Bitcoin is still in the downtrend and forms the ninth weekly candlestick in a row. Despite all that, the asset is above the $29k-$30k range. At the same time, there has been a decrease in coins on exchanges as well as an increase in bullish activity. All these factors show that investors believe in the formation of a swing low at $25.3k. So, the market is now ready for full-fledged growth.

It seems that the current rally of the cryptocurrency was caused by its correlation with the stock indices that resumed their upward move. It all became possible due to several factors. The US dollar index, having reached 104, deepened its correction. This was a positive factor for risk assets amid the rally of stock indices.

In addition, the dollar index broke through the important support zone. Resistance is now seen at around 100. Technical indicators are signaling the weakening of the asset. The Relative Strength Index and the Stochastic are moving down below the bullish zone, and the MACD is entering the red zone. This indicates that risk assets have significant growth potential.

Fed Chairman Powell's statement also became the driving force for financial instruments. He said that the Federal Reserve wants to return to a dovish monetary policy stance as soon as possible. The Fed's chief also hinted at the possibility of a 25-50 basis point increase at the upcoming meetings.

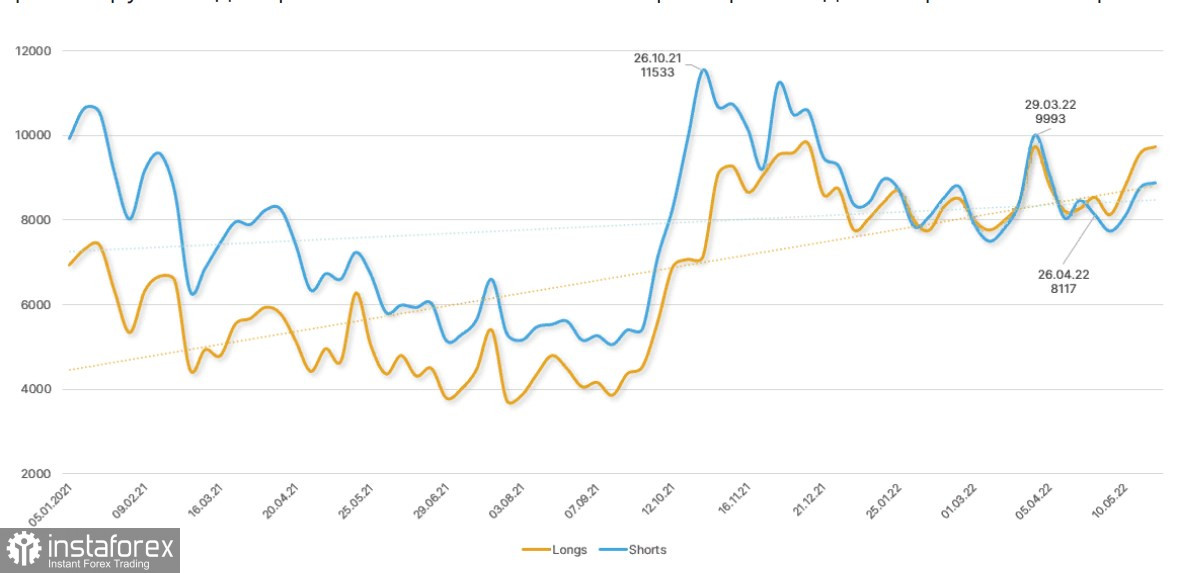

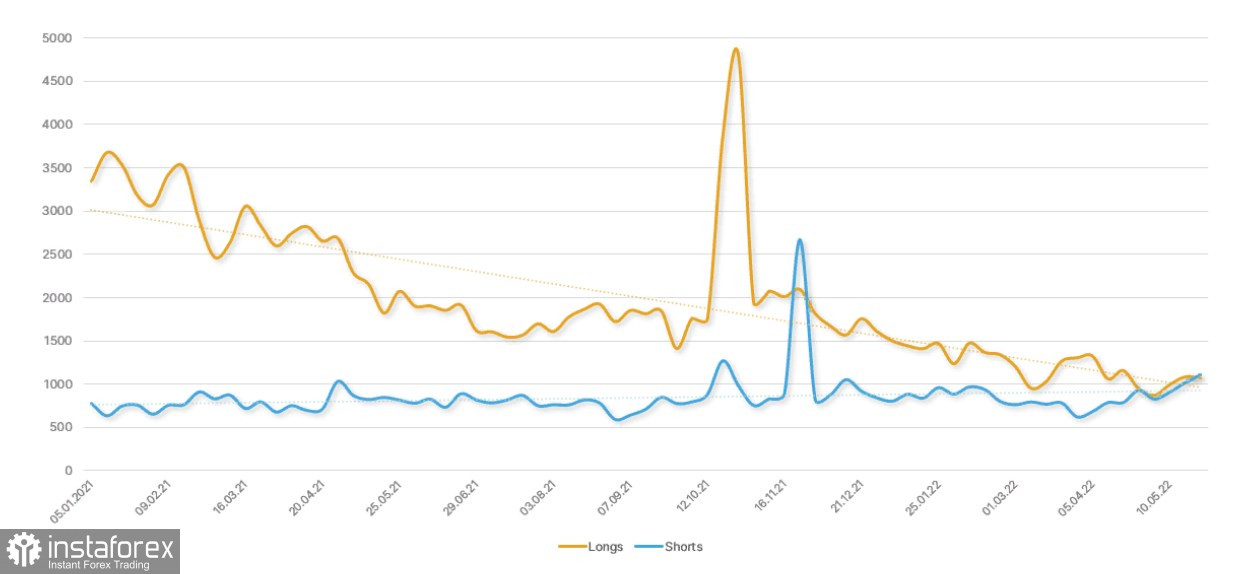

As for the technical picture, bitcoin reached the swing low at $25.3k and consolidated, which triggered a rise in the volume of long positions. This means that the market believes in the asset's growth potential even in the short term. According to CFTC, demand for BTC futures on the CME exchange started to increase after a prolonged fall.

