Although yesterday, the macroeconomic calendar was absolutely empty, the trading day turned out to be very impressive. Since the beginning of the day, the US dollar began falling amid the announcement made by Joe Biden. The US president said that the US military would intervene to defend Taiwan in any attack from China. Judging by the market reaction, traders consider such actions as absolutely negative. It seems that the US is planning to start a new war.

Closer to the end of the trading day, the US Fed struck a serious blow to the greenback. One of the regulator's representatives said that in September the Fed might take a pause in the key interest rate hike. It means that interest rates will be raised only two more times and what will happen then is still unclear. According to Jerome Powell's statements, the Fed will raise the benchmark rate at least by 0.75% to 1.75%. It is also possible that interest rates will be hiked by 1.00% to 2.00%. Notably, traders priced in the key interest rate of 2.50% or even 3.00% long ago. That is why such a revision may have a considerably negative influence on the US dollar.

In addition, Christine Lagarde said that the ECB might refuse negative interest rates in September. However, it is not clear what interest rate she was talking about – the refinancing rate or the deposit one. Even if she talked about the deposit rate, which is now at -0.50%, this was enough to trigger an uptrend in the euro. Thus, there is no wonder that the euro is more active than the pound sterling.

Now, the market is a bit stagnant. Investors are waiting for the publication of the PMI flash data that may also affect the market. In particular, the eurozone manufacturing PMI may decline to 55.0 points from 55.5 points. The services PMI may slide to 57.3 points from 57.7 points. As a result, the composite PMI may decrease to 55.0 points from 55.8 points. These reports may spur a drop in the euro.

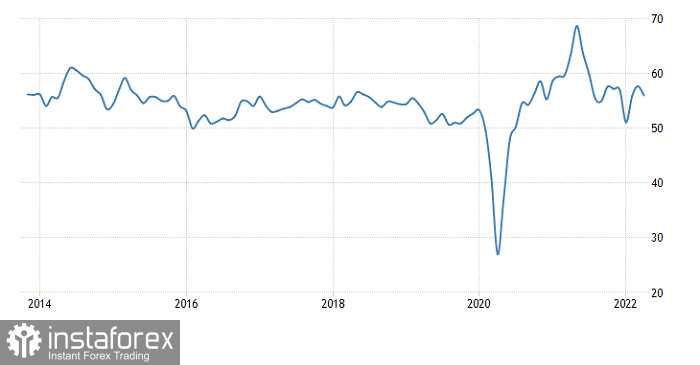

Eurozone Composite PMI

However, at the beginning of the US trade, the quotes may return to the levels recorded early today. The fact is that the US will also disclose its preliminary PMI estimates. Notably, forecasts are rather gloomy. The services PMI may drop to 55.0 points from 55.6 points. There is no wonder that the composite PMI will decline to 55.5 points from 56.0 points.

US Composite PMI

The euro/dollar pair broke the resistance level of 1.0636, thus prolonging the upward correction from the local low of 1.0349 recorded in 2016.

On the four-hour chart, the RSI technical indicator is in the overbought area, thus pointing to overheating of long positions. On the daily chart, the indicator downwardly crossed the mid 50 line, thus signaling the continuation of the correctional process.

On the four-hour chart, the Alligator's moving averages are heading upward, thus reflecting the correctional movement. On the daily chart, red and green moving averages are intersecting each other, signaling a slowdown in the downtrend.

OutlookUnder the current conditions, overheating of long positions may cause a drop, but the bullish sentiment will still remain in force. A new surge in long positions will take place if the price consolidates above 1.0700.

The alternative scenario will become possible if the price returns to 1.0600 on the four-hour chart. In this case, we may see a signal of the end of the correctional movement.

In terms of the complex indicator analysis, we see that technical indicators are signaling buy opportunities on the short-term and intraday periods amid the correction. On the mid-term period, the indicator is providing sell signals since the downtrend is still in force.