The main event of Monday is a record increase in inflation in Germany to 8.7% (forecast 8.1%), as well as an increase in oil prices against the background of the EU's attempt to shoot itself again either in the foot or in the head, which is expressed in the refusal to buy oil from Russia. A decision has not yet been made, but if it is made, inflation in Europe will receive a powerful impetus to further growth, and the threat of recession will become obvious.

Brent oil has been growing for 8 days in a row, breaking the bar of $ 121 per barrel, the growth is facilitated by rumors about the imminent lifting of covid restrictions in China, which means that there will be an increase in demand from its side for oil. The OPEC+ meeting will take place on Thursday, the growth of quotes and Europe's attempt to impose an embargo may lead to an adjustment of OPEC+'s position on production volumes.

The US dollar continues to decline, the best results are shown by commodity currencies. The growth of inflation in Germany contributed to the growth of the euro, as the growing pressure in favor of tightening monetary policy was added to the ECB meeting on June 8. Today, the key event of the day is inflation data in the eurozone as a whole. After yesterday's data on individual countries, the forecast is likely to be exceeded.

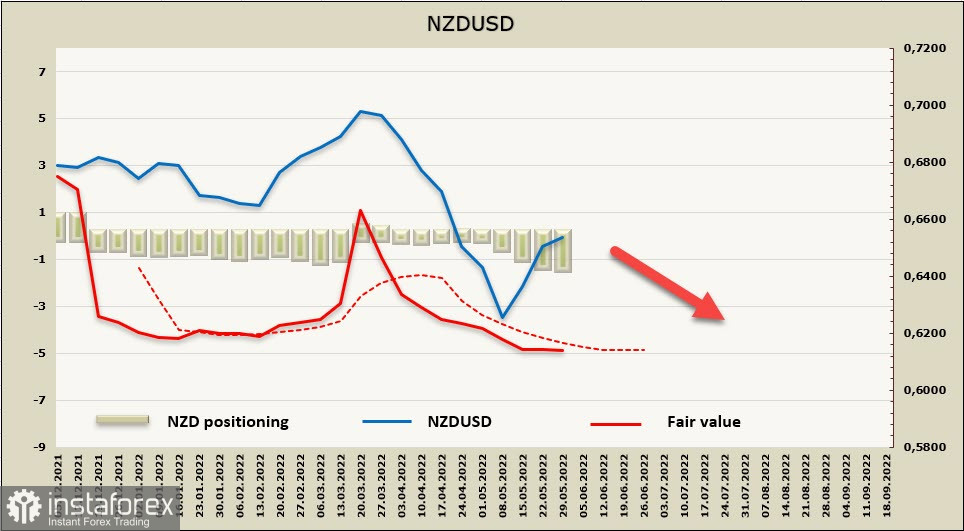

NZDUSD

As expected, the RBNZ raised the rate by 50p. to 2%, while the rate forecast has become more aggressive, the same 50p increases are expected at the next two meetings, and in the 3rd quarter of 2023 the rate will reach 4%, and this is higher than the Fed forecast. This change will put bullish pressure on the kiwi in the long term.

