EUR/USD

Higher timeframes

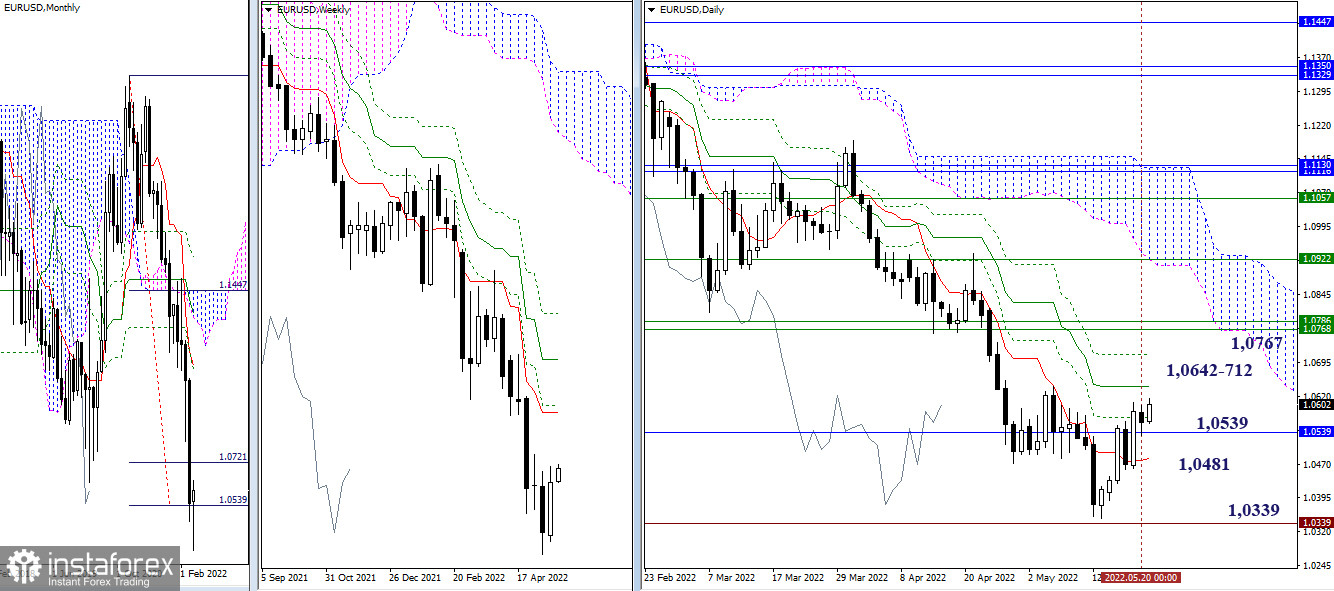

The euro completed the previous week with the construction of the Absorption pattern after developing a corrective rise. The weekly result inspires some optimism for bulls. Confirmation of intentions and the development of an upward correction may soon allow fixing the current sentiments on the monthly timeframe, where the monthly downward target for the breakdown of the Ichimoku cloud (1.0539) was worked out not so long ago. The immediate tasks in this direction are the elimination of the daily death cross (1.0642 – 1.0712) and the conquest of the weekly short-term trend (1.0767). The level of 1.0539 is now acting as a center of attraction, holding back the development of the situation. Support in the current conditions can be noted at 1.0481 (daily short-term trend) and 1.0339 (the minimum extremum of the past).

