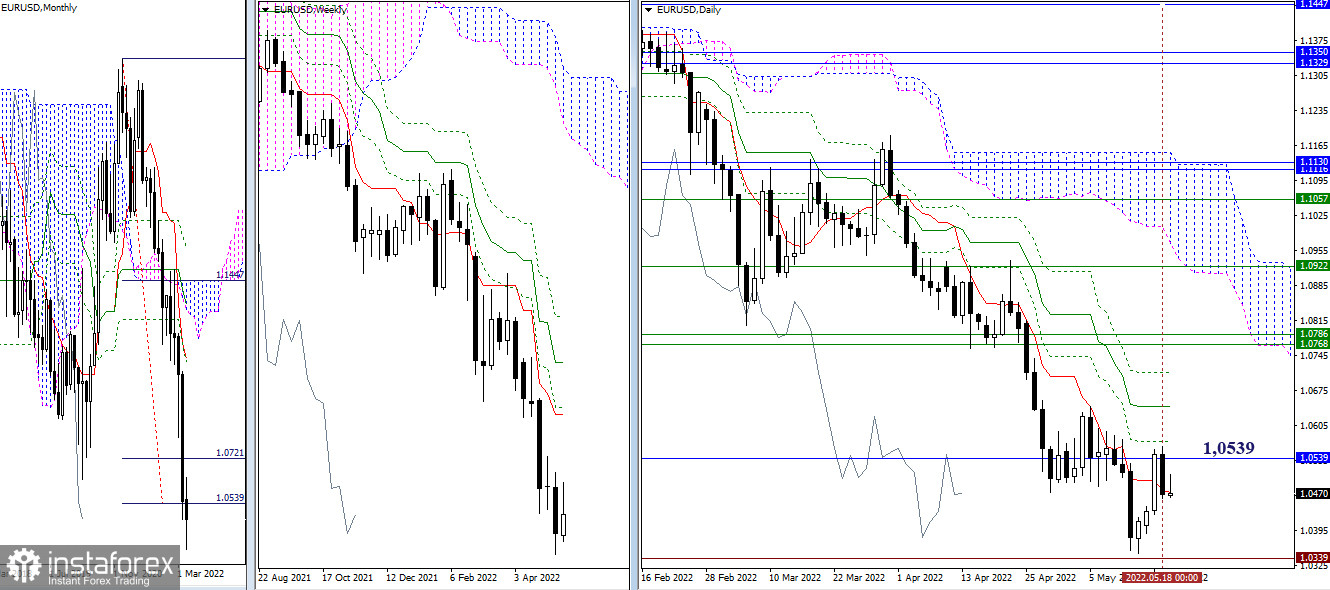

EUR/USD

Higher timeframes

Yesterday, bears issued a daily rebound in the resistance area of 1.0539 (monthly level). Now it is important whether the bears can confirm the rebound and develop it, completing the current upward correction around 1.0539. In the future, their main task in this area will be a breakdown of support at 1.0339 and the restoration of the downward trend. If this fails, then consolidation around 1.0539 and fixation above the level may lead to the development of bullish prospects. The nearest resistance levels are the daily Ichimoku death cross (1.0573 – 1.0642 – 1.0712).