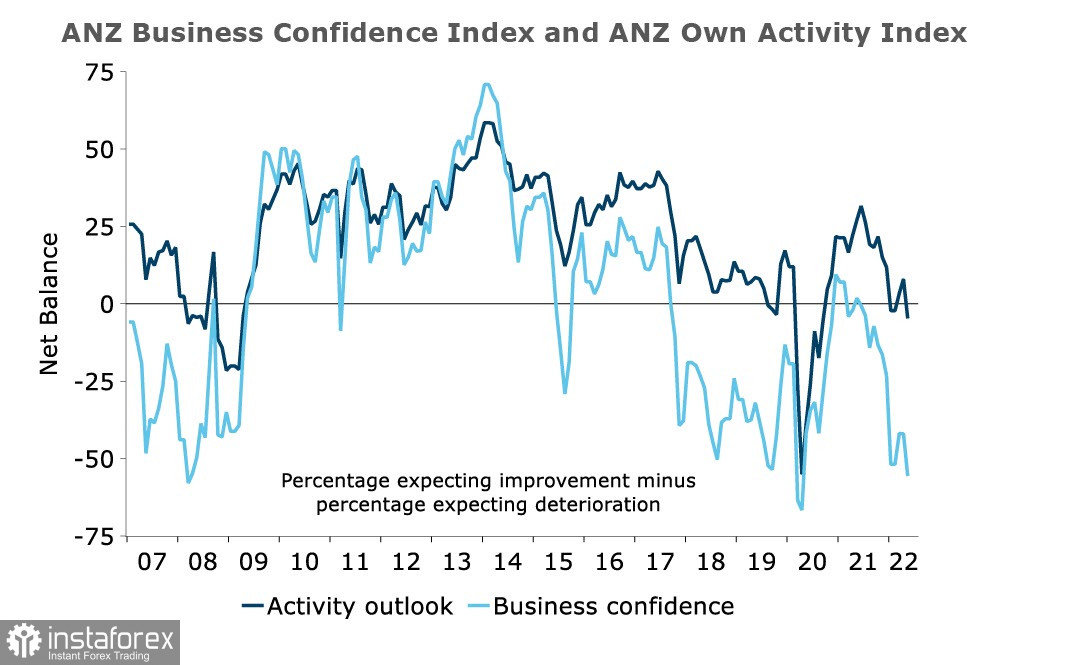

Accordingly, if inflation does not slow down growth, then New Zealand will have a direct road to stagflation, this is the most negative scenario. If the price growth starts to slow down, and the survey showed that there are prerequisites for this, then in this case the kiwi will have a chance to start recovering against the USD, but it is too early to talk about this prospect.

After several months of uncertainty, speculators still began to form a bearish position on the NZD, which increased for the fourth week in a row and reached, as follows from the CFTC report, 1.25 billion. The estimated price, despite the kiwi's attempts to go up in correction, remains below the long-term average, this is a sign that the upward momentum does not have enough strength to break the bearish trend.

We assume that a local maximum will be formed at the current levels, after which NZDUSD will turn down. The maximum of May 5 (0.6563) will act as resistance, a move higher will cancel the forecast and you will need to look for a new level for a reversal. In the long term, we consider the trend bearish.

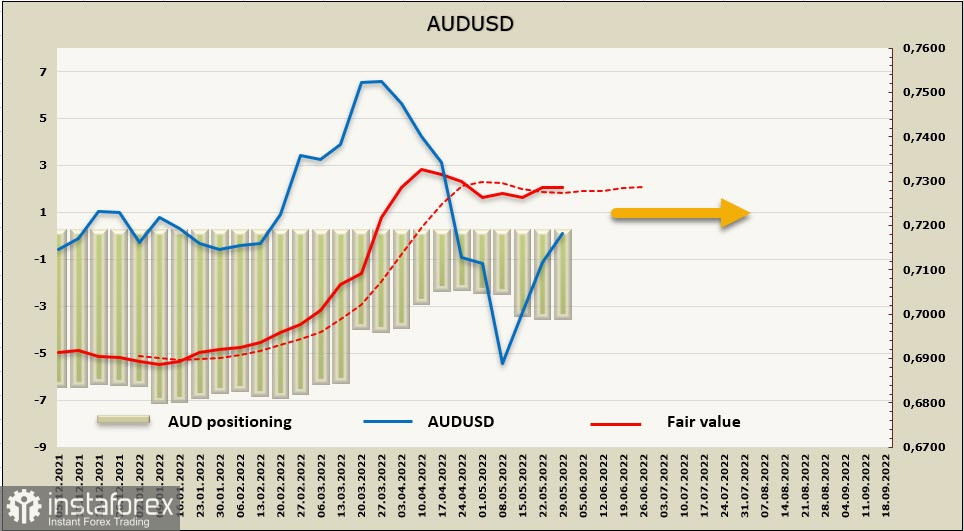

AUDUSD

The pressure on the Australian economy remains palpable, the decline in demand from China led to a sharp reduction in the balance of payments in Q1. Despite the growing oil, private capital expenditures decreased, and the housing market is under severe pressure, 2.4% fewer construction permits were issued in April, a year-on-year drop of 32.4p.

The weekly change in AUD is -92 million, and the net short position reached -3.23 billion, which is a pretty strong bearish advantage. The estimated price is slightly higher than the long-term average, which leaves chances for continued growth, but the momentum is weak.

The growth of AUDUSD in the second half of May was not accompanied by an adjustment in the positioning of speculators, who not only did not reduce the accumulated short position but even slightly increased it. This means that the major players are still determined to sell Aussie against the dollar, which makes the current growth purely corrective. We assume that the upward movement is on the verge of exhaustion, the resistance is 0.7240/50, then 0.7270, at the first resistance, the formation of a local peak is more likely, and either a reversal to the south or a transition to the lateral range.