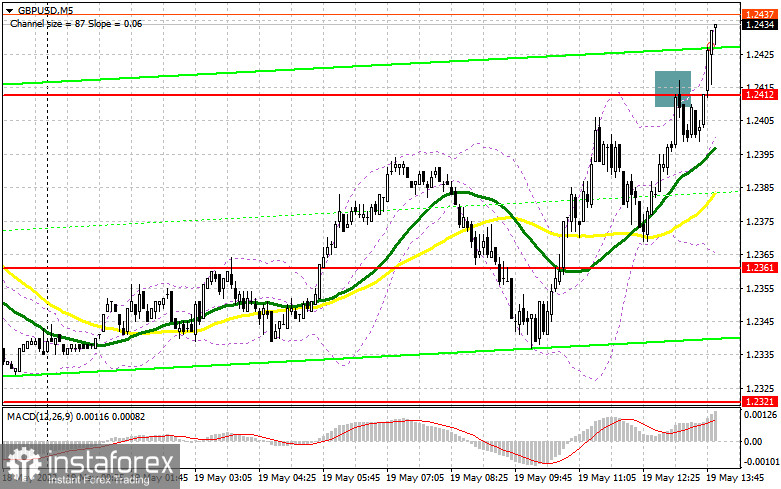

In my morning forecast, I paid attention to the level of 1.2361 and recommended making decisions on entering the market. Let's look at the 5-minute chart and figure out where and how it was possible and necessary to enter the market. I said that the lack of statistics will play on the side of the buyers of the pound - and it happened. The breakthrough of 1.2361 took place, but on the reverse test from top to bottom, the bulls quickly took back this level. Therefore, there was no signal for the passage. There was also no top-down reverse test for purchases. Only by the middle of the day, did the test and the false breakout at 1.2412 give a sell signal, which, as you can see, led to the fixing of losses. In the afternoon, the technical picture was completely revised. And what were the entry points for the euro this morning?

To open long positions on GBP/USD, you need:

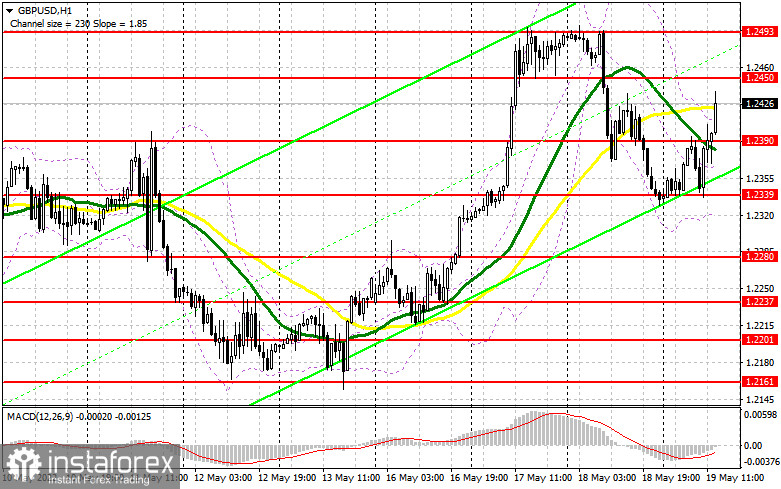

The buyers of the pound do not intend to give up. For this reason, I am betting on an active struggle in the support area of 1.2390, to which the pair may decline after the release of data on the number of initial applications for unemployment benefits and the volume of housing sales in the US secondary market. Strong indicators will surely lead to the 1.2390 test, and here we need to wait for the formation of a false breakdown. Only it forms a good signal to open long positions in the continuation of the upward trend and with the prospect of going beyond the nearest resistance of 1.2450. It is also possible to expect a sharper spurt of the pair, but only in the case of weak statistics in the United States. Consolidation above 1.2450 with a reverse test from top to bottom will lead to a new buy signal followed by movement to the area of the week's maximum of 1.2493. I recommend fixing profits there. The more distant target will be the 1.2574 area. In the case of a decline in the pound and the absence of buyers at 1.2390, most likely, the trade will move into the framework of the side channel, and the winner of today will not be revealed. In this case, I advise you not to rush shopping. It is best to enter the market after a false breakdown at 1.2339. You can buy GBP/USD immediately for a rebound from the minimum of 1.2280, or even lower - around 1.2237 and only for a correction of 30-35 points within a day.

