In May 2022, the cryptocurrency market experienced several extremely difficult tests. As a result, the level of market volatility reached a local peak, and the fear and greed index fell to 5 points. At the same time, Bitcoin experienced the largest drop in a year and updated a local low at $25k. Having reached the peak of panic in all indicators, the market began to stabilize, and the coins updated local highs. In addition, there are more and more positive factors that will spoil the upward movement of Bitcoin and the cryptocurrency market.

The first and most logical signal for a reversal is the achievement of the local Bitcoin bottom. The asset tested the $25.3k level and bounced back to the $28k–$30k area, where it continued to consolidate. Subsequently, the coin managed to seriously stabilize the direction of price movement, due to which the digital coin became the "new stablecoin" in the crypto space for a while. The formation of a local bottom always becomes the finale of a difficult market situation and a fundamental negative. In the historical context of the BTC movement, you can also notice that in most cases, a new low is followed by a stabilization or upward movement. This is exactly what we are seeing now with Bitcoin.

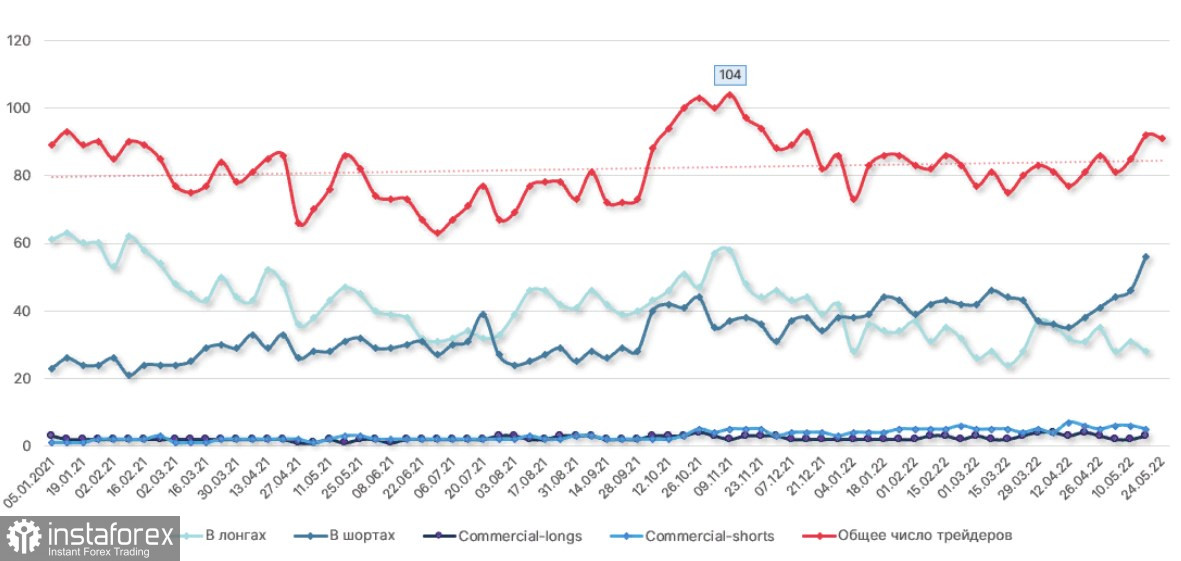

The fundamental positive, reflecting the logic of investors' behavior, is reinforced by the activation of the bulls. Over the past week, there has been a reorientation of large capital to opening long positions, as well as a continued accumulation of BTC coins. Large hedge funds are building up longs, as evidenced by the CFTC study. This is a positive signal that may indicate interest in Bitcoin as a defensive asset due to the stabilization of the exchange rate and the reduction of volatility. It is quite likely that the current increase in long positions may be the beginning of another reorientation of large capital, which will have a positive effect in the long term.

