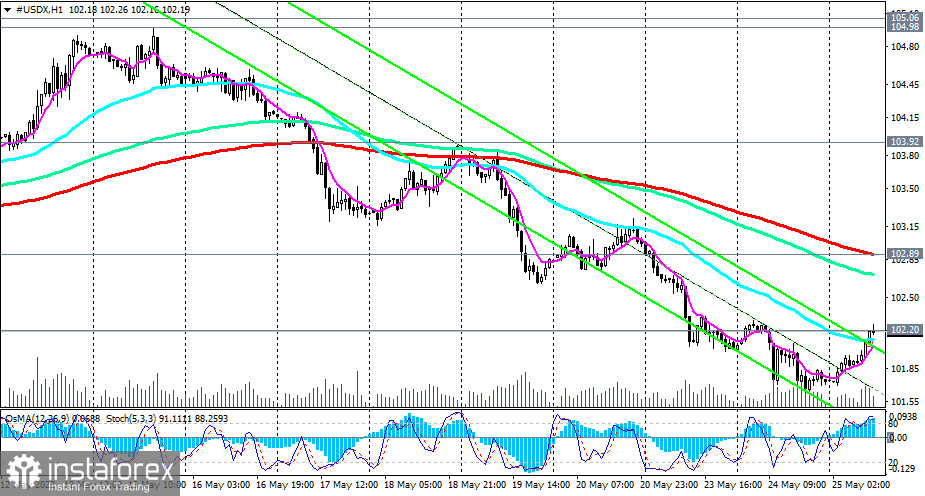

As noted in today's "Fundamental Analysis", the price of the CFD of the dollar index (displayed in the trading terminal as #USDH) maintains debt positive dynamics, feeding in the ascending channel (on the daily chart #USDH) above the 102.20 mark, through which the lower limit of this channel passes.

In our preliminary review for 05/20/2022, we assumed that if "the deadline for a possible withdrawal of #USDH continues," then "the deadline for a possible withdrawal of #USDH is at the support level of 101.40 (EMA50 on the daily chart)."

The situation began to unfold according to the same scenario as in USDX, but all prices on NYE did not reach the support level of 101.40. The reversal started at 101.74 (today's opening price). As a result of further growth and after the breakdown of the resistance level of 102.20 & #X20; USDH returns to the ascending channel on the daily chart and heads towards the upper border, passing below (and since January 2003) the local maximum of 104.98.

The first most "bistre" buy signal has already been received: the price has broken through a significant short-term resistance level of 102.15 (EMA200 on the 15-minute chart #USDH).

In case of "success development" and further growth, the breakdown of the important short-term resistance level of 102.89 (EM200 on the 1-hour chart) will be a confirmation signal for the recovery of long positions.

In an alternative scenario, the trial support level is 101.40, all houses are standing, and prices are heading towards long-term support levels of 98.55 (EMA144 on the daily chart), 97.55 (EMA200 on the daily chart) with an intermediate goal of a psychologically significant support level of 100.00.

From a fundamental point of view, we should expect the strengthening of the dollar and the growth of the USDX, and one of the main reasons for this, according to analysts, is "the monetary policy of the Fed, conducted among the world's largest central banks."

Support levels: 101.40, 100.00, 98.55, 97.55

Resistance levels: 102.15, 102.89, 103.00, 103.92, 104.90, 105.00

Trading Recommendations:

#USDX: Sell Stop 101.30. Stop Loss 102.40. Take Profit 101.00, 100.00, 98.55, 97.55;

Buy Stop 102.40. Stop Loss 101.30. Take Profit 102.89, 103.00, 103.92, 104.90, 105.00.