The main event of today for the New Zealand dollar was the increase in the Reserve Bank of New Zealand (RBNZ) key interest rate, and immediately by 50 basis points. Although this decision coincided with market expectations, the New Zealander reacted to the RBNZ decision with a significant strengthening. Now the main interest rate in New Zealand is 2%. RBNZ Governor Adrian Orr believes that the country's economy, in particular households, will easily endure the tightening of monetary policy. Thus, the head of the RBNZ made it clear that his department has switched to the path of tightening monetary policy, which means that today's rate hike will not be the last. According to Orr, to contain the current high inflation, it is necessary to raise the rate above 3%. Naturally, this will not happen overnight. As for a recession, it cannot be ruled out, but the forecasts of RBNZ economists do not yet confirm it. Orr's statement that there is still a lot of work on rates confirms the view of further tightening of monetary policy. In the evening, at 19:00 London time, the NZD/USD pair, like all other dollar pairs, will have to survive the publication of the minutes of the last meeting of the Open Market Committee (FOMC) of the US Federal Reserve. Well, we will begin the technical analysis of this trading instrument by considering the weekly chart.

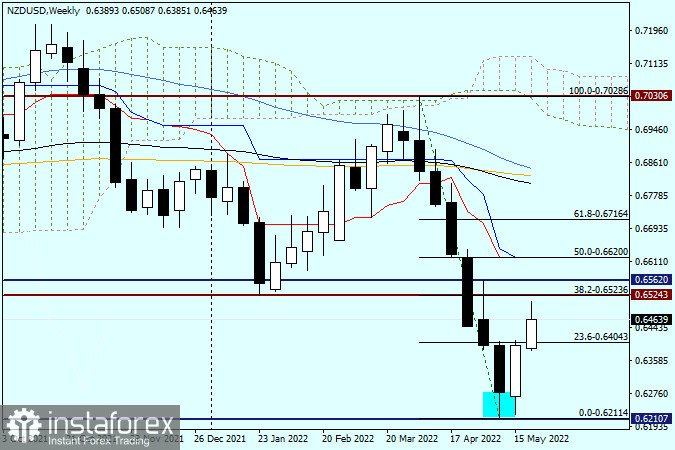

Weekly

Looking at the weekly chart of the New Zealander, I again draw your attention to the significance and influence of shadows. As you can see, after the highlighted lower shadow of the bearish candle, the recovery of the exchange rate began and was quite active. According to the Fibonacci tool grid, stretched by a decrease of 0.7028-0.6211, the pair reached the first pullback level of 23.6 Fibo. This week, the growth continued, and the kiwi has already tested the important psychological level of 0.6500. What came out of it is also clearly visible on the graph. A strong rebound, as a result of which trading is conducted near 0.6470. Although the first attempt to pass 0.6500 was unsuccessful, for some reason there is little doubt that the bulls for the New Zealand dollar will find the strength to retest for the breakdown of this important level. Closing the week above 0.6500 will signal the pair's readiness to move to new peaks. In this case, the immediate goal of the players to increase the exchange rate will be the price area 0.6524-0.6562, where the 38.2 Fibo level passes, as well as the previously broken support.

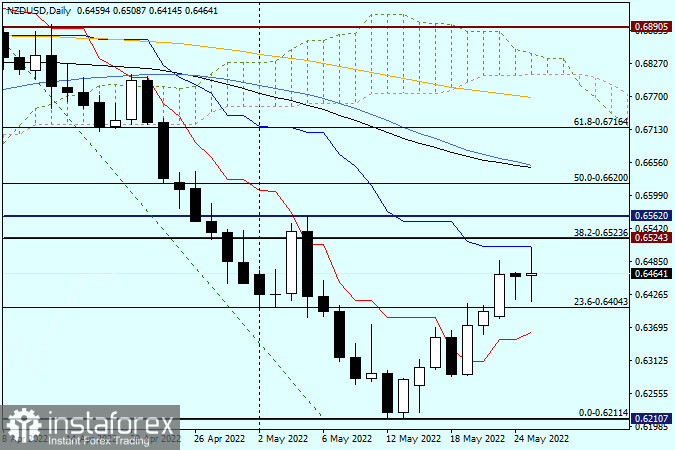

Daily

Looking at the current daily candle, we can conclude that the pair has been overwhelmed by a wave of volatility. In particular, this is indicated by the approximately equidistant upper and lower shadows of today's candle. And there are still FOMC protocols ahead. In all likelihood, the bidders quickly won back the rate increase expected from the RBNZ and recorded a profit, as a result of which the pair retreated from today's highs. From the technical side, I note that the blue Kijun line of the Ichimoku indicator played an essential role as resistance. According to trading recommendations, everything is not so simple. It's better to wait for now. In general, the greater priority, in my opinion, is purchasing after declines to the area of 0.6455 and, possibly, to 0.6435.