The euro's attempts to break above $1,053 are commendable, but so far unconvincing. The European Central Bank's desire to strengthen the regional currency with verbal interventions and hints at an increase in the deposit rate is not enough for the EURUSD pair to develop a more or less decent correction. However, never say never.

The hawkish rhetoric of the ECB representatives did not provide help to the euro, but by the fact that the EU is pulling the rubber with the 6th package of sanctions against Russia. It is obvious that in conditions when the European Union is 25% dependent on Russian oil, 40% on gas and 50% on coal, the imposition of an embargo means that Europe itself cuts the branch on which it sits. If there is a pause in this process, the EURUSD bulls use it as an excuse for a counterattack. At the same time, you need to understand that, no matter how successful it was at the start, the final result will still be in favor of their opponents.

Why? To begin with, let's remember that 10 increases in the federal funds rate will not surprise anyone. In 2022, the Federal Reserve is likely to bring it to 3%, while the ECB, at best, will raise the deposit rate to 0.25%. Yes, the futures market believes that it will be 0.5%, but investors, as usual, are reinsured. In fact, the eurozone in its current state does not need either an increase in debt servicing costs or a recession. In addition, the ECB has much less leverage over inflation than the Fed.

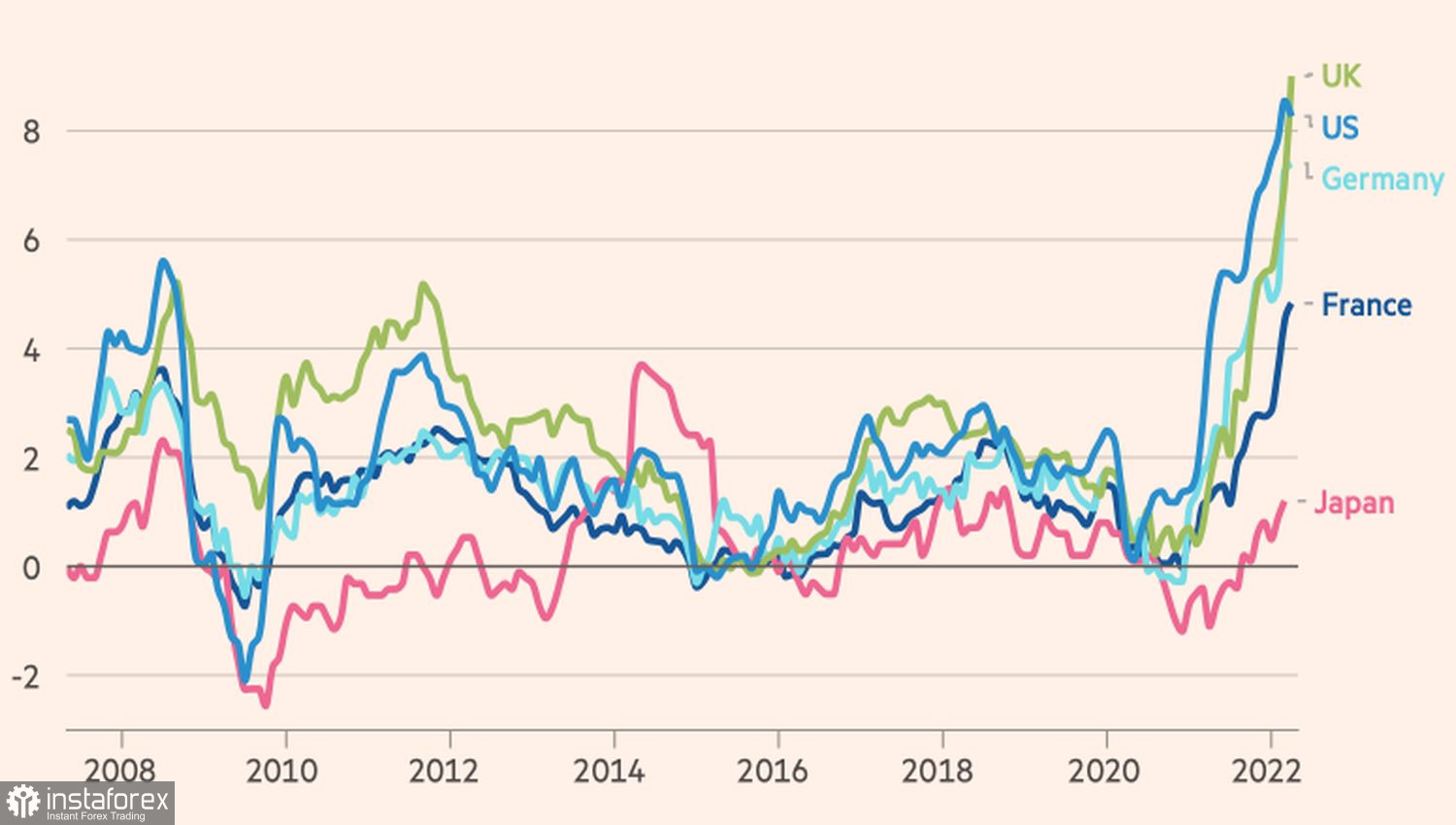

The 7.4% increase in consumer prices in the eurozone is less than in the US or Britain, where the figures climbed above 8% and 9%, respectively. At the same time, the nature of inflation in the eurozone is fundamentally different from America. If the energy crisis is the main driver of CPI's rise in Europe, then the United States has a very hot labor market. Great Britain faces both kinds of problems, so the Bank of England can only sympathize.

