Analysis of Tuesday's deals:

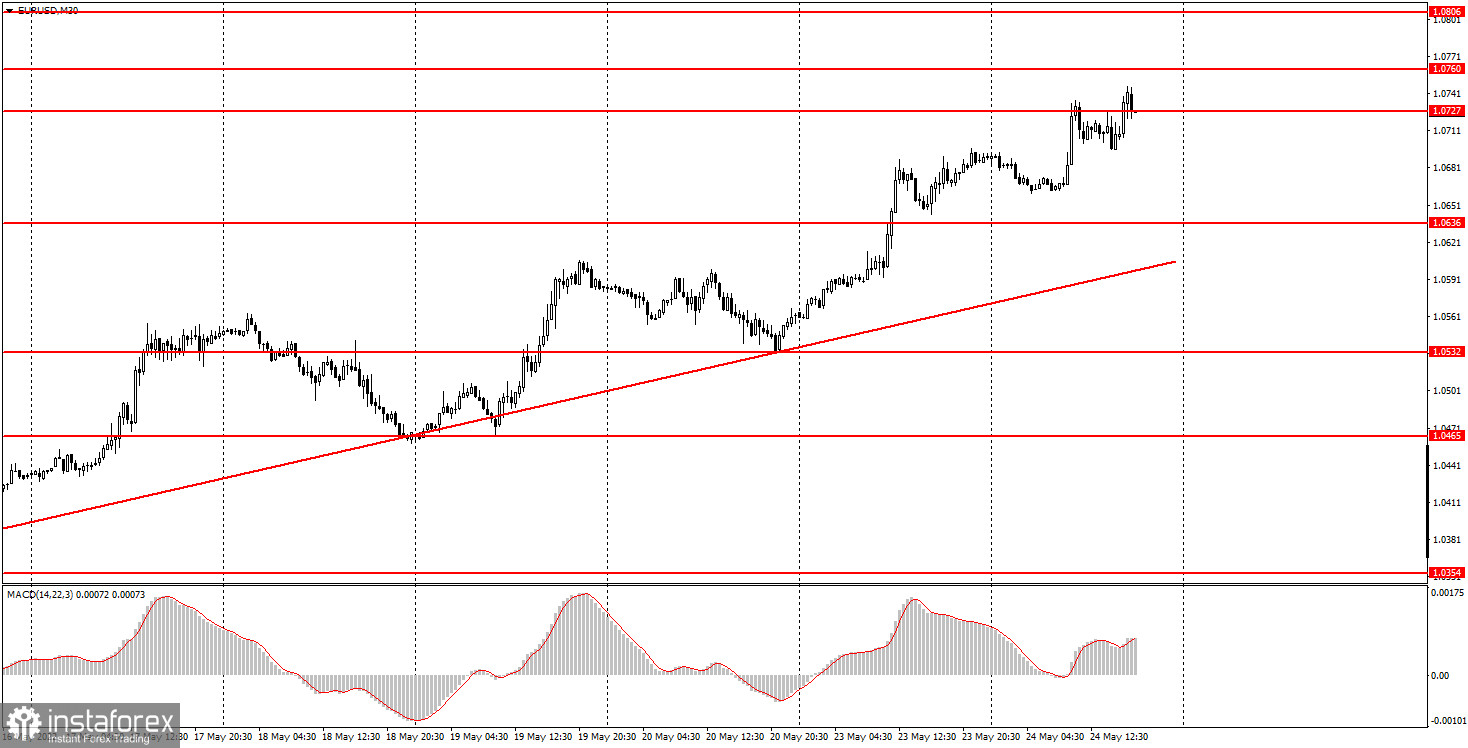

30M chart of the EUR/USD pair

The EUR/USD currency pair continued its upward movement on Tuesday. The pair showed a sharp upward acceleration even at the European trading session, which occurred 2.5 hours before the release of the first reports of the day. Recall that business activity indices in various areas of the European Union were set to be published in the morning. Since these indices turned out to be weaker than forecasts, they could not provoke the euro's growth in any way. Consequently, the market ignored them, as we expected yesterday. To be fair, it should be noted that the deviations of the predicted values from the actual ones were minimal. Nevertheless, the euro has found grounds for growth, which is fully consistent with the technical picture, which is now expressed by an ascending trend line. Consequently, the market is not looking for any reasons to buy the euro for the second consecutive day. It should also be noted that European Central Bank President Christine Lagarde made a speech on Monday, saying that rates could be raised twice in 2022. Given that the ECB rate is currently negative, we cannot call these statements hawkish or "dramatically changing the picture." Consequently, the euro continues to rise on pure technique.

