The spring of 2022 brought tears of pain and disappointment to the cryptocurrency market. It is commonly believed that the main sponsor of the plight is the policy of the US Federal Reserve System. The increase in the key rate and the withdrawal of multibillion-dollar volumes of liquidity promise the cryptocurrency market the renewal of new local lows. However, is it really the Fed that has a decisive influence on the price drop?

If we take the recent situation, when Bitcoin updated its local low at $24.2k, then it can be argued that the natural price decline was "pushed" as part of an operation to attack the UST stablecoin. The initial fall of the cryptocurrency was a local reaction to another increase in the key rate. During the systematic price decline, we saw several impulsive drops to local lows. There was also a suspicious increase in the volume of long positions.

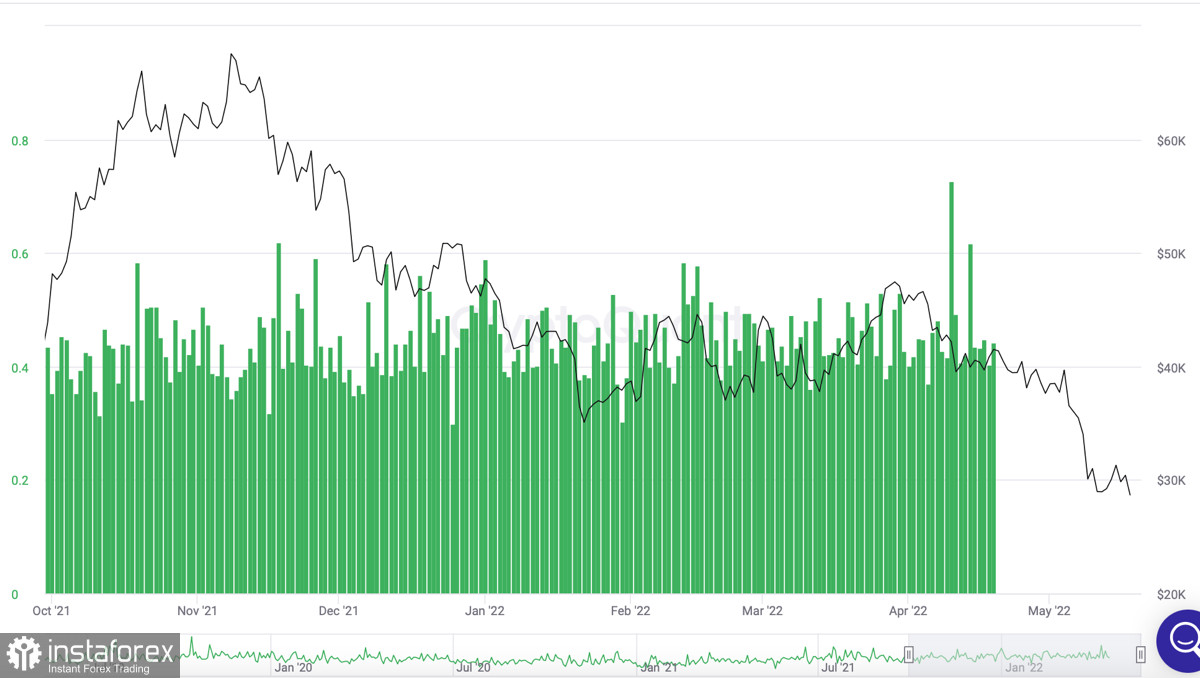

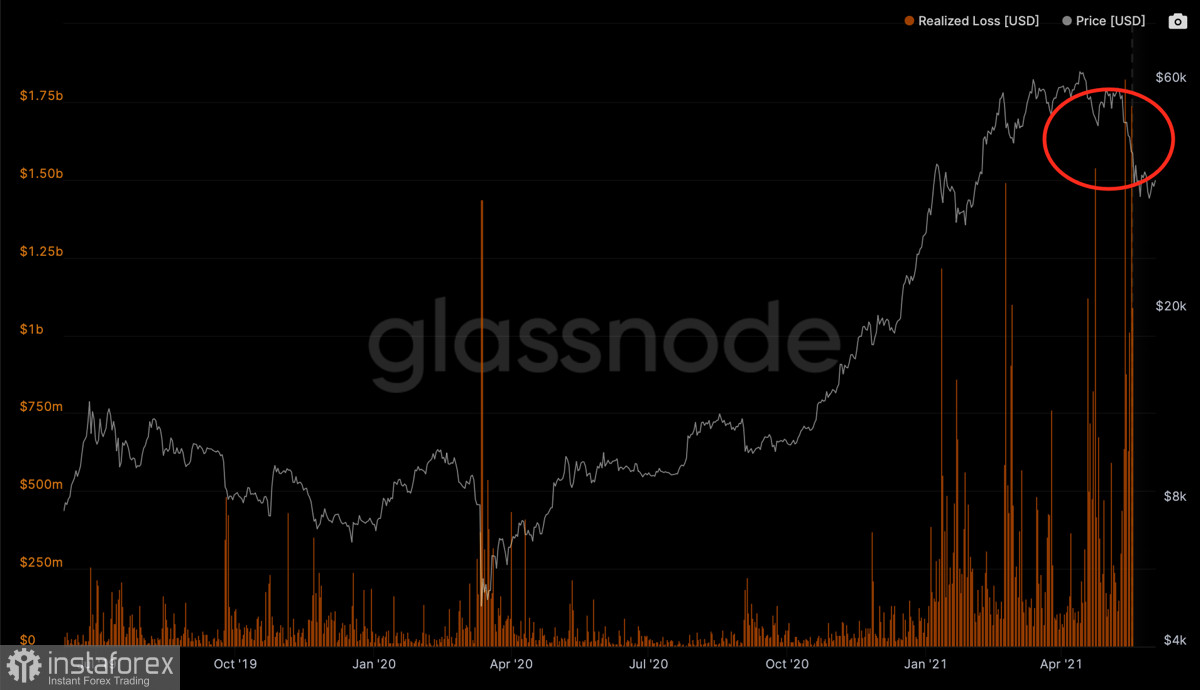

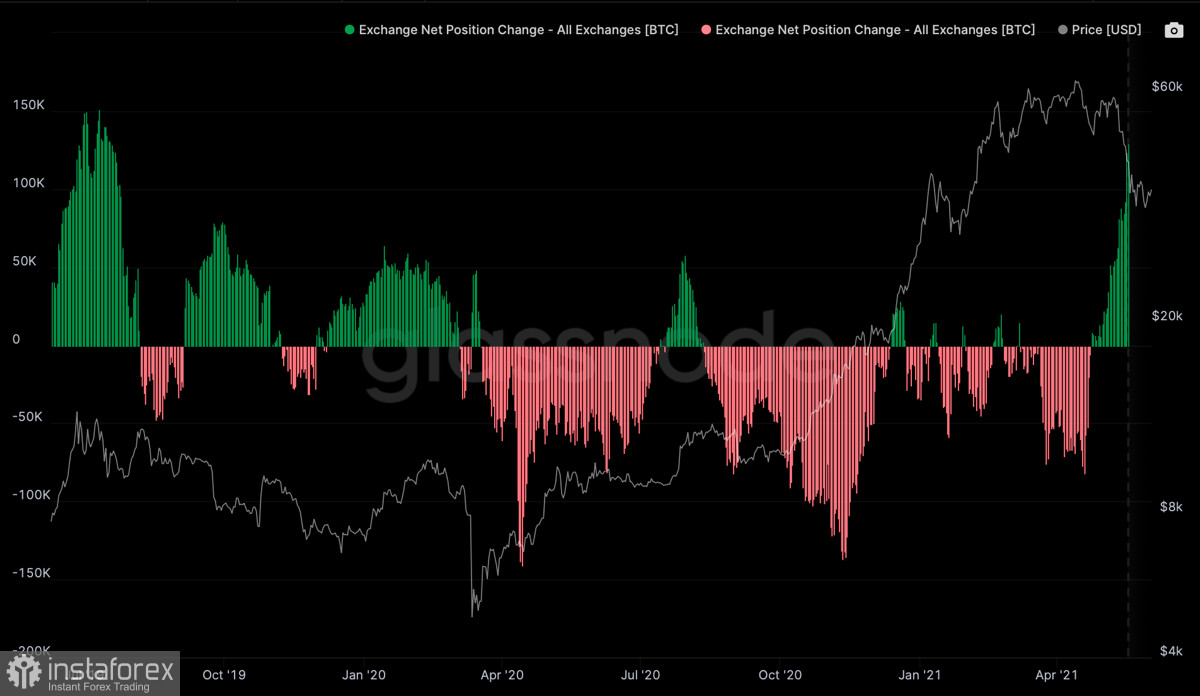

As a result, this led to the fact that large volumes of BTC began to sell off and thereby increase the level of volatility. This set off a massive selling cascade and we recorded a large loss in realized volumes between May 4th and May 11th. As a result, we saw a large influx of BTC coins to the exchanges and the gradual squeezing out of "weak hands" from the market. Obviously, such manipulations are possible only in the case of obvious fundamental factors that negatively affect the cryptocurrency market. However, it can be assumed that if it were not for a significant jump in volatility and a provoked cascade of sales, then such a deep drop could have been avoided.

