Hello, dear colleagues!

Yesterday was not the best day for risk assets. In recent overviews, we talked about an increase in risk sentiment. Today, the situation has dramatically changed in spite of reports that China has lifted Covid-19 restrictions in Shanghai and other cities. The end of the pandemic is coming to an end, which is great. After two years of infections, deaths, and multiple restrictions, it is time to say goodbye to this plague. Meanwhile, demand for US Treasuries strengthened amid risk aversion. At the same time, 10-year bond yields dropped to 2.90%, stock indices plunged, and the greenback strengthened. Risk aversion drives the dollar up, US Treasury Secretary Janet Yellen said in an interview yesterday. In fact, it seems to be true. The greenback has been the number one safe haven for a relatively long time, putting the Japanese yen and the Swiss franc on the back burner.

Speaking of the macroeconomic calendar, yesterday's release of the CPI report in the eurozone showed a drop to 7.4% versus 7.5%. Moreover, the final data came in line with the market forecast. Does it mean that inflation will now go down? Of course, not. To tame inflation, the ECB will have to put a lot of effort, in other words, to start acting aggressively and decisively, like the Fed. However, the state of the European economy is much weaker than that of the American one. That is the reason why the ECB is still dovish. Today, market players will focus on the ECB's monetary policy meeting accounts, US weekly jobless claims, and the Philadelphia Fed Manufacturing Index.

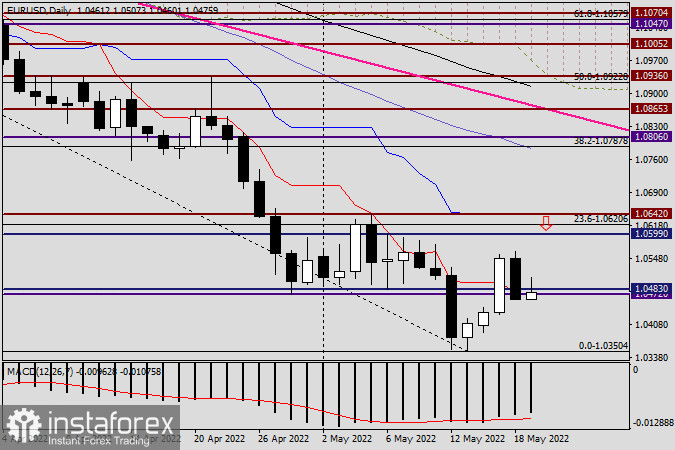

Daily

Yesterday, the pair fell below 1.0470 and the red Tenkan Line of the Ichimoku indicator. The fact that yesterday's bearish candlestick has no lower shadow indicates that euro bears will try to regain control over the market. The pair's attempts to rise above 1.0470 have been sluggish today. It may well be due to bearish resistance that prevents the quote from reaching the psychological level of 1.0500. Today, the price has already touched 1.0507, while the current upper shadow and the bullish body of the candlestick clearly indicate significant problems with the pair's growth. If the pair tries to reverse up, it is important to focus on price behavior in the 1.0485-1.0505 range. If bearish Japanese candlesticks emerge in the outlined range in the lower time frames, short positions could be considered, with targets at 1.0460, 1.0433, and 1.0404. Anything can happen in the market but in light of yesterday's candlestick and its closing price, it would be unwise to buy the instrument right now.

Have a nice trading day!