Analysis of Tuesday's deals:

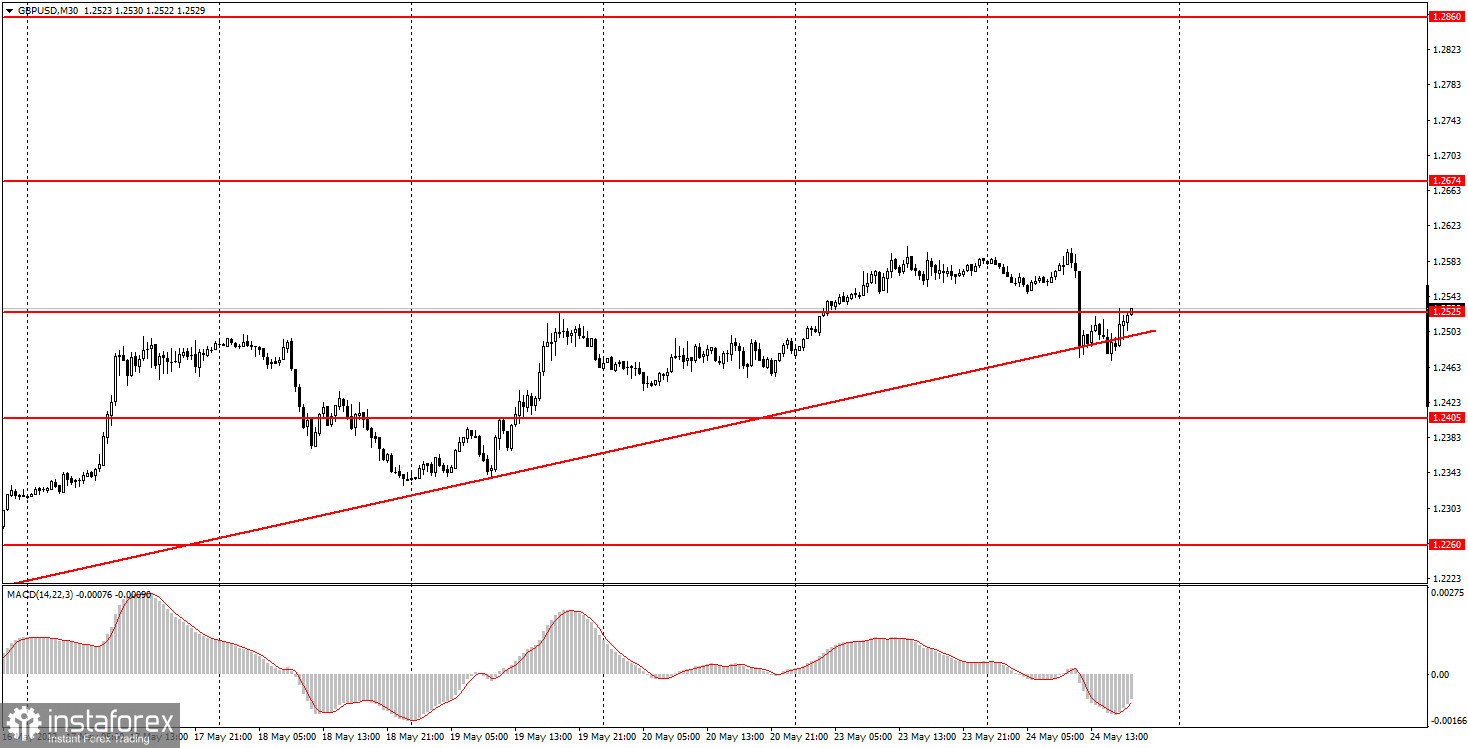

30M chart of the GBP/USD pair

The GBP/USD pair corrected to the ascending trend line today, but could not confidently overcome it. Thus, the British pound is now on the verge of completing a short-term upward trend and starting to fall again. We believe that the growth shown in the last two weeks is purely technical. Therefore, it will end when traders consider that they have corrected the pair sufficiently. It is good that now there is a trend line that helps to track the trend. Also note that the UK just published indexes of business activity in the services and manufacturing sectors. We are not very interested in the production report, but business activity in the service sector decreased from 58.9 to 51.5. This is a very serious drop, and experts' forecasts were much higher. Therefore, the market could react by selling the pound to this report. The time when the pound started to sharply fall coincides with the time when the report was released. Therefore, everything is logical here. PMIs in the services and manufacturing sectors of the US also declined, but fell slightly, so the market almost did not react to such data. Federal Reserve Chairman Jerome Powell and European Central Bank President Christine Lagarde's speeches will take place tonight (actually already tomorrow) at night, which can provoke a reaction in tomorrow's European trading session.