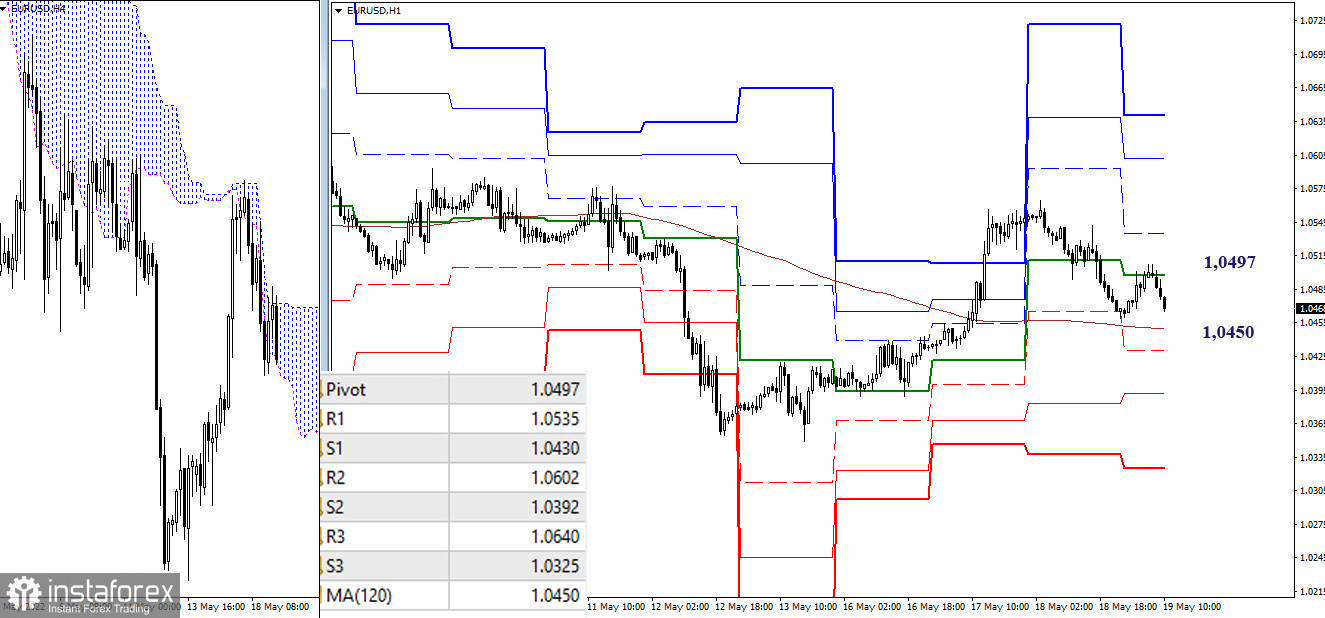

H4 - H1

In the lower timeframes, the strength test continues for the bulls. There is a struggle to enter the bullish zone relative to the H4 cloud and maintain key supports on the side of the bulls. The loss of support for the weekly long-term trend (1.0450) can again change the current balance of power. The bears' plans for the further decline within the day will be aimed at passing the supports of the classic pivot points (1.0430 – 1.0392 – 1.0325). If bulls now hold positions and regain the central pivot point of the day (1.0497), then we can expect a continuation of the rise and strengthening of bullish sentiment. In this case, the reference points for the day will be the resistance of the classic pivot points (1.0535 – 1.0602 – 1.0640).

