The price of Gold is trading in the green at 1,916 at the time of writing. Technically, the rate reached strong downside obstacles and now it has turned to the upside. After its massive drop, a rebound was natural.

Still, it remains to see how it will react after the US data publication. As you already know, the US is to release high-impact data which could bring sharp movements here in XAU/USD. Non-Farm Payrolls indicator is expected at 193K in January but below 223K in December. The ADP Non-Farm Employment Change came in worse than expected on Wednesday, so the NFP is expected to report poor data as well.

In addition, the Unemployment Rate, ISM Manufacturing PMI, Final Services PMI, and Average Hourly Earnings will be released as well, so the fundamentals should have a big impact.

XAU/USD Buyers Took The Lead Again!

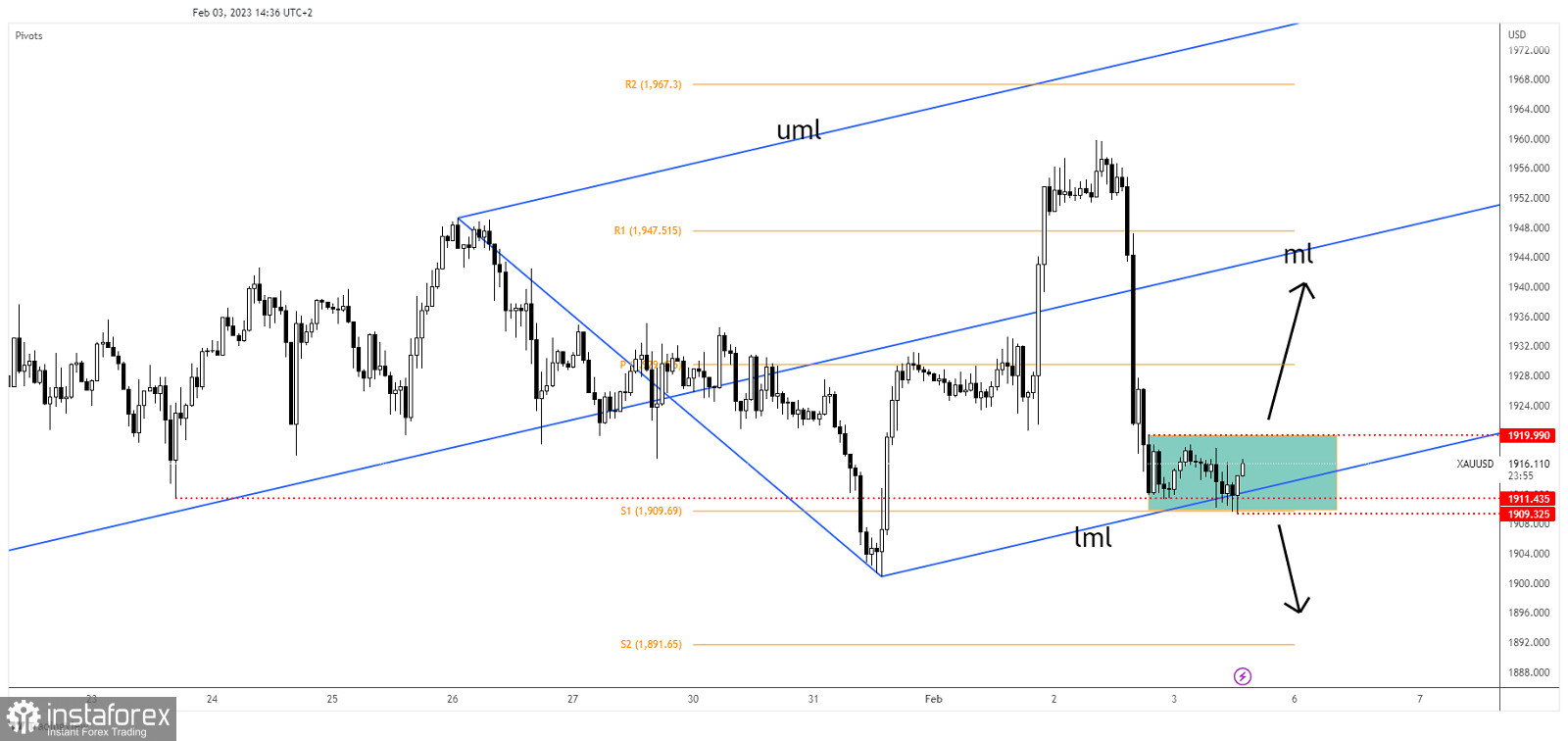

Technically, the sell-off was stopped by 1,911 and by the lower median line (lml) as expected. You knew from my previous analysis that the rate could find strong demand around these levels and it could turn to the upside.

It has retested the downside obstacles and the S1 (1,909) registering a false breakdown with great separation on the h1 signaling strong upside pressure. In the short term, it has developed a range pattern, so a valid breakout from this minor formation could bring new opportunities.

XAU/USD Outlook!

A new lower low, a valid breakdown below 1,909 activates a deeper drop and brings a bearish signal.

A new higher high, a valid breakout above 1,919 activates further growth and represents a buying opportunity.