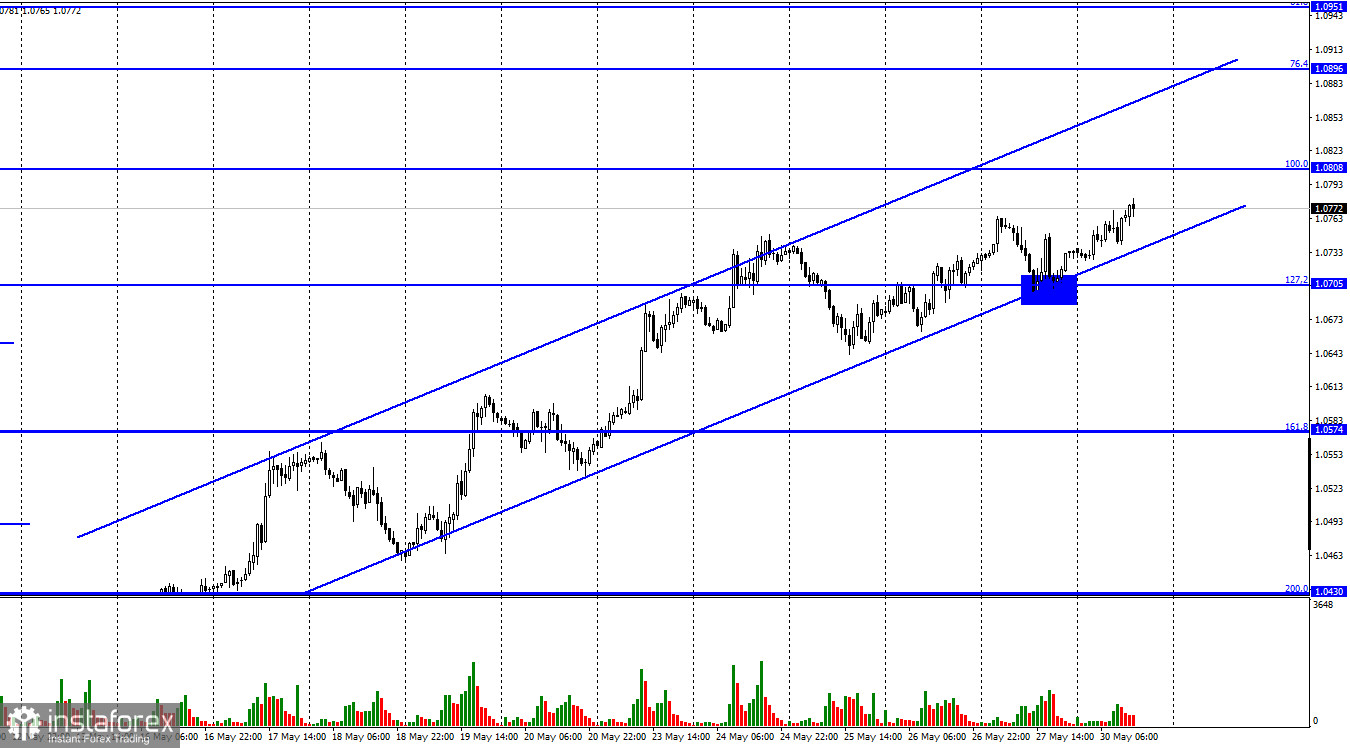

Hello, dear traders! On Friday, the EUR/USD pair rebounded from the correction level of 127.2% at 1.0705 and reversed in favor of the euro. On Monday, it continued rising towards the correction level of 100.0% at 1.0808. According to the ascending trend channel, the sentiment of traders is still considered bullish. If the pair closes below it, it will favor the dollar and will result in some fall towards the Fibo level of 161.8% at 1.0574. The euro has strengthened considerably during the recent weeks. Even today, with lack of news background, traders continued to gradually buy the euro. Therefore, I assume that the conclusion I made last week is correct. If there is no positive news for the euro and it keeps rising, it means that traders' sentiment started to change to bullish or has already changed. In this case, the general sentiment is implied, not a sentiment for 2 weeks.

Notably, the euro started rising due to the latest important news. European Central Bank President Christine Lagarde announced an interest rate hike in 2022. Moreover, Lagarde indicated a rate hike as well as the end of the quantitative easing program. Therefore, the ECB rhetoric is gradually becoming more hawkish. The euro reacted to this key event as the US dollar reacted to the Fed's tightening its stance and raising the interest rates! Currently, the euro and the dollar are reversing their roles. The US dollar has already gained recently. Now it's time the euro rose a little. This week, several major events will affect traders' sentiment, in particular Christine Lagarde's new speech, the EU inflation report and the US labor market report. Any of these events may lead to a close below the ascending channel on the hourly chart.