To open short positions on GBP/USD, you need:

In the current realities, only the protection of 1.2450, the new resistance, will help the bears get a sell signal, which will lead to an increase in the downward correction and the pair's return to the 1.2390 area. A real struggle should be unleashed for this level since in addition to the fact that moving averages pass there, this range is the middle of the intraday channel, the return of which will again shift the scales to the side of the sellers of the pound. Strong US data and a false breakout at 1.2450 will be an excellent setup for opening short positions with the expectation of a breakthrough and consolidation below 1.2390. The reverse test from the bottom up of this range forms an additional sell signal that can collapse the pound to 1.2339, where I recommend fixing the profits. A more distant target will be the 1.2280 area, the test of which will cast doubt on the further growth of the pair in the near future. But so far, there is no hope for the implementation of this scenario. With the option of GBP/USD growth and lack of activity at 1.2450, another upward jerk may occur against the background of the demolition of stop orders. In this case, I advise you to postpone short positions to the maximum of this week 1. 1.2493. I also advise selling there only in case of a false breakdown. It is possible to open short positions on GBP/USD immediately for a rebound from 1.2574, counting on the pair's rebound down by 30-35 points within a day.

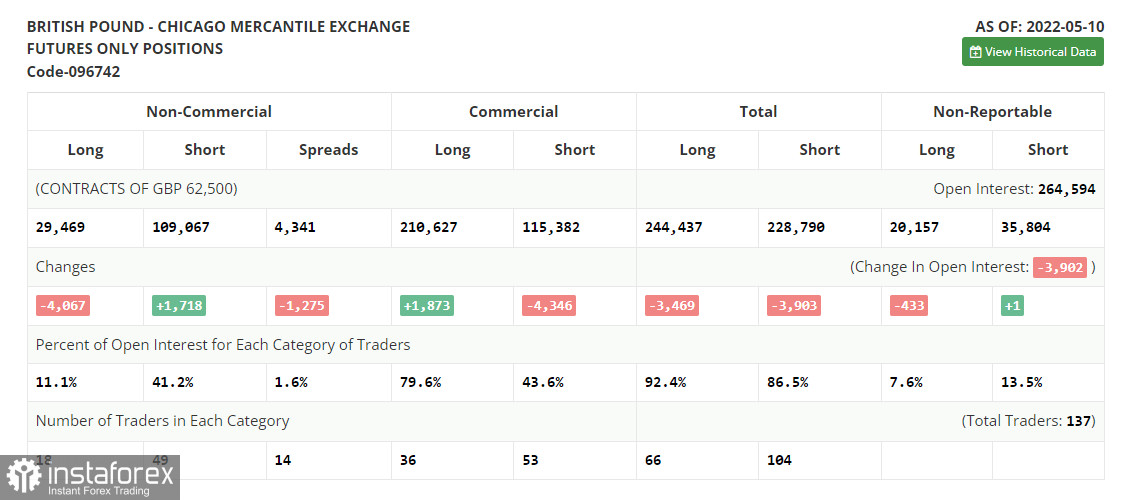

The COT report (Commitment of Traders) for May 10 recorded a reduction in long positions and another increase in short positions, which led to a further increase in the negative delta. The presence of several problems in the UK economy and a rather difficult situation with inflation is forcing investors to get rid of the British pound, which is very seriously losing its attractiveness against the background of demand for safe-haven assets and more profitable instruments. The monetary policy of the Federal Reserve System, aimed at tightening the cost of borrowing, will continue to support the US dollar, pushing the British pound lower and lower. The actions of the Bank of England to raise interest rates have not yet brought the proper result, and talk that due to serious economic difficulties, the regulator may suspend the normalization of monetary policy altogether frightens investors even more. As I have repeatedly noted, future inflation risks are now quite difficult to assess also due to the difficult geopolitical situation, but it is clear for sure that the consumer price index will continue to grow in the coming months. The situation in the UK labor market, where employers are forced to fight for every employee by offering higher and higher wages, is also pushing inflation higher and higher. The COT report for May 10 indicated that long non-commercial positions decreased by -4,067 to the level of 29,469, while short non-commercial positions increased by 1,718 to the level of 109,067. This led to an increase in the negative value of the non-commercial net position from the level of -73,813 to the level of -79,598. The weekly closing price decreased from 1.2490 to 1.2313.

- Moving average (moving average determines the current trend by smoothing out volatility and noise). Period 50. The graph is marked in yellow.

- Moving average (moving average determines the current trend by smoothing out volatility and noise). Period 30. The graph is marked in green.

- MACD indicator (Moving Average Convergence / Divergence - moving average convergence/divergence) Fast EMA period 12. Slow EMA period 26. SMA period 9

- Bollinger Bands (Bollinger Bands). Period 20

- Non-profit speculative traders, such as individual traders, hedge funds, and large institutions use the futures market for speculative purposes and to meet certain requirements.

- Long non-commercial positions represent the total long open position of non-commercial traders.

- Short non-commercial positions represent the total short open position of non-commercial traders.

- Total non-commercial net position is the difference between the short and long positions of non-commercial traders.