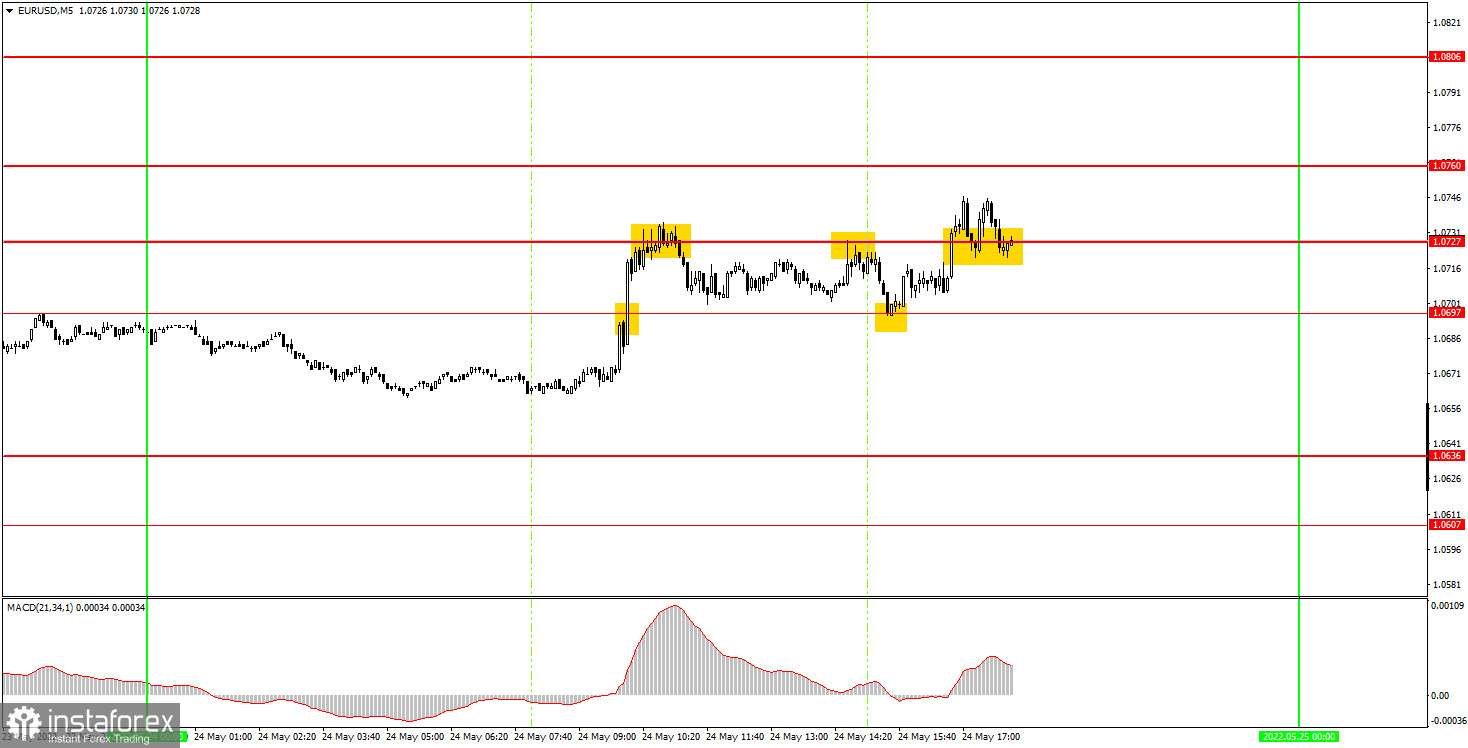

5M chart of the GBP/USD pair

The technical picture on the 5-minute timeframe does not look too good today. By and large, there was only one surge of emotions in the market during the day, and the rest of the time there was almost a flat movement. The pair forcedly marched up to the level of 1.0727 at the beginning of the European trading session, but it was not possible to work out a buy signal near the level of 1.0697, since the price immediately appeared at the target level. This was followed by a rebound from the level of 1.0727, which could have been worked out, but it was not possible to count on high profits, since the level of 1.0697 was very close from below, which eventually kept the pair from falling further. Profit on a short position amounted to a maximum of 10 points. The rebound from the level of 1.0697 could also be worked out, and the price even overcame the level of 1.0727, but could not continue the upward movement, so the deal had to be closed manually in the late afternoon. Profit on it amounted to about 15-20 points. Therefore, it was difficult to get the profit today, but again, a small profit is better than any loss. Moreover, Tuesday's volatility was not the highest, and the movements were not the most trendy.

How to trade on Wednesday:

The ascending trendline continues to be relevant on the 30-minute timeframe. Thus, the euro can still count on growth, which, from our point of view, is purely technical. Nevertheless, it is also quite logical, given how long the euro has been falling. On the 5-minute TF, it is recommended to trade at the levels of 1.0607, 1.0636, 1.0697, 1.0727, 1.0760, 1.0806. When passing 15 points in the right direction, you should set Stop Loss to breakeven. ECB President Christine Lagarde is expected to speak in the European Union, and she delivers a speech almost every day this week. Then there will be data on orders for durable goods in America, but we do not expect a strong market reaction from this report. The Federal Reserve minutes is scheduled for the late evening - the economic report of the federal banks, but it usually very rarely provokes the market to strong movements.

Basic rules of the trading system:

1) The signal strength is calculated by the time it took to form the signal (bounce or overcome the level). The less time it took, the stronger the signal.

2) If two or more deals were opened near a certain level based on false signals (which did not trigger Take Profit or the nearest target level), then all subsequent signals from this level should be ignored.

3) In a flat, any pair can form a lot of false signals or not form them at all. But in any case, at the first signs of a flat, it is better to stop trading.

4) Trade deals are opened in the time period between the beginning of the European session and until the middle of the American one, when all deals must be closed manually.

5) On the 30-minute TF, using signals from the MACD indicator, you can trade only if there is good volatility and a trend, which is confirmed by a trend line or a trend channel.

6) If two levels are located too close to each other (from 5 to 15 points), then they should be considered as an area of support or resistance.

On the chart:

Support and Resistance Levels are the Levels that serve as targets when buying or selling the pair. You can place Take Profit near these levels.

Red lines are the channels or trend lines that display the current trend and show in which direction it is better to trade now.

The MACD indicator (14,22,3) consists of a histogram and a signal line. When they cross, this is a signal to enter the market. It is recommended to use this indicator in combination with trend lines (channels and trend lines).

Important speeches and reports (always contained in the news calendar) can greatly influence the movement of a currency pair. Therefore, during their exit, it is recommended to trade as carefully as possible or exit the market in order to avoid a sharp price reversal against the previous movement.

Beginners on Forex should remember that not every single trade has to be profitable. The development of a clear strategy and money management are the key to success in trading over a long period of time.