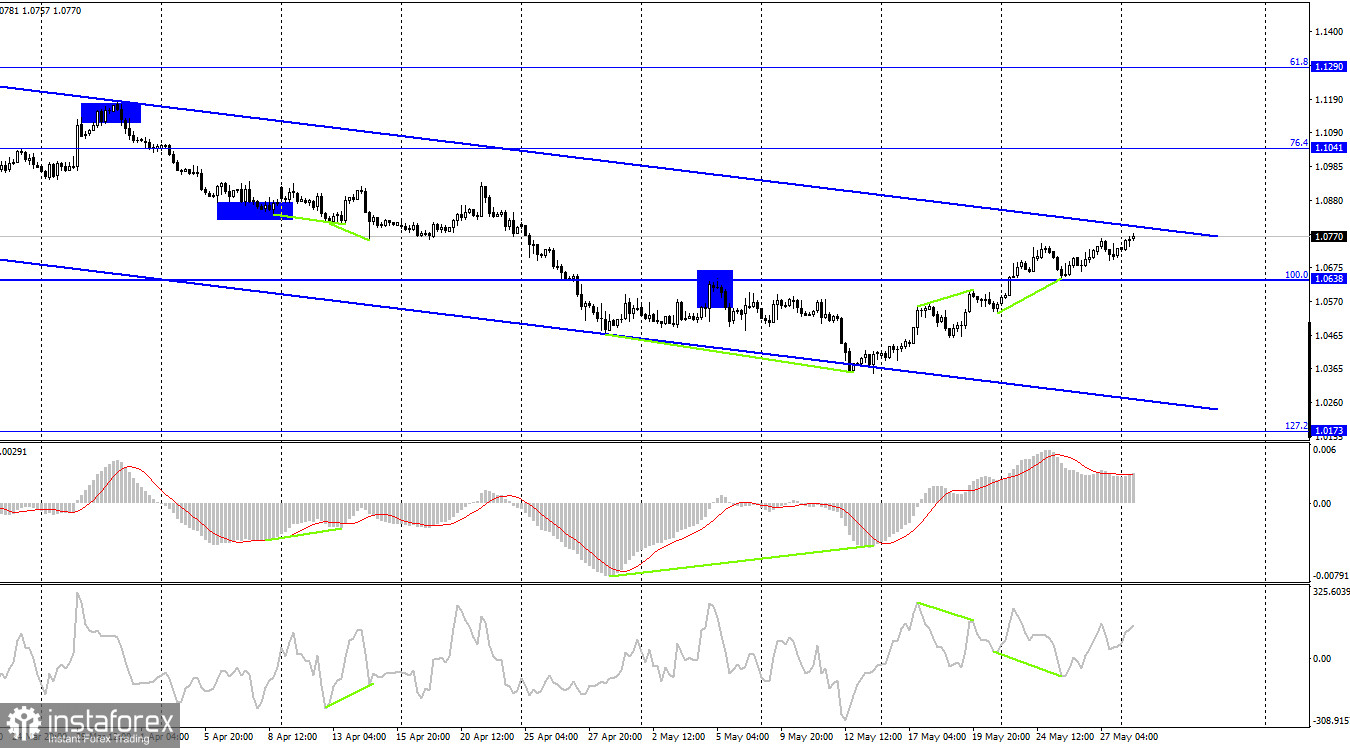

On the 4-hour chart, the pair continues rising towards the upper line of the descending channel which still characterizes traders' sentiment as bearish. On the current chart, the sentiment has not changed yet. However, if the pair consolidates above the channel, it will confirm the change of traders' sentiment to bullish and increase the probability of further rise towards the correction level of 76.4% at 1.1041. A rebound from this line is also possible. However, I recommend selling the pair if it reverses below the 100.0% Fibo level at 1.0638.

