New home sales in the United States sank 16.6%. An increase in mortgage rates caused a sharp drop in demand. Recession risks mount as the Fed interest rate rises. The Richmond Fed Manufacturing Index came in at -9 instead of the forecast reading of 10. Atlanta FED President Raphael Bostic suggested that the central bank would raise rates by 50 basis points in June and July and then pause interest-rate increases in September.

A rapid fall in macroeconomic indicators signals that the US economy is weaker than expected since even a modest rate increase slows economic growth. Data on durable goods orders for April will be published today. If figures come worse than expected, the dollar may sink even deeper.

USD/CAD

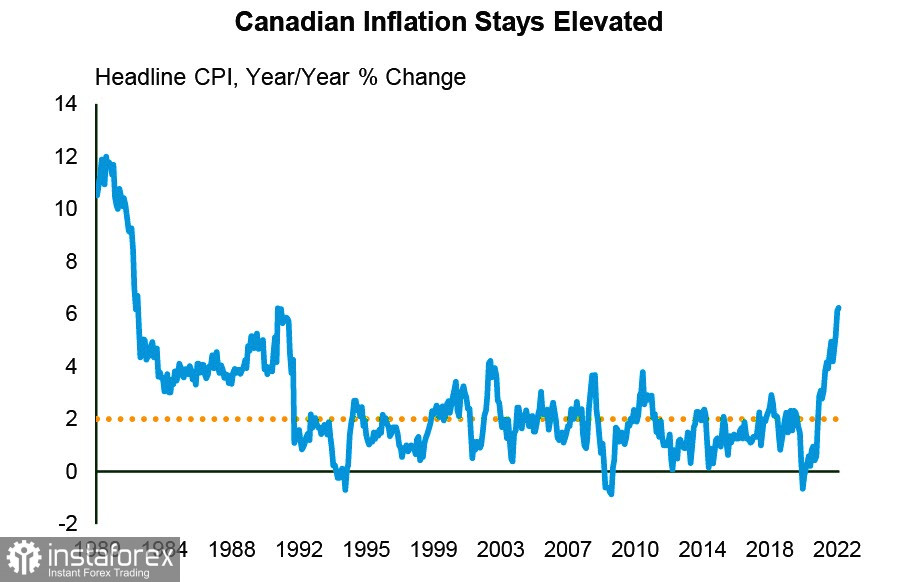

Canada's annual inflation rate quickened to 6.8% in April. Food prices hit the 40-year high of 9.7%, and shelter costs grew by 7.4%. Rising prices for goods and services exert pressure on inflation.

There are no signs of a slowdown in inflation. Prices are rising faster than the Bank of Canada anticipated. This means the regulator could hike rates more aggressively in the future. The interest rate is expected to be raised by 50 basis points at the meeting on June 1. Similar increases are also likely in July and September. So, the overnight rate would come in at 3%, the upper limit of the neutral rate. If the inflation hike continues, the Bank of Canada would have to consider going above the neutral rate.

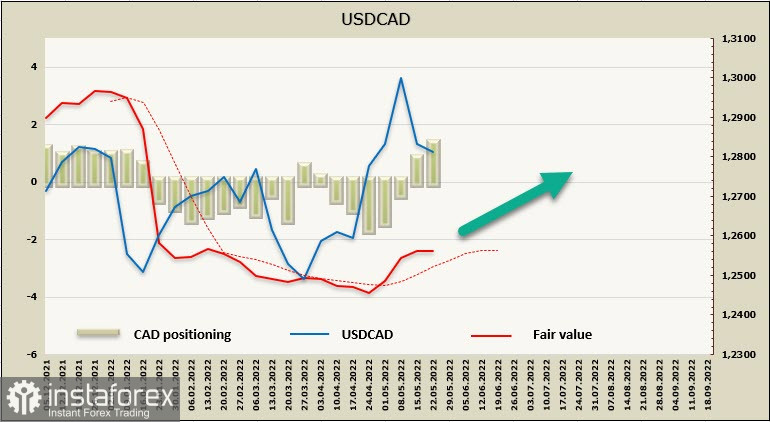

The loonie edged down versus the dollar. The net long position rose. The price is still above the long-term moving average, which indicates the continuation of the bullish move of USD/CAD.

USD/CAD trades at its weekly levels. Despite the weaker dollar, the corrective move does not get any deeper. At any moment, the loonie might go to the upper limit of the channel, with targets at 1.3240 and 1.3335.

USD/JPY

Inflation in Japan accelerated unexpectedly, with the core CPI up by 2.1% y/y. This indicates that in spite of years of deflationary pressure, Japan can't cope with rising prices, driven by high raw material and energy costs. Meanwhile, the Bank of Japan thinks that the surge in inflation is not sustainable as it is neither caused by rising demand nor accompanied by rising wages. The BoJ has repeatedly stated that growing inflation is not the reason for abandoning QQE and monetary policy tightening. In other words, it can be assumed the reported increase in consumer prices would not have any effect on monetary policy.

At this point, the growing trade deficit in Japan requires closer attention. It has not led to a current account deficit yet because of Japan's large current account surplus, which will only widen as foreign banks continue to tighten monetary policy. This will also push yields higher. Although much of the primary income is reinvested in other currency areas, demand for the yen is not rising.

So far, the yen is stable.

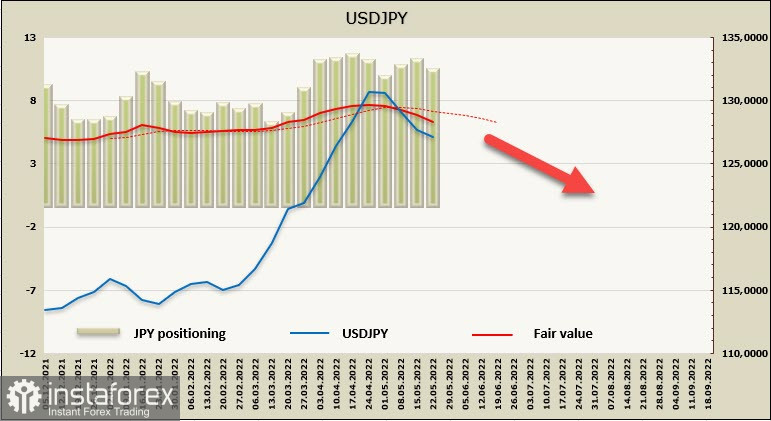

The net short position decreased in a week, but bearish bias is still strong. There are signs of an impending correction. The price is below the long-term moving average. The possibility of a correction is still high.

The quote may fall to support at 124.10/40. A bullish reversal would take place should the rhetoric of the BoJ come in line with the Fed's. So far, the corrective impulse continues. Therefore, long positions could be considered as soon as swing low support is formed and the first signs of the end of the corrective move are made.