However, if this assumption is correct, then the asset needs more time. Retail investors and part of the institutional audience are still pessimistic. The increase in the number of longs may also be part of the activation of buyers against the backdrop of favorable market conditions. Such a conclusion can be drawn from the same CFTC report, which states that the number of participants in the CME futures market is starting to grow. In any case, the growing trading volumes in the futures market are a positive signal that indicates a gradual decrease in the level of fear and a growing interest in cryptocurrencies.

Another important factor that contributed to the current normalization of the situation is the local uncorrelation with NDX and the DXY correction. Bitcoin made a local pause, despite the growth of stock indices. This indicates a drop in the level of codependency with trading indices. The increase in trading activity on the network of the main cryptocurrency is a direct reason for the decrease in correlation with the NASDAQ. This is a positive signal that allows investors not to look back at the fund before making operations on the crypto market. At the same time, we see a strong correction of the US dollar, which reached 104 and began to decline. Interest in Bitcoin against the background of the DXY correction is also a positive signal that will allow the coin to reach a local high.

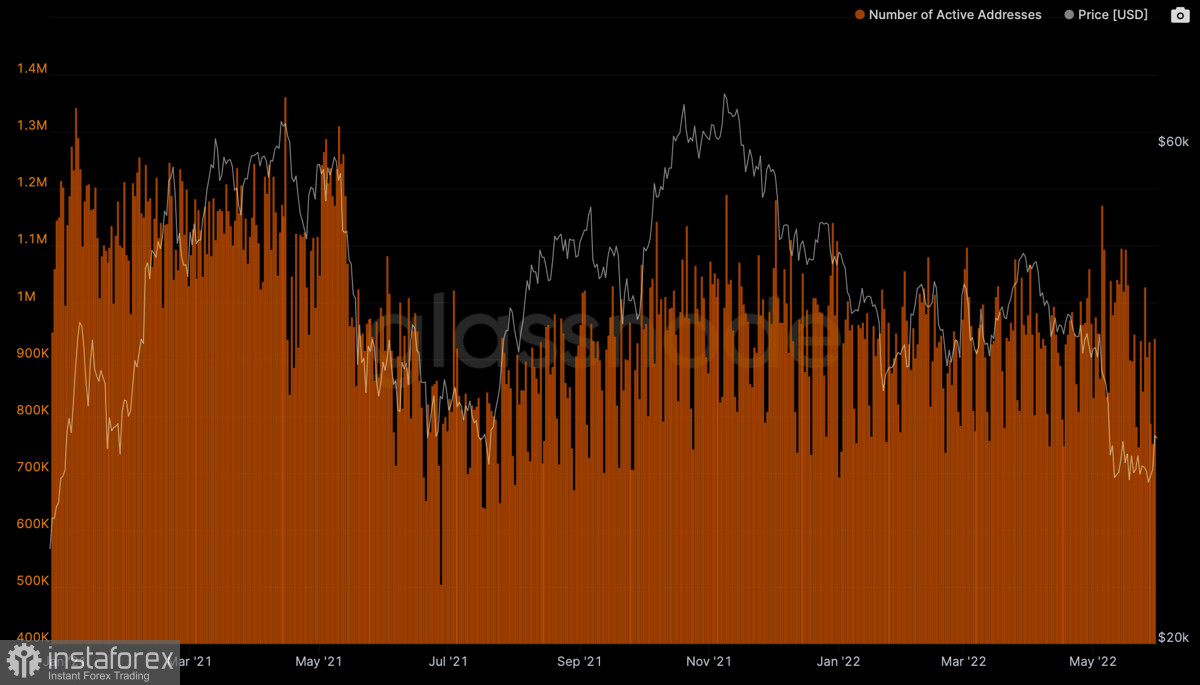

Despite the positive situation, on-chain activity in the Bitcoin network remains at an average level. The metric of the number of unique users is at the average level, and the volume of daily trading is $32 billion. There is also an influx of BTC coins to cryptocurrency exchanges, which indicates the lack of a unified policy regarding the digital asset. Given the lack of a coherent investment approach to Bitcoin, as of May 31, a long-term upward trend cannot be expected. The current rebound should be taken as an upward correction after a long downward trend with negative consequences.