When to go long on EUR/USD:

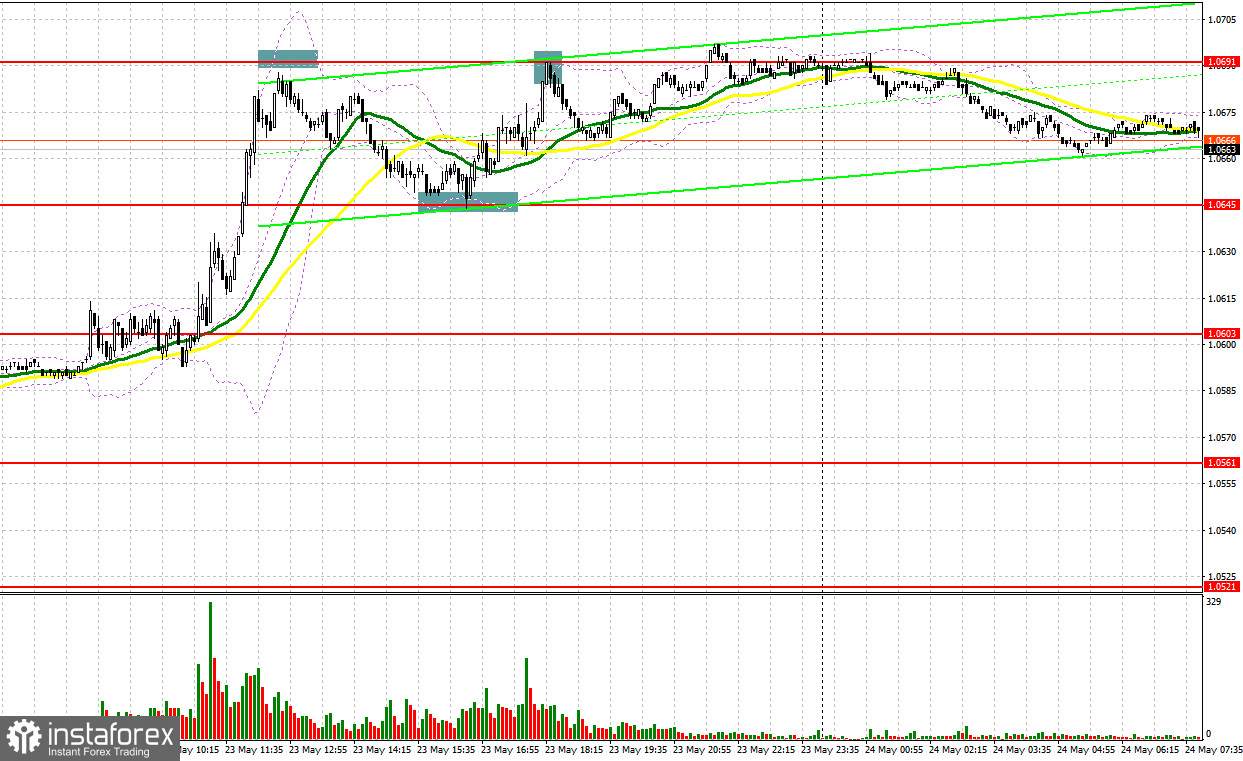

Yesterday, several market entry signals were formed. I suggest you take a look at the 5-minute chart and figure out what happened. I paid attention to the level of 1.0602 in my morning forecast, and advised you to make a decision on entering the market from it. This range was surpassed, however, it was impossible to say unequivocally that the bulls managed to settle higher, it was impossible - constant trading around 1.0602 did not generate a clear signal to buy the euro. For this reason, I missed the morning push towards the 1.0691 high. There were also no short positions from this level for a rebound, since just a few points were missing before the test. The situation was much more interesting and fun in the afternoon. The decline and false breakout at 1.0645 is a signal for long positions, after which the pair rose by more than 40 points and reached 1.0691. Failure to settle above this range in the middle of the US session and a signal for short positions. As a result, a decline by 20 points.