H4 - H1

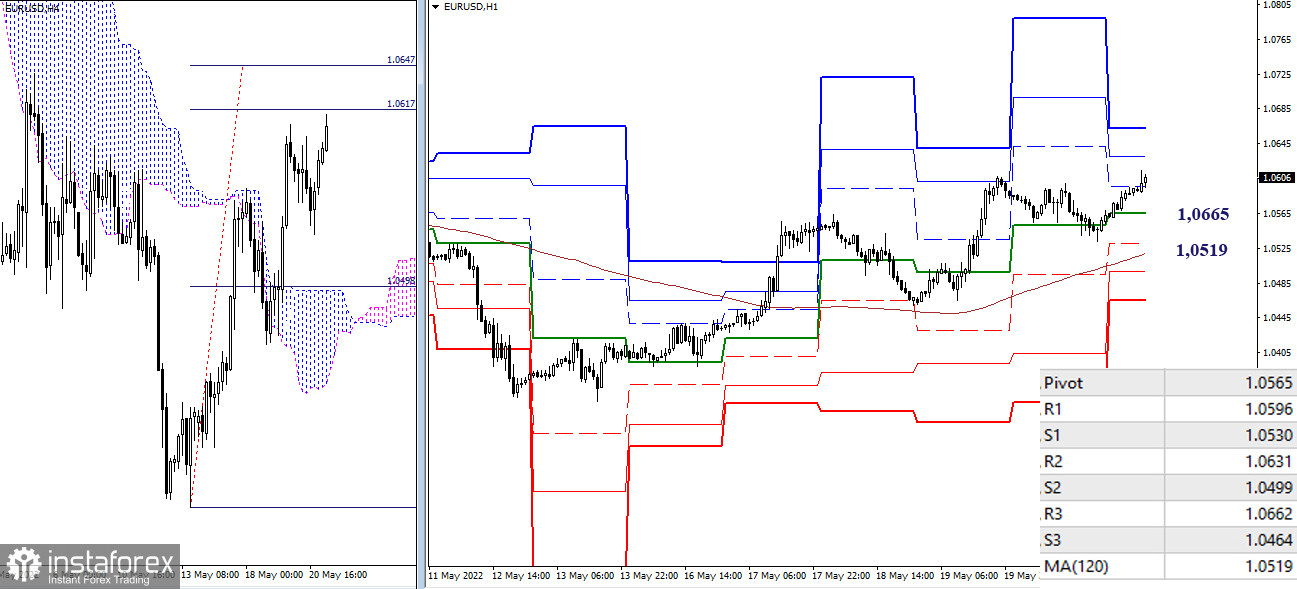

At the moment, the main advantage in the lower timeframes belongs to the bulls. Bullish targets can now be noted at the resistance levels of the classic pivot points (1.0631 – 1.0662) and the target for the breakdown of the H4 cloud (1.0617 – 1.0647). The key levels of the lower timeframes are playing the role of support today, located at 1.0665 (central pivot point) and 1.0519 (weekly long-term trend). Consolidation below and reversal of the moving average can change the current balance of power. At the same time, the relevance will return to the supports, and the support of the classic pivot points (1.0499 – 1.0464) will be added to the daily short-term trend (1.0481).