A similar opinion is expressed by experts from the Durham University Business School. In their opinion, the impact of monetary policy on Bitcoin quotes is overestimated. Moreover, analysts concluded that the pressure on the crypto market and Bitcoin decreased as the Fed's key rate tightened. At the same time, a surge in activity began as the volatility of the digital asset increased. To top it off, experts state that the tightening of monetary policy does not affect the profitability of cryptocurrencies in any way. At the same time, the tightening of monetary policy is closely related to the decline in profits from Bitcoin and other coins.

And here lies the key maxim, which indicates that in the future the crypto market will get rid of the correlation with stock indices. The current price drop was influenced by many fundamental factors, such as the war in Ukraine, rising inflation and global sanctions, which cut off a large market from digital coins. All this is happening against the backdrop of a downward trend in cryptocurrencies and an increased correlation with stock indices. At the same time, investors are losing liquidity due to the Fed's policy and are very cautious in managing their capital. In the current environment, almost all assets, except for USD, Treasury and mortgage bonds, show a decline.

Given these facts, we can say that the current fall in BTC, and after it, the entire crypto market, is only indirectly related to the policy of the Fed. The fall of the cryptocurrency is associated with many negative factors, which coincided with significant liquidity restrictions and situational correlation with stock indices. However, with the normalization of the situation and the gradual recovery of the price, Bitcoin will become in demand due to its scarcity and growing profitability.

As of May 19, the cryptocurrency continues to be within the framework of consolidation in the range of $28.5k–$31.3k. Technical indicators are moving flat, and sales volumes are returning to a stable rate. At the same time, attention should be paid to exchange activity. The level of volatility has fallen, and judging by the growing volume of coins on the exchanges, the BTC/USD price will again be pushed to local lows in order to knock out "weak hands."