***

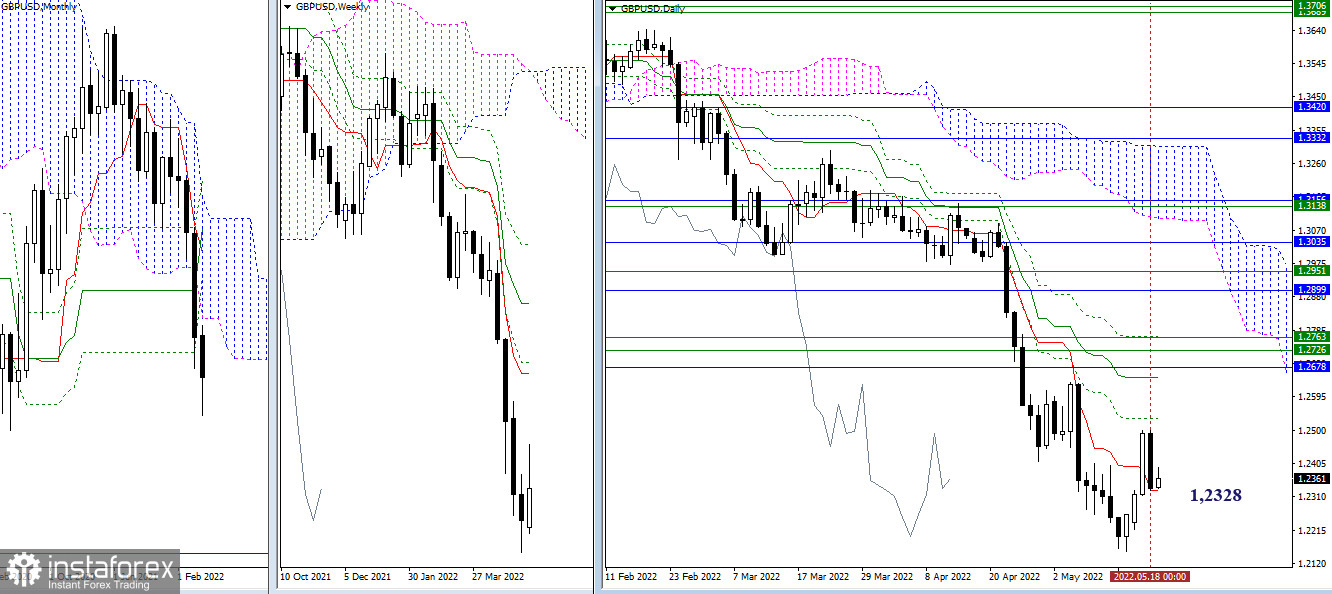

GBP/USD

Higher timeframes

Sellers stopped the upward corrective rise. The pair returned to the zone of influence of the daily short-term trend (1.2328). Now the question will be decided which of the players in the market will have its support. The interests of the bears are aimed at continuing the decline and restoring the downward trend (1.2155). Players' desire to increase rests on maintaining support for the short-term trend and testing new resistances, the nearest of which can now be noted at 1.2534 and 1.2651 (levels of the daily Ichimoku death cross).

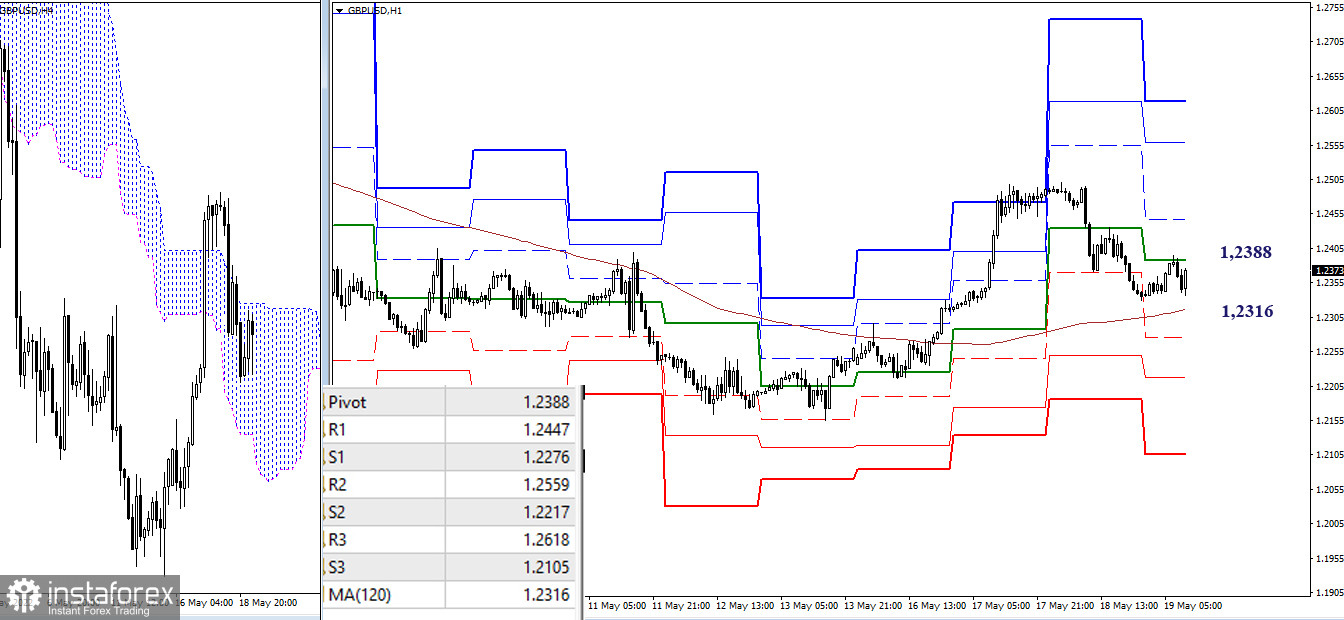

H4 - H1

The depth of the current decline is already significant, but at the same time, bulls have not yet lost support for the weekly long-term trend (1.2316), one of the key levels of the lower timeframes, responsible for distributing the balance of power. Therefore, the main advantage in the lower timeframes is still on the side of the bulls. Reference points for the development of intraday movement today are at 1.2447 – 1.2559 – 1.2618 (resistance of classic pivot points) and at 1.2276 – 1.2217 – 1.2105 (support of classic Pivot points).

***

In the technical analysis of the situation, the following are used:

higher timeframes – Ichimoku Kinko Hyo (9.26.52) + Fibo Kijun levels

H1 - Pivot Points (classic) + Moving Average 120 (weekly long-term trend)