The dynamics of inflation in the leading countries of the world

The ECB is unable to put pressure on oil or gas prices, while the Fed has the opportunity to raise the unemployment rate with the help of tight monetary policy. ECB President Christine Lagarde and her colleagues should count on a miracle, while Fed Chairman Jerome Powell clearly has a plan. That is why financial markets trust the Fed more than the ECB, and continue to keep in mind the idea of the parity of the euro and the US dollar.

The collapse of the US stock market, which lost about $1.5 trillion of its value at the auction on May 18, and the lowering of Bloomberg forecasts for China's GDP from 3.6% to 2% in 2022 add fuel to the fire of the EURUSD peak. The problems of China are reflected in the entire global economy and, first of all, in such an export-oriented region as the eurozone.

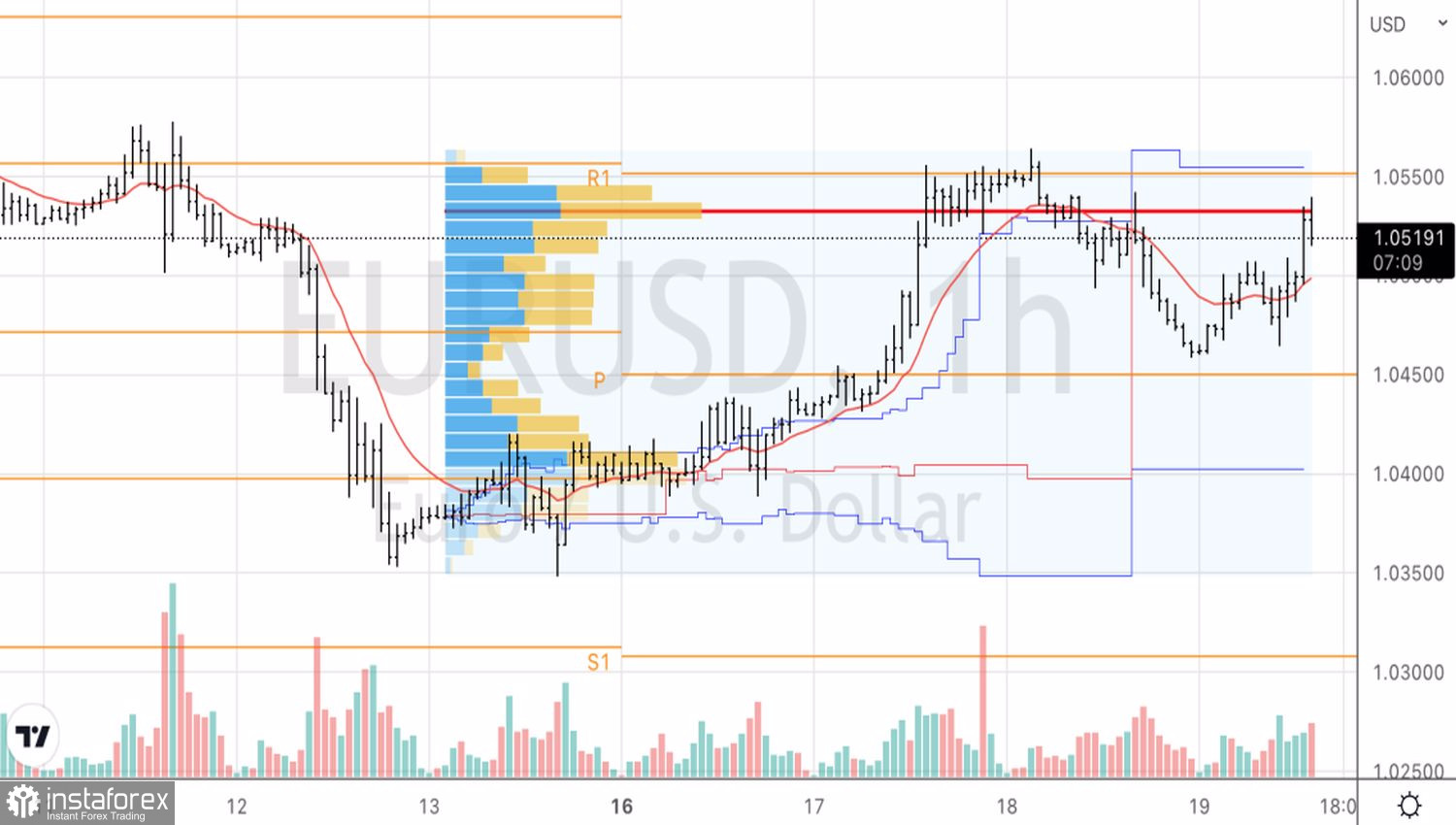

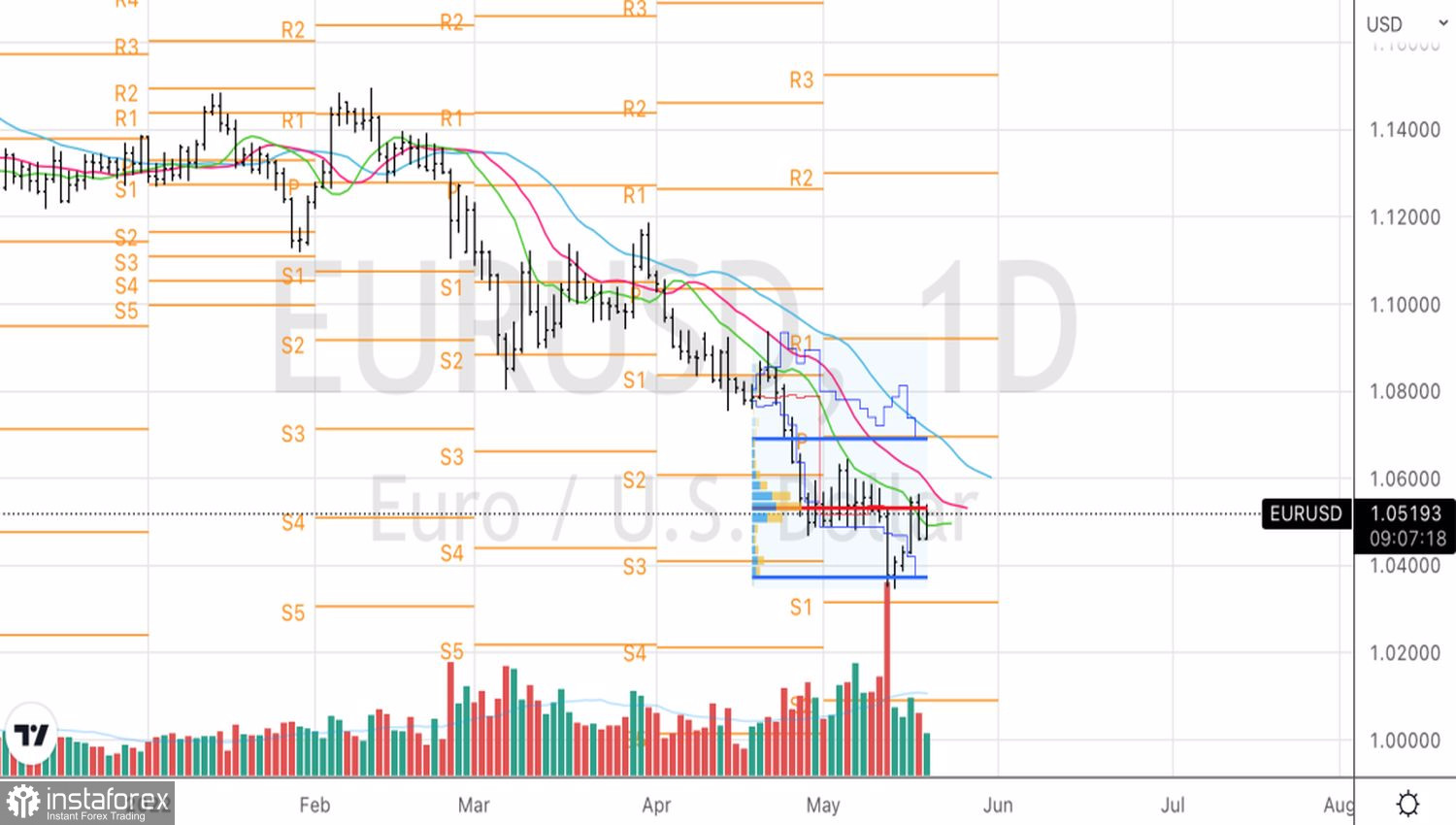

Technically, the struggle for fair value near 1.053 resumed on the daily and hourly charts. The short-term prospects of EURUSD will depend on who wins it. At the same time, short positions remain a priority in the medium-term investment horizon. Either in the case of the inability of the bulls to settle above 1.053, or on the rebound from the resistances at 1.061 and 1.066.

EURUSD, daily chart

EURUSD, hourly chart