In addition, the activity of large hedge funds is now on the rise. Increased bullish bias and the balance ratio between shorts and longs are in favor of the latter. Usually, a rise in the activity of major players is seen as a stabilizing factor for investors. So, when they trade more actively, it is seen as a positive factor for the market. Historical volumes of stablecoins on exchanges also reflect an inflow of capital to the crypto market, which shows a sell-off of stablecoins and a purchase of other digital assets.

At the same time, bearish sentiment is strong among retail investors, with the number of short positions in this segment of the bitcoin market growing. This is due to the recent retest of the $28k mark when the total volume of long positions decreased by $536 million. At the same time, the order book clearly shows that a large buy position was opened in the $28k area. With this in mind, it can be assumed that certain large companies continue to shake out "weak hands" of the market. It could be another reason for a possible upside rally.

The situation in the bitcoin market is gradually getting back to normal, which is common for a bullish market. Many indicators are far from the highs, but the general tendency shows that the crypto market and BTC may soon trade in an uptrend. According to technical indicators on the daily time frame, the volume of long positions on BTC is rising. However, these positive factors are not enough to assume an impending bullish rally.

The tightening of the QE program starts on June 1. The Fed will be reducing the balance sheet by $45 billion a month and then increase the pace to $90 billion. Fed officials don't know the effects of this process on the economy, so the market is now left astray. This is a very important factor that may trigger an increase in volatility and yet another fall below the $30k barrier.

Above all else, the Fed is expected to raise interest rates by 25-50 basis points in June. The move will clearly have a negative effect on bitcoin and other markets. Since investors are still trying to adjust to new circumstances, BTC/USD may rise to the range of $33k-$35,5k, in line with the Fibonacci level of 0.236. Its further movement will depend on how the market reacts to QE tightening.