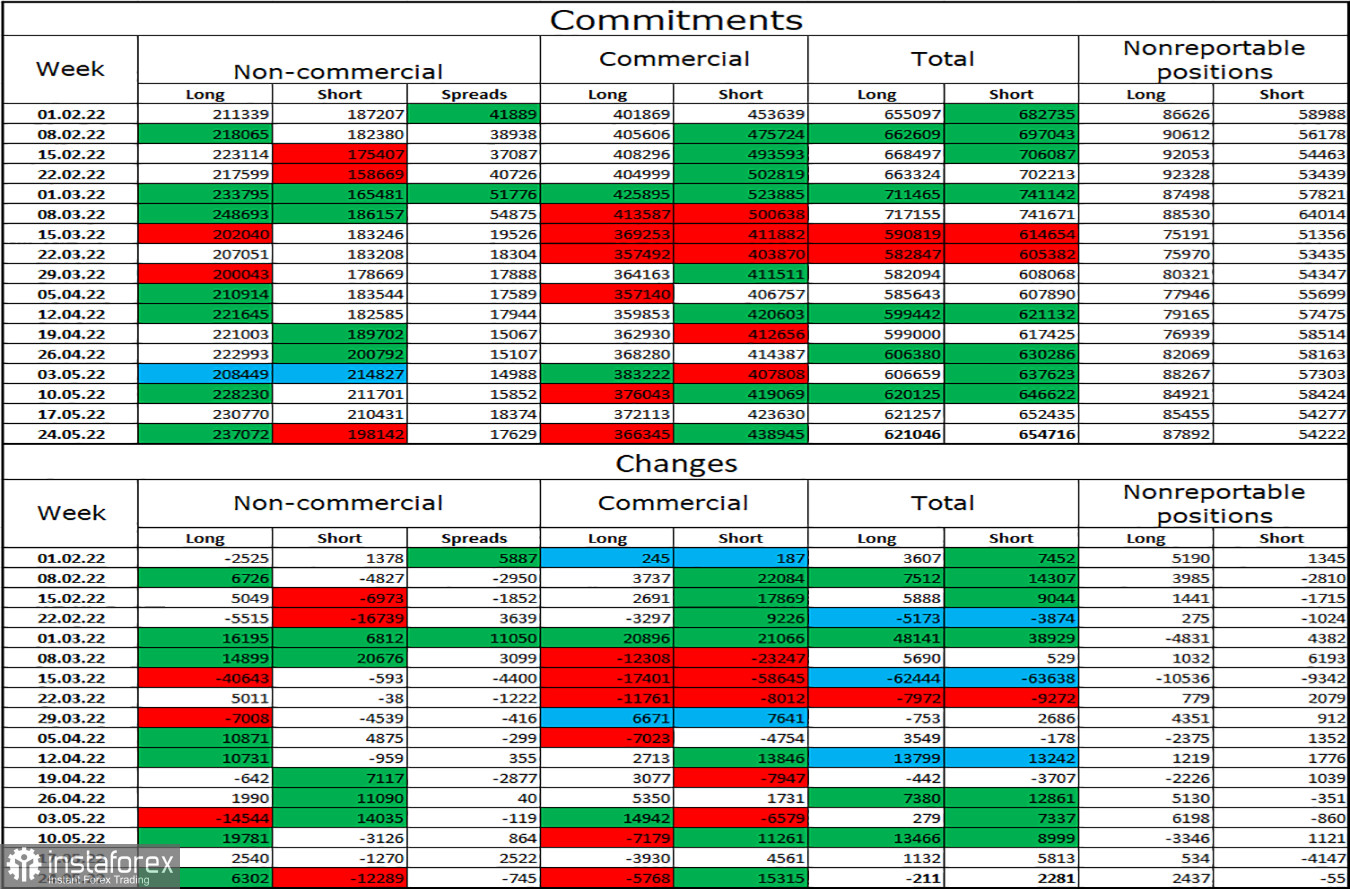

COT report:

Last week, speculators opened 6302 long contracts and closed 12289 short contracts. That means the bullish sentiment of major players has increased again. The total number of long contracts held by them is now 237,000, while the number of short contracts totals 198,000. As seen above, the difference between these figures is not substantial and it is hard to believe that the euro has been declining continuously in the recent months. The non-commercial traders' sentiment has remained bullish during the last months. However, this fact was not favorable for the euro. Moreover, now it is seen on all the charts how traders' sentiment is starting to change to bullish. Thus, the euro has better chances for growth. If bear traders try to achieve their goals in the next two weeks, the euro may have greater potential for a long-term rise compared to the dollar.

US and EU economic news calendar:

On May 30, the EU and US economic calendars do not contain any events. News background will not affect traders' sentiment during the rest of the day.

EUR/USD outlook and recommendations for traders:

I recommend selling the pair if there is a close below the corridor on the hourly chart with the targets of 1.0705 and 1.0574. I recommend buying the euro if the pair consolidates above the corridor on the 4-hour chart with the target of 1.1041.