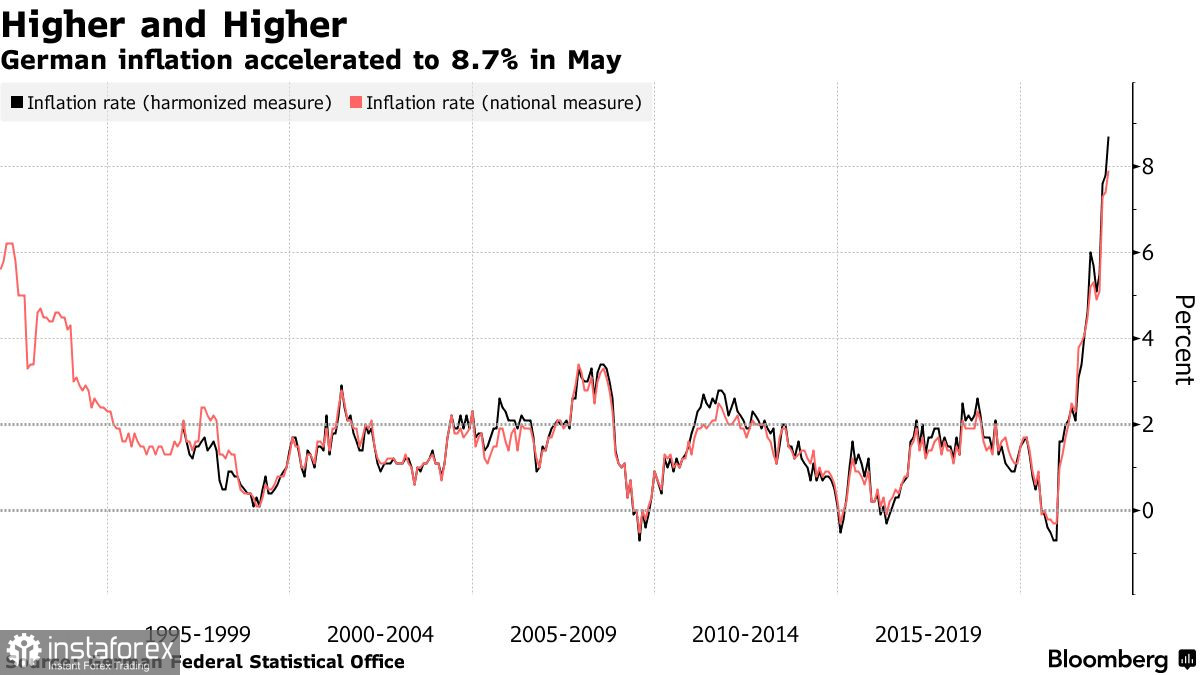

Pressure on risky assets is gradually returning at the end of this month, even though inflation in the eurozone continues to set new records. The report on the eurozone expected today will exceed all the most daring forecasts of economists. As for the European flagship, Germany, inflation has reached another record high, which has added headaches to the European Central Bank and urgency to decide on the completion of the economic stimulus program. Data from Spain also exceeded economists' forecasts.

According to the report, a sharp rise in energy and food prices has led to a new record level of inflation. Consumer prices in the continent's largest economy jumped by 8.7% in May this year compared to last year. Analysts had forecast growth of only 8.1%. As I have repeatedly noted, the inflation data will make the European regulator "move". There are less than 10 days left before an important ECB meeting at which officials are to announce the end of large-scale asset purchases and confirm their plans to raise interest rates in July this year for the first time in more than a decade. Some politicians are already signaling the need for the first rate hike by half a percentage point at once, and not by a quarter, which is supported by the majority.

Against this background, German bonds showed a decline, and the yield on 10-year bonds rose by eight basis points to 1.05%.

Inflation figures increase pressure not only on the European Central Bank but also on the government, as the standard of living of households continues to decline sharply, which causes several discontents among the population. More recently, Finance Minister Christian Lindner called the fight against rising prices a "top priority", while at the same time advocating an end to expansive fiscal policy. "Inflation is a huge economic risk. We must fight the price increase, which can lead to another economic crisis, where inflation will be fueled on its own," Lindner said at a press conference in Berlin.

Last week, several politicians from the ECB, including President Christine Lagarde, expressed similar concerns, saying that a constantly high price increase could take hold, which would significantly affect consumption. It is already obvious that consumers will have to reckon with further price increases. Many resources are still in short supply, which further leads to higher prices. Good data on the labor market are no longer positive since the spiral of wage increases leads to higher prices, and so far no one can stop it. The gradual return of energy prices to their annual highs, in this case of oil, will put pressure on future pricing.

Today, data on inflation in the eurozone for May of this year were released. An annual jump of 7.7% is expected at once. Going beyond the estimates of economists will lead to a sharp spike in volatility, although it is so obvious that a slowdown in inflationary pressure should not be expected in the near future.

The ECB's decisions taken next month will be based on new economic forecasts, which are likely to show that price pressure in the eurozone will remain above the target level of 2% in 2023 and 2024 - this is a bullish signal for the European currency. Therefore, there is still every reason to continue the growth of risky assets.

In the European currency, buyers need to get above 1.0780, which will lead to a new rapid upward jerk of the pair to the area of 1.0820 and 1.0850. There, the bulls will again face quite serious problems - especially given the overbought trading instrument on shorter timeframes. If the pressure on the euro returns, the bulls will try to do everything to protect 1.0730. If you miss it, most likely, the bears will fail the trading instrument to the lows: 1.0690 and 1.0640.

Buyers of the pound defended the level of 1.2590, which allowed them to count on continued growth. In the short term, bulls will certainly expect to go beyond 1.2630, which will strengthen the growth of the trading instrument. A breakthrough of 1.2630 will lead to an instant breakthrough to the monthly maximum of 1.2665 with the prospect of updating 1.2710 and 1.2760. If buyers fail to cope with the tasks assigned to them at the end of the month, and a breakthrough of 1.2590 still takes place, the pressure on the pound will increase. This will open the way to the lows: 1.2550 and 1.2520. The furthest goal in the current conditions will be the support of 1.2480 - the minimum of last week, where the bulls were quite active.