COT report:

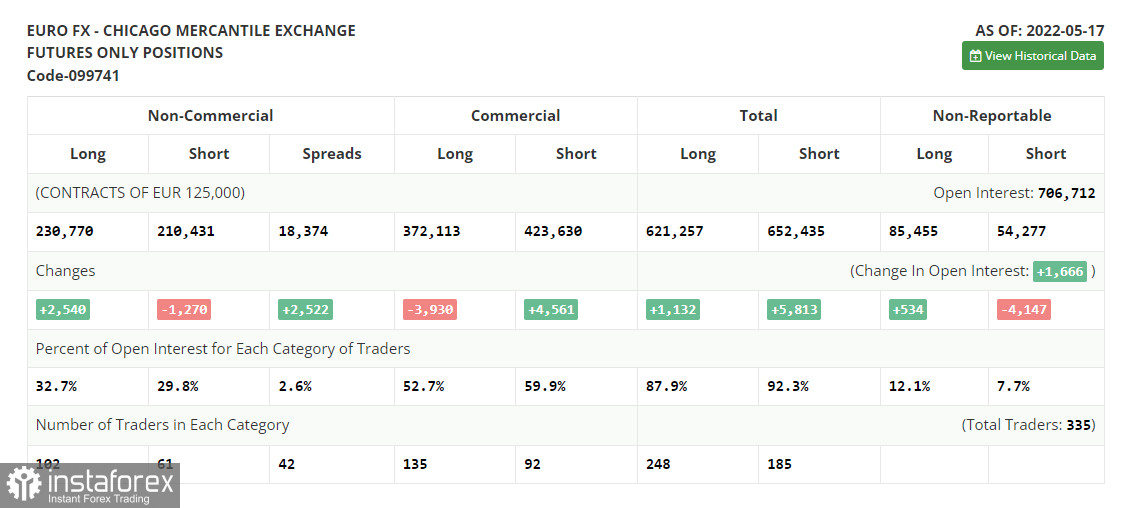

Before talking about the further prospects of the EUR/USD movement, let's look at what happened in the futures market and how the positions of the Commitment of Traders have changed. The Commitment of Traders (COT) report for May 17 showed that long positions have further increased while short positions decreased. Traders continue to buy on the bottom, relying on new evidence and statements from representatives of the European Central Bank, which is serious about starting to raise interest rates in the near future. Representatives of various central banks of the eurozone have repeatedly spoken about this last week.

The ECB Governing Council is now expected to raise its deposit rate by a quarter point as early as July this year, then in September and once in December, bringing it to 0.25% by the end of the year. However, even this plan causes a number of criticisms from European politicians who demand more active actions from the ECB aimed at combating high inflation in the eurozone. The key interest rate is expected to be raised in September and December to 0.5% from its current zero level. The euro's potential for growth may also be fueled by rumors that the Federal Reserve may slow down in September with a further increase in interest rates after aggressive policy changes in the spring-summer period.

The COT report shows that long non-commercial positions increased by 2,540 from 228,230 to 230,770, while short non-commercial positions decreased by -1,270 from 211,701 to 210,431. The euro makes it more attractive for traders, and the change in the balance of power in favor of the bulls confirms this. As a result of the week, the total non-commercial net position increased and amounted to 20,339 against 16,529 a week earlier. The weekly closing price almost also slightly increased and amounted to 1.0556 against 1.0546.

Euro bulls continue to reach for new weekly highs, coming close to the next resistance of 1.0691, above which it was not possible to break through yesterday. A large set of reports on the euro area will be released today, which will reveal economic activity and allow economists to draw the necessary conclusions about future growth rates. From a technical point of view, a lot will depend on whether the bulls show themselves around 1.0691 or not. Only very strong data on the index of business activity in the manufacturing sector, the index of business activity in the services sector and the eurozone composite PMI index will enable bulls to make another attempt to rise above the resistance of 1.0691. But it will be quite difficult to do this, since the emerging divergence on the MACD indicator will certainly limit the short-term upward potential of the pair. Only a breakthrough and reverse test from top to bottom of this level and additional strong eurozone statistics will lead to the first signal to buy the euro while aiming to rise to a new major resistance at 1.0736, where I recommend taking profits.

