It is vital for the bull to buy on the decline in order to make money on the rise. Given that the markets are "used" to being bullish, their strategies have usually been justified even in difficult Covid years. But will it be so this year? We are sorting it out.

Redemption of failures in 2022 – a dangerous game or an opportunity?

If we take standard strategies, buying failures always brings good profits. We can only congratulate those traders who bought the Nasdaq Composite at the lowest intraday level last Thursday on the 7.5% profit. Although it was really difficult to enter at the low and exit deals at the peak. And in general, "fishing for the bottom" is good for both short and long-term.

At the same time, there is such a moment: gradually, long positions on the fall form a stable environment of repeated bearish rallies, rocking asset volatility with large peaks.

If you look at the history of other major cyclical downturns, the conventional wisdom is that it's good to buy on dips. It seemed like a great strategy at one point, provided, of course, if you stock up on stocks for a long and long time ahead.

Look at the graph above. The red dotted line marks the levels where, according to all signs of technical analysis, the most interesting rallies should have begun, since the collapse of the 2000s. The same S&P 500 looks like it is going to grow significantly (September 2000, the trend is highlighted in orange).

But despite quite serious peaks, in fact, in nominal terms, the S&P did not show a profit until 2013, and the Nasdaq did not show a profit until 2014. Strictly speaking, it was a bearish trend, diligently kept from stalling at the peak by the Federal Reserve's monetary policy, and it lasted for 14 years, and therefore has a very blurred picture with sharp upward jerks.

Obviously, those who would like to trade on shorts or midrange during this period would have a much better chance of going broke – and it doesn't really matter if you play for bears or bulls. Short trades (I'm not talking about intraday ones, although there were enough dramatic situations there) in the two thousandth were a very high-risk business, and they cost a tidy sum to many.

Now look at the chart again. A bright green dotted line marks the moments when the chart fell to the bottom in 2000. It was at these moments that it was most profitable for a trader to enter the market with long positions. It is obvious that in the entire bearish cycle up to 2021, the indices did not manage to settle above this line for any length of time. And what seemed to be the bottom in 2000 turned out to be almost the top in 2008. So those who bought, it would seem, on the decline in 2008, soon found out for themselves that the true bottom can lie much deeper.

Of course, if you take money out of the markets, they still need other targets. And if you trade stocks, you will also lose your dividend income. But was there any income at all?

If we took the total return of stocks in relation to the bond index, for example, Lehman Aggregate, and in relation to gold, we would quickly find out that stocks, in general, have not recovered their estimated value in relation to the precious metal.

Only by 2015, the level of shares in gold reached the level of 2002-2003, that is, much later than the dot-com crash, but even in the bubble of the previous two, covid years, it did not reach the highs of the two thousandth.

It seems that the stock bubble has not inflated to its previous proportions – and this is wonderful. In fact, it has sulked, only now in the segments of SPAC, memes, cryptocurrencies and other technologies. Against their background, the NASDAQ and S&P 500 indexes are old men with a reinforced concrete reputation.

But what is much more important, buying the bottom on this entire segment would leave you on the nose – even if you made a profit in monetary terms.

Indeed, judging by this graph, if you had bought assets in 2002, you would have "shed" a lot of money – even in gold, even in currencies.

Of course, a huge role is played by the point from which we plot the graph. The bubble of the 2000s was one of the largest, and any other segment on the chart will turn out to be the bottom in comparison with it.

There is a significant BUT: for two years we have seen a clear growth of another bubble – bubble, since the economy has been developing extremely poorly all this time. Now the bubble is starting to deflate. And the charts above show us that a bearish trend is actually a long one.

If you analyze this chart further, you will notice an obvious truth: bonds are clearly losing in profitability to stocks in the historical cross-section. For most of the last 22 years, it has been much more profitable to buy stocks than any other reasonably liquid alternative. In the long run, stocks tend to win. It is extremely difficult to identify the points at which they will lag behind for a long time. This is a question of whether it is worth trading bonds. It is also reasonable to assume that stocks will continue to maintain their advantage over other asset classes. But still, buying on the fall or, as a plan B – accumulation of purchased assets in the hope that the markets will recoup – can let the trader down.

