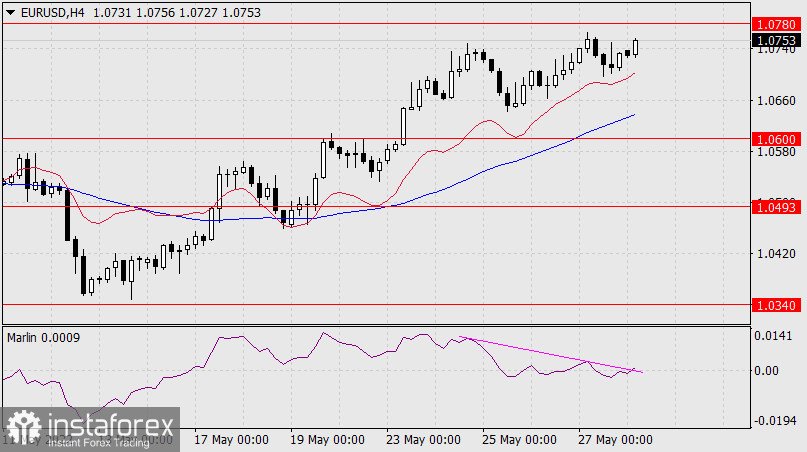

The euro is trying to develop an upward trend - Friday closed above both indicator lines with a white candle, that is, the price settled above them. But the Marlin Oscillator began to turn down, and this reduces the likelihood of reaching the target levels of 1.0780 and 1.0830. There is a risk of a false exit of the price above the indicator resistance. At the same time, the price still has the desire and the opportunity to reach the level of 1.0780, that is, to complete what it could not do on Friday.

On a four-hour scale, as before, the Marlin Oscillator does not share the price's optimism. A divergence has formed, the signal line of the oscillator is in negative territory – there may well be a price surge with the intention of reaching 1.0600, or at least an attempt to overcome the MACD line (approximately 1.0645).

A variant is possible with the price reversing upwards from the level of 1.0600, that is, the now expected decline will only be a correction before the medium-term growth, approximately to the high on March 31 (1.1130/80).