Going beyond 1.0736 will hit the bears' stop orders, allowing the upward trend to continue with the prospect of new highs: 1.0775 and 1.0811. However, such growth will only be possible if we receive a disappointing report on US activity in the afternoon. In case the pair falls, the bulls' primary task is to protect the level of 1.0645, just below which there are moving averages, playing on the bulls' side. A fall can occur at any moment, since all of yesterday's growth, which is not based on anything, can be blocked very quickly. The negative reaction to the data on the euro area will quickly bring down the euro to 1.0645. Therefore, only a false breakout at this level, by analogy with what I analyzed above, will provide a signal for long positions on the euro. If the pair falls and there are no bulls at 1.0645, then it would be best to postpone longs. The optimal scenario for opening long positions would be a false breakout of the low around 1.0603, but you can buy EUR/USD immediately for a rebound only from 1.0561, or even lower - around 1.0521, counting on an upward correction of 30-35 points within the day.

When to go short on EUR/USD:

Yesterday the bears failed and now they will have to make a lot of efforts to protect the nearest resistance at 1.0691, which euro bulls have set their sights on. As long as trading is below this range, the probability of EUR/USD decline will remain, but it is unlikely that the bears will begin to take active steps before the release of statistics. Weak eurozone data will push EUR/USD back to 1.0645, beyond which more active confrontation will unfold. A breakdown and reverse test of this range from the bottom up will provide a signal for a breakthrough, but even this will not lead to a reversal of the upward trend observed since May 13th. The nearest target will be support at 1.0603, where I recommend taking profits. Consolidating below this range and a similar update from the bottom up is a signal for further short positions with the goal of hitting 1.0561.

A more distant target will be the area of 1.0521, the test of which will jeopardize the entire bullish trend. In case of euro growth, only a false breakout at 1.0691 and divergence on the MACD indicator can form a signal to sell the euro. If the bears are not active at 1.0691, the bulls will try to add long positions to the 1.0736 area. Much of today will depend on the statements and ECB President Christine Lagarde, who is expected to speak in the afternoon. The optimal scenario would be short positions when a false breakout forms from 1.0736. You can sell EUR/USD immediately on a rebound from 1.0775, or even higher - in the area of 1.0811, counting on a downward correction of 25-30 points.

I recommend to read:

Indicator signals:

Moving averages

Trading is above 30 and 50 moving averages, which indicates a continuation of the upward trend.

Note: The period and prices of moving averages are considered by the author on the H1 hourly chart and differs from the general definition of the classic daily moving averages on the daily D1 chart.

Bollinger Bands

A breakthrough of the lower border of the indicator in the area of 1.0645 will lead to a fall in the euro. Surpassing the upper border of the indicator in the area of 1.0691 will lead to the euro's growth.

Description of indicators

- Moving average (moving average, determines the current trend by smoothing out volatility and noise). Period 50. It is marked in yellow on the chart.

- Moving average (moving average, determines the current trend by smoothing out volatility and noise). Period 30. It is marked in green on the chart.

- MACD indicator (Moving Average Convergence/Divergence — convergence/divergence of moving averages) Quick EMA period 12. Slow EMA period to 26. SMA period 9

- Bollinger Bands (Bollinger Bands). Period 20

- Non-commercial speculative traders, such as individual traders, hedge funds, and large institutions that use the futures market for speculative purposes and meet certain requirements.

- Long non-commercial positions represent the total long open position of non-commercial traders.

- Short non-commercial positions represent the total short open position of non-commercial traders.

- Total non-commercial net position is the difference between short and long positions of non-commercial traders.