Hello, dear traders!

After the GBP/USD pair failed to return below the broken resistance level of 1.2523, it slowly moved northwards. Taking into account the lack of UK macroeconomic statistics, the pound has been strengthening against the US dollar most likely due to the current weakness of the dollar. At least, the author of this article holds this view. Today, the UK reports on the volume of net loans to individuals as well as approved mortgage applications data are not significant as they do not have a profound impact on the price dynamics of the GBP/USD pair. As for the US statistics, the consumer confidence index (CCI) is of key importance. It will be released today.

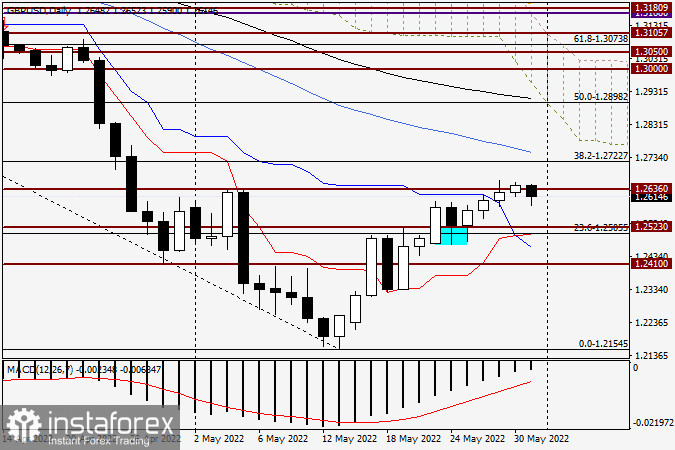

Daily

According to yesterday's trading, a small bullish candle was formed on the daily chart. However, the pair's closing price was above strong resistance of sellers at 1.2636. Moreover, as mentioned above, it is premature to analyze a true breakdown by a single closed candle above or below any level. At the moment of writing this article, the pair is under a slight pressure and is trading below 1.2636. However, today the candle is forming a bearish shadow, while pound bulls are trying to reduce losses. The outcome will be reported after the close of today's trading session. In case the current situation changes and the pair continues rising, its next target will be a strong technical zone within the range of 1.2700-1.2750. As seen, the 38.2% Fibonacci level with the potential to decline from 1.3642-1.2154 is at this point. The 50 simple moving average is slightly above. In case the pair reaches the highlighted zone, the next target for bulls will be another strong technical level of 1.2900. Bears focus on trying to return the price below the broken resistance level of 1.2523. If they manage to succeed, the next target will be the area of 1.2500-1.2462 with the red Tenkan line and the blue Kijun line of the Ichimoku indicator.

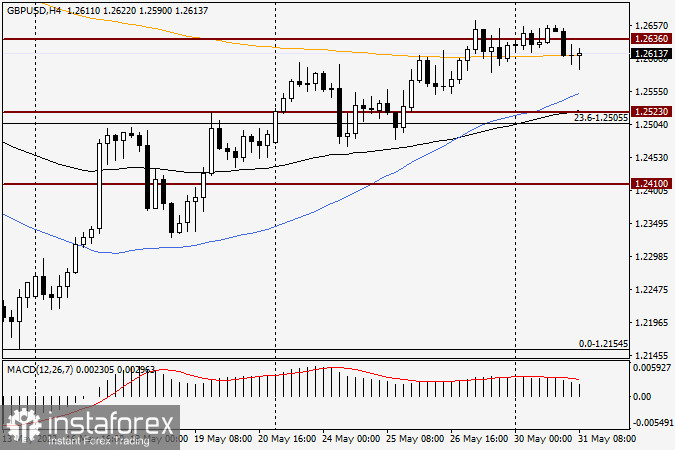

H4

The 4-hour chart shows that after the pair returned below the level of 1.2636, the orange 200-exponential moving average prevents the pair's growth. If three candles in a row close above the 200-EMA and the level of 1.2636 on this timeframe, a pullback to the broken level is likely. Then it is possible to consider buying the British pound. As seen, two consecutive candles above 1.2636 are not enough and the pair comes back below that level. The formation of a bearish candlestick pattern below the 200 EMA will give a signal to sell the pair with the targets of 1.2552 and 1.2525. The 50 MA and the black 89 EMA are at these levels. They may play the role of support together with the descending level and return the pair to the uptrend. In conclusion, I want to emphasize that many experts do not realize the importance of the pound's growth and consider it temporary. However, the Bank of England plans to raise the interest rates again. Notably, the GBP/USD pair has fallen dramatically. In my view, a further rise of the British pound against the US dollar is predictable. Let's analyze the US labor market report and see how the current trading week ends.

Good luck!