As a result, a bearish trend requires not so much profit maximization strategies, but first of all strategies to minimize serious risks – hedging and tracking charts "manually" will help the trader in this matter.

All the more reason to be careful with so-called undervalued assets, no matter where the temporary wind blows. Tech giant stocks are good in the long run or on the eve of good news. The rest of the time, with a bearish trend, they are subject to quite serious fluctuations.

Stagflation threatens us

Experienced economists are now very pessimistic.

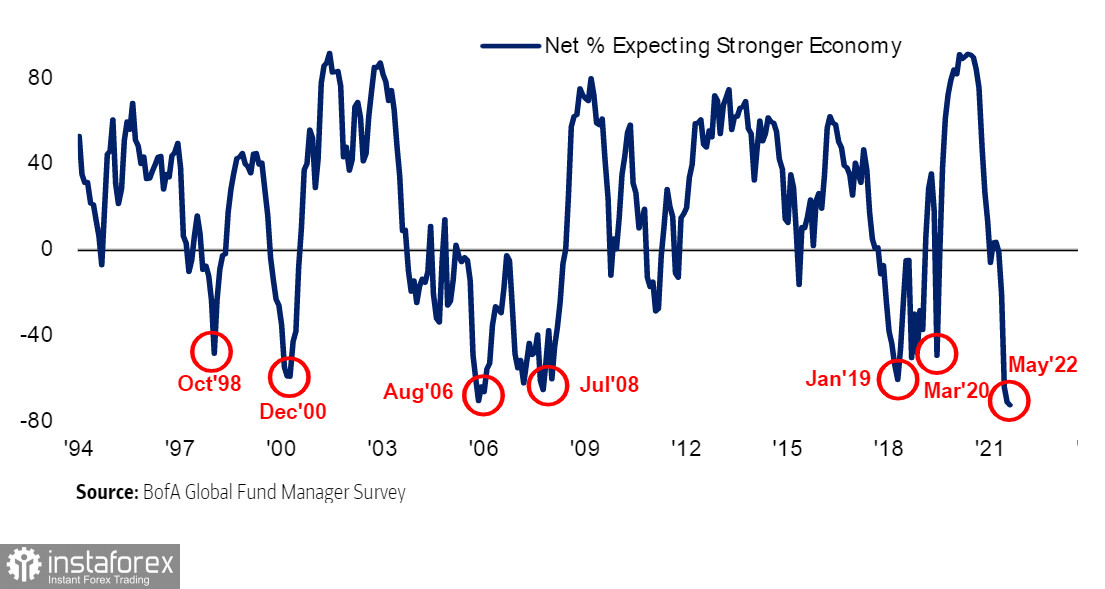

So, the latest survey of managers of large investment funds from Bank of America Corp showed that the mastodons and tyrannosaurs of the stock markets are very gloomy and clearly bearish, but we are not talking about capitulation yet.

Oddly enough, the saddest factor for them is the scourge of 2021 – excess cash. In fact, fund managers now have more money than ever since the terrorist attacks of September 11, 2001 - a period that includes both the global financial crisis and the Covid-19 pandemic.

The two-year cornucopia organized by the Fed in support of the economy has created such volumes of money that even five months after the start of policy tightening, hedge funds are not able to digest them.

This seems illogical, because right now assets offer the most interesting opportunities in terms of profitability and, in theory, should force their owners to trade more actively. Instead, players prefer to hold on to cash, which means they are generally negative.

The purely indicative signals of the market are mixed with concern about systemic financial risks, which worries current investors all the more because many of them found the crisis of 2008 – the largest in the history of the stock markets. Pessimism has already, in fact, overcome the bar of 2008 and has become the largest since the very introduction of the survey – since 1994.

At the same time, it should be noted that they were wrong about stagflation in 2008. But only due to the fact that the Fed changed its policy in time, softening interest rates.

In 2008, concerns about inflation caused by rising commodity prices and a historic spike in oil prices convinced investors (and some central bankers) that stagflation was ahead.