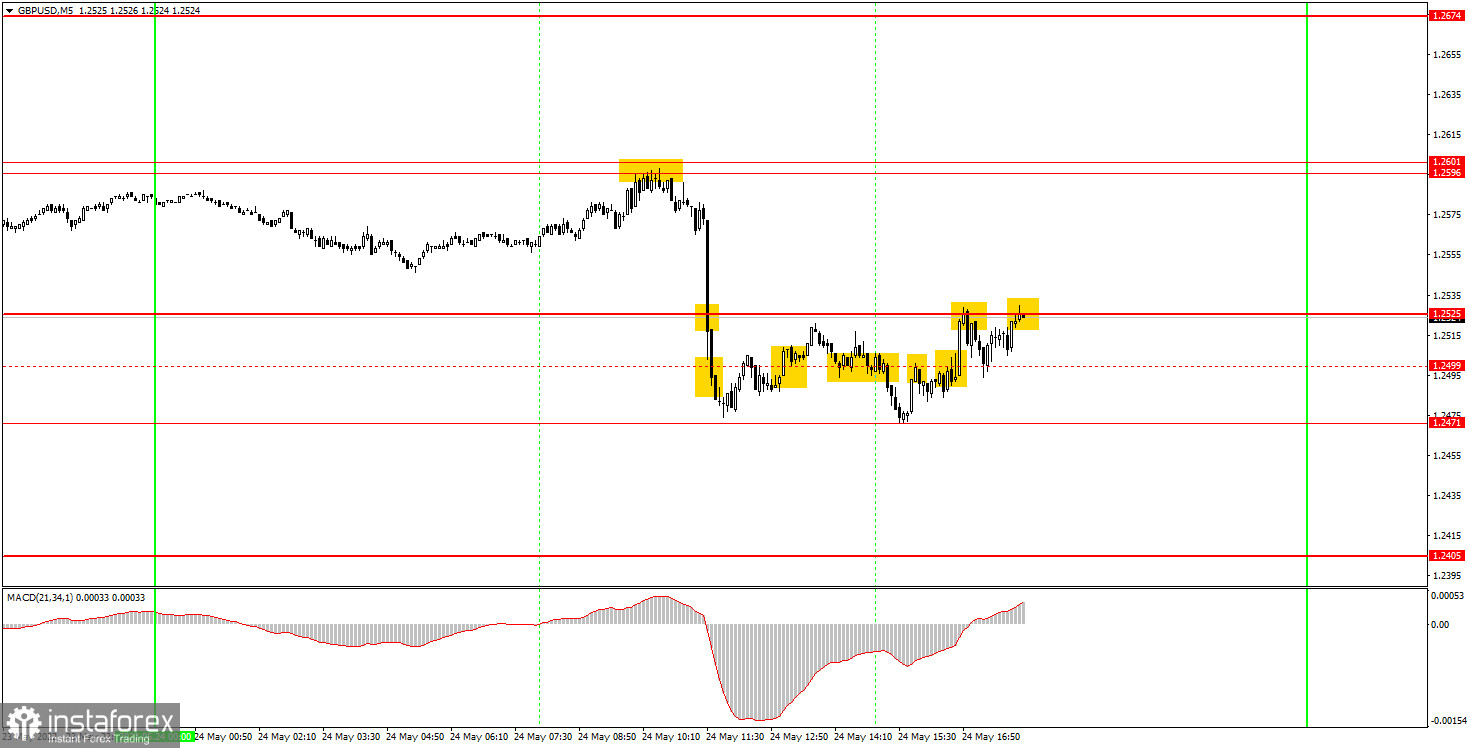

5M chart of the GBP/USD pair

The movement was very strange on the 5-minute timeframe. Firstly, it did not coincide with the movement of the euro/dollar pair, which was strange to see. But here everything is explained by weak statistics from Britain. Secondly, the market showed one spurt down and after that it moved the pair almost in a flat. However, in terms of trading signals, everything is pretty good. Let's figure it out. The first sell signal was almost perfect in terms of accuracy. The pair bounced off the 1.2596-1.2601 area and rushed down even before the release of the UK reports. Therefore, novice traders definitely managed to open short positions. The pair subsequently fell below the 1.2525 and 1.2499 levels. A short position should have been closed when the price settled above the level of 1.2499, which was removed from the charts at the end of the day. But it was not necessary to open a long position on the same signal, since the level of 1.2525 is very close to the top. As a result, it was possible to work out only one more signal for shorts, when the price again settled below the level of 1.2499, but it was already false - the pound could not continue moving down. It also failed to go down 20 points, so Stop Loss could not be placed. As a result, this deal turned out to be unprofitable. A profit of about 75 points was received on the first transaction, and a loss of 30 points on the second.

How to trade on Wednesday:

The upward trend is still preserved on the 30-minute timeframe, but the trend line may not withstand the onslaught from above. If it is overcome, the pair will rush to the level of 1.2405. However, at the moment we can say that the pound maintains an upward mood. On the 5-minute TF, it is recommended to trade at the levels of 1.2405, 1.2471, 1.2525, 1.2596-1.2601, 1.2674-1.2697. When the price passes after opening a deal in the right direction for 20 points, Stop Loss should be set to breakeven. There are no major reports or events scheduled for tomorrow in the UK. On the other hand, Powell will speak in the morning in America, the Durable Goods Orders report will be released during the day, and the Fed's Minutes report will be released in the evening. We believe that the most important event of the day will be Powell's speech.