***

GBP/USD

Higher timeframes

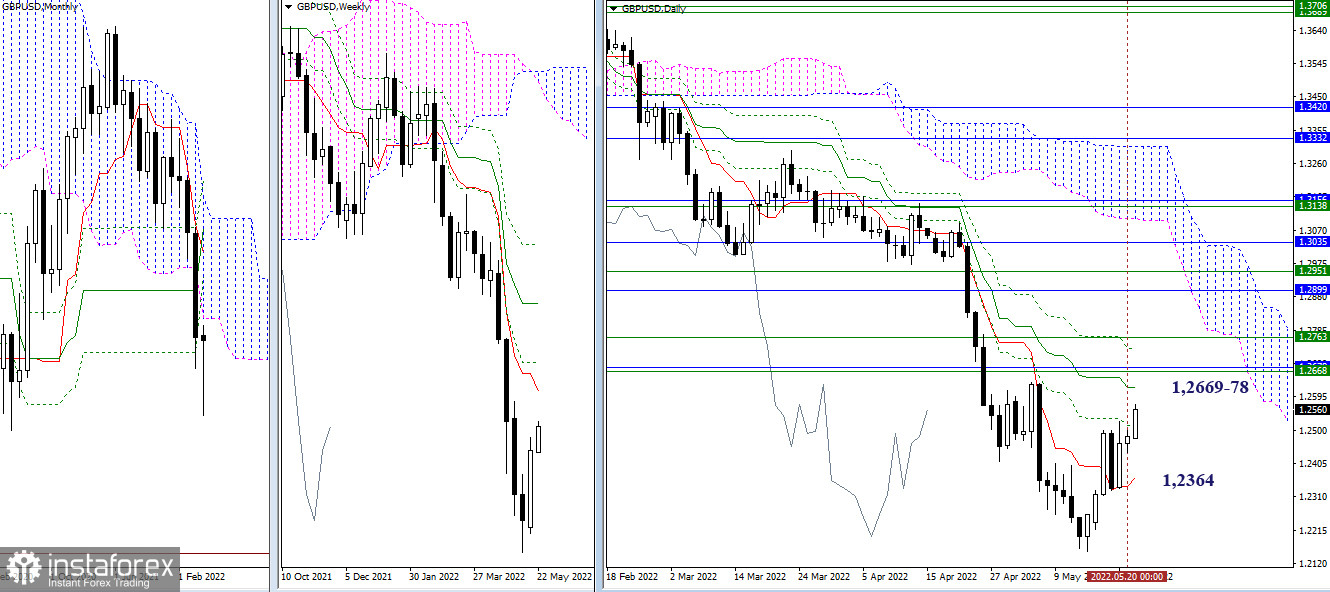

Last week's implementation of an upward correction, which managed to overcome the daily short-term trend, allowed bulls to enlist optimism. At the moment, bulls face a number of tasks at once, their execution will make it possible to build new plans and dream of new horizons. So, in order to maintain and strengthen their positions, bulls will soon need to eliminate the daily Ichimoku cross (1.2622 - 1.2733), seize the weekly short-term trend (1.2669), and return to the monthly cloud (1.2678). The passed daily short-term trend (1.2364) now serves as the immediate support.

H4 - H1

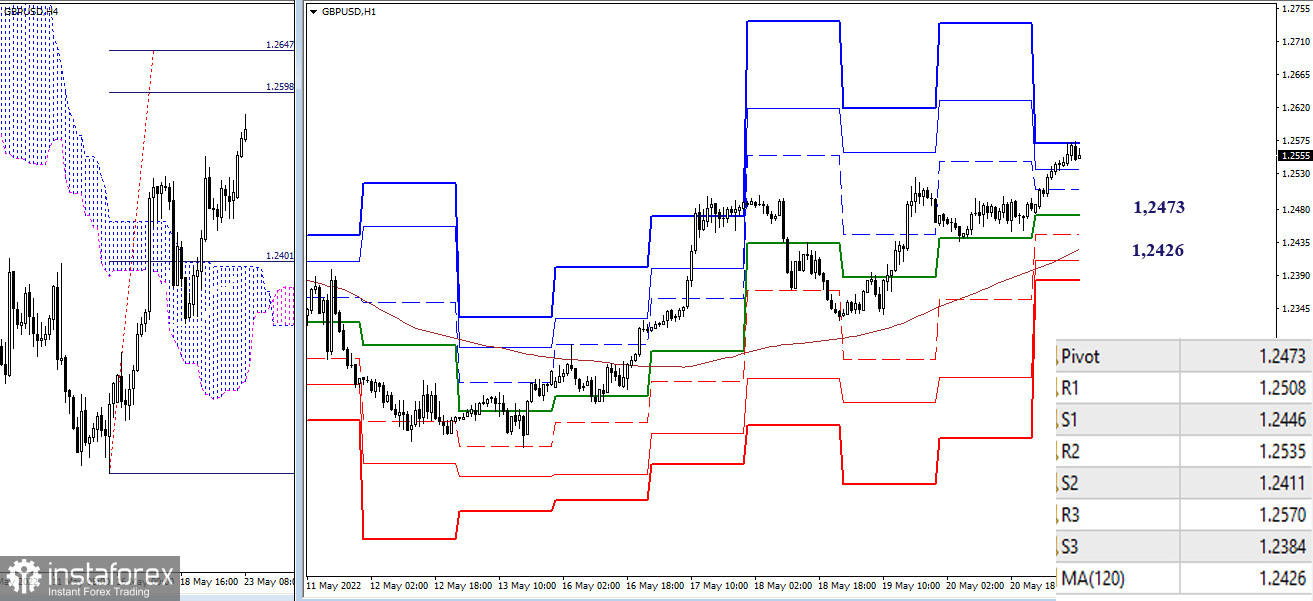

As of this writing, the final benchmark of the classic pivot points (1.2570) is being tested in the lower timeframes, then the interests of the bulls within the day will be directed towards the fulfillment of the upward target for the breakdown of the Ichimoku cloud at H4 (1.2597 – 1.2647). If there is a change in sentiment, then support today can be noted at the boundaries of 1.2535 – 1.2508 – 1.2473 – 1.2426 (classic pivot points + a weekly long-term trend). Consolidation below will change the current balance of power and will require a new assessment of the situation.

***

In the technical analysis of the situation, the following are used:

higher timeframes – Ichimoku Kinko Hyo (9.26.52) + Fibo Kijun levels

H1 - Pivot Points (classic) + Moving Average 120 (weekly long-term trend)