Today, the dollar again moved to growth on the eve of the publication of the minutes of the May Fed meeting (FOMC minutes) at 18:00 GMT.

In all his speeches that followed this meeting (May 3–4), Fed Chairman Jerome Powell stated that the central bank intends to pursue a more aggressive monetary policy, raising interest rates by 0.50%, at least at 2 forthcoming (June and July) meetings.

Following the results of the meeting that ended on May 4, the Fed decided to raise rates by 0.50% and announced a reduction in the central bank's balance sheet ($9 trillion), which will begin in June. The Fed will reduce its portfolio of Treasury bonds and mortgage-backed securities by a little less than $100 billion every month. The reduction of the balance sheet is one of the components of the monetary policy normalization program that the Fed is implementing to slow down inflation. Fed officials focus on changing short-term interest rates, but reducing the asset portfolio is also an important part of this process.

"Inflation is much too high and we understand the hardship it is causing. We are moving expeditiously to bring it back down," Powell said during a press conference immediately after the release of the rate decision. In his opinion, low and stable inflation is key to achieving strong economic performance, and the Central Bank has the necessary tools to accomplish this task.

"The Federal Open Market Committee is generally inclined to consider the possibility of further interest rate hikes by 50 basis points during the next few meetings," Powell said. "The American economy is extremely strong and is quite capable of withstanding the tightening of monetary policy."

"As for the consequences (shrinking the balance sheet, and how it will affect the US economy), it is worth emphasizing that they are very uncertain," Powell said. He also acknowledged that the expected 0.50% interest rate hike at the next two meetings is already priced in. Now market participants will evaluate how successful the Fed's actions will be in curbing inflation, which has reached highs in the US over the past 40 years.

At the same time, managers of US companies are worried that an excessive tightening of financial conditions could affect economic growth as a whole.

The publication of the minutes is extremely important for determining the course of the current policy of the Fed and the prospects for raising interest rates in the US. The volatility of trading in financial markets during the publication of the protocol usually increases, since the text of the protocol often contains either changes or clarifying details regarding the results of the last Fed meeting. Most likely, it will be so this time: the volatility in dollar quotes will increase. But it's hard to say where it will go immediately after the publication of these protocols. If the rhetoric contained in the minutes of statements is regarded by market participants as soft, the dollar may decline (in the short term).

In general, economists expect the dollar to strengthen again, and one of the main reasons for this is the Fed's monetary policy, the most stringent among the world's largest central banks.

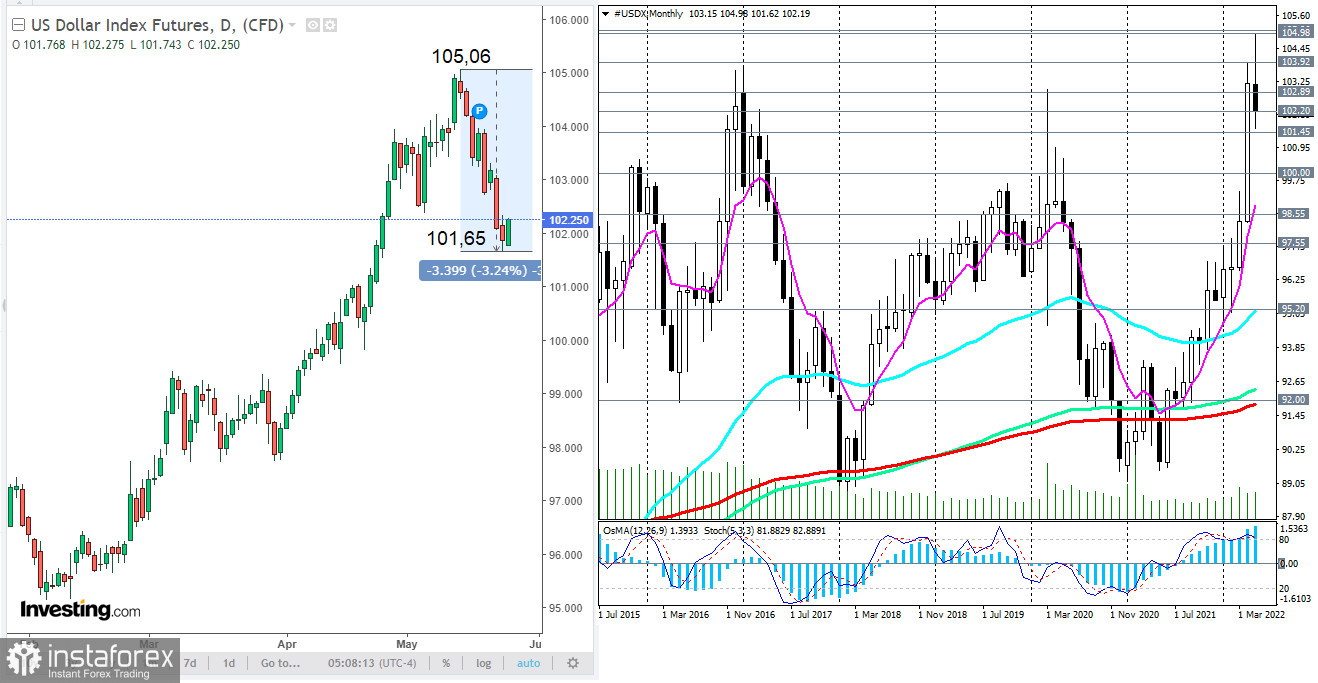

From a technical point of view, the price of the CFD of the dollar index (shown as #USDX in the trading terminal) maintains a long-term positive trend, trying to return to the upward channel (on the daily chart #USDX), above 102.20.