Global disadvantages and risks:

Gilead Sciences shares were under the strongest pressure until mid-March of this year. The decrease in the impact of the coronavirus pandemic played a role here, which stimulated a wide demand for shares of pharmaceutical companies. But it still has problems, though not so critical. The company has a high level of debt of $ 26.208 billion as of March 31, 2022, to the amount of equity of $ 19.915 billion, which corresponds to 131.6%. But it should also be noted that the company's debt is well covered by operating cash flow of 40.5% and is offset by EBIT coverage of 11.3 times. It is expected that by the end of this year, revenue will decrease to $ 24.574 billion, and net income will decrease to $ 4.227 billion. It is assumed that earnings per share (EPS) at the end of 2022 will decrease to $ 3.436. According to 12 analysts, the possible range of EPS is from $ 3.030 to $ 4.500. Gilead Sciences had a large one-time loss of $ 4.3 billion, which affected the results of the last fiscal year. The price/profit ratio (P/E) is 18.1x, which is higher than the industry average, where the average value of the indicator is 15.5x, and the US market is 15.5x.

Positive:

The company is currently profitable. Profit is projected to grow by an average of 8.4% per year over the next 3 years. Gilead Sciences' margin improved. No events of concern have been detected, it has no negative equity. The company's shares were not diluted. The company has a projected profit growth of 8.4% above the savings rate of 1.9%. It is assumed that the return on capital over the next 3 years will increase by 28.6% against the industry average, which is 22.5%. Gilead Sciences' short-term assets of $ 12.6 billion exceed its short-term liabilities of $ 8.6 billion.

Gilead Sciences may resume trials of injectable lenacapavir for the treatment of HIV infection, which is a positive for the company's shares.

Distribution of 28 analyst recommendations on the company's shares: 15 to hold; 11 to buy; 2 to actively buy. The overall rating of recommendations for the company 2.5 is shifted towards buy. The company's shares are noticeably undervalued.

Key financial indicators:

The market capitalization is $ 81.96 billion.

Revenue for the last 12 months (TTM) was $ 27.472 billion.

Net profit for the last 12 months (TTM) $ 4.515 billion.

PEG 12 months (TTM) 0.54

P/E 12 months (TTM) 18.10

EPS 12 months (TTM) 3.58

Free Cash Flow (FCF) of $ 9.953 billion.

Dividend per share (%) 4.51

Dividend per share ($) 2.92

Ex-dividend date - 14.06.2022

The next dividend payment date is 27.07 - 01.08.2022.

Technical picture:

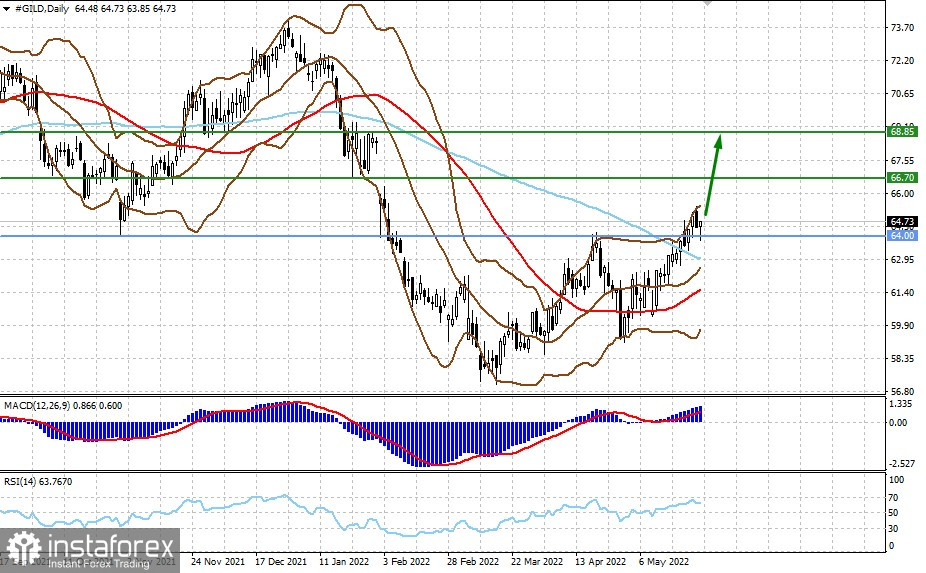

The security is trading above the support level of 64.00 on the daily chart, remaining in a three-month upward trend. The price is above the middle line of the Bollinger indicator. The MACD indicator is growing. The Relative Strength Index (RSI) is above the 50% level and is turning up.

Trading recommendation.

The stock is trading above the 50 and 100 daily moving averages. The price is above the support level of 64.00. The company's shares are slightly declining on the premarket by 0.203 to 64.78 from Monday's closing level of 64.80 (+0.51%).

Likely target levels:

The 1st target is 66.70 (short-term target) from yesterday's closing price of 64.80 (expected yield of 2.84%).

The 2nd goal is 68.85 (expected yield of 5.88%).

Conclusions:

We believe that the Gilead Sciences stock has a good potential for recovery growth. The paper can grow to the 3rd target mark in the period from 1 to 3 months.