Instead, the Fed lowered interest rates, and not the entire industry collapsed, but only the financial system, marking the beginning of a decade of deflationary slow growth.

Many economists assume that this time it will happen again. If this is the case, many traders will have to return to their scenarios, it is worth focusing on a long bearish trend with temporary bursts of bullish impulses.

And I must say, fund managers are fully aware of this scenario, since they are much less convinced that rates will continue to rise.This is also reflected in the fact that they still have the lowest percentage of portfolios in stocks of technology companies in a decade, the main beneficiaries of the low rates of the last decade. And all of them are expected to fall in profitability.

Interestingly, since investors are not set up for either a soft landing or a recession, the market provides opportunities to make a lot of money if these scenarios are implemented. For example, your portfolio may include shorts on commodity assets, on energy resources and long positions on technology. In the European region, these can be short transactions on currencies, on shares of pharmaceutical companies and discretionary longs.

But the tail risks are the most dangerous this year. They are so dangerous that they were even mentioned by Fed Chairman Jerome Powell in the comments on the latest rate hike. Among these risks, 10% of the specific weight falls on the Ukrainian-Russian conflict, and only 1% – on the next outbreaks of coronavirus. However, neither the war nor the pandemic is over yet, and they can shake up the world economy several times until they deplete the reserves of resources.

Why, then, does BofA think that the bulls are not ready to give up yet? Fund managers still expect up to eight rate hikes from the Fed. If the bulls had capitulated, the markets would have abandoned this belief and hoped that rates would fall again, or at least remain at the same level. Opinions on this matter differed greatly, but the average forecast increased from last month from 7.4 increase in April to 7.9.

Fund managers are worried and pessimistic, but they are still not convinced of the inevitability of a recession. So far, the real capitulation of the markets to the bears has not come, which means that the bottom of the market is ahead.

Consumer demand is the cornerstone

The destruction of consumer demand may be a critical indicator of the future crisis, which will determine whether inflation and rates will continue to rise, or whether they will begin to decline before the end of the year.

The idea is that at some point inflation will rise so much that people will refuse to buy.

As prices gain momentum and buyers spend less, demand decreases, and prices fall after them.

This always leads to a general weakness of the economy, but not necessarily to the "stagflation" that is so feared.

Whether the destruction of demand actually happens will depend on a lot of decisions made by people around the world. It is not yet visible, but there are some developments that suggest that this is already happening locally.

Retail sales in the United States unexpectedly increased in April. This is strong evidence against the destruction of demand, at least until household cash and credit reserves are depleted.

Meanwhile, Walmart Inc. - the dominant retailer in many regions and perhaps more in touch with the American consumer than anyone else - showed the largest intra-session drop since the collapse of Black Monday in October 1987. And it's not about destroying demand, at least at the moment.

Thus, inflation is not eating up demand yet, but judging by Walmart, it is already eating away part of the companies' profits. This will undoubtedly affect the retail sector in the future. It also suggests that shareholders, followed by traders rather than consumers, may end up bearing the brunt of this spike in inflation.

Walmart was one of the very few companies whose stock price was higher at the low of the GFC market in March 2009 than at the peak in October 2007. half as much as the market as a whole), so this incident is an alarming reminder that stocks can suffer the most.

And this also gives us some reason to believe that the burden of risks of a decline in the value of stocks, and all assets, especially high-risk markets, will also be shared by the stock market. It is as if, by buying and holding bitcoin, you have assumed the risks associated with its value in the future.

This is one of the reasons why bear markets are more dangerous for traders than ever, because in past crises there were not so many high-risk instruments. On the other hand, investing was the lot of the middle and upper classes, and individual trading had not yet been born. The very structure of currency and exchange markets in general has changed, has become more speculative, mobile and dependent on the psychology of the masses and the current news background. Oddly enough, this is not only able to drown the markets faster, but also smooth out the entire bearish trend if the bulls turn out to be too fanatical. In any case, buying the bottom remains a risky strategy – especially in this volatile year.