen line on the daily chart). In my opinion, longs on the pair look risky, while selling will be relevant if the GBP/USD bulls indicate their inability to overcome the 1.2500 target.