Basic rules of the trading system:

1) The signal strength is calculated by the time it took to form the signal (bounce or overcome the level). The less time it took, the stronger the signal.

2) If two or more deals were opened near a certain level based on false signals (which did not trigger Take Profit or the nearest target level), then all subsequent signals from this level should be ignored.

3) In a flat, any pair can form a lot of false signals or not form them at all. But in any case, at the first signs of a flat, it is better to stop trading.

4) Trade deals are opened in the time period between the beginning of the European session and until the middle of the American one, when all deals must be closed manually.

5) On the 30-minute TF, using signals from the MACD indicator, you can trade only if there is good volatility and a trend, which is confirmed by a trend line or a trend channel.

6) If two levels are located too close to each other (from 5 to 15 points), then they should be considered as an area of support or resistance.

On the chart:

Support and Resistance Levels are the Levels that serve as targets when buying or selling the pair. You can place Take Profit near these levels.

Red lines are the channels or trend lines that display the current trend and show in which direction it is better to trade now.

The MACD indicator (14,22,3) consists of a histogram and a signal line. When they cross, this is a signal to enter the market. It is recommended to use this indicator in combination with trend lines (channels and trend lines).

Important speeches and reports (always contained in the news calendar) can greatly influence the movement of a currency pair. Therefore, during their exit, it is recommended to trade as carefully as possible or exit the market in order to avoid a sharp price reversal against the previous movement.

Beginners on Forex should remember that not every single trade has to be profitable. The development of a clear strategy and money management are the key to success in trading over a long period of time.