Inflation in the eurozone has accelerated over the past year, thus putting at risk further economic growth of the region which may be evident as soon as this autumn. This fact fueled debates among ECB officials about how interest rates should be raised. Notably, no one questions the need for a rate hike anymore. What is more, the start of the rate increase is already set for July this year. The main question is what the scope of the rate hike should be and how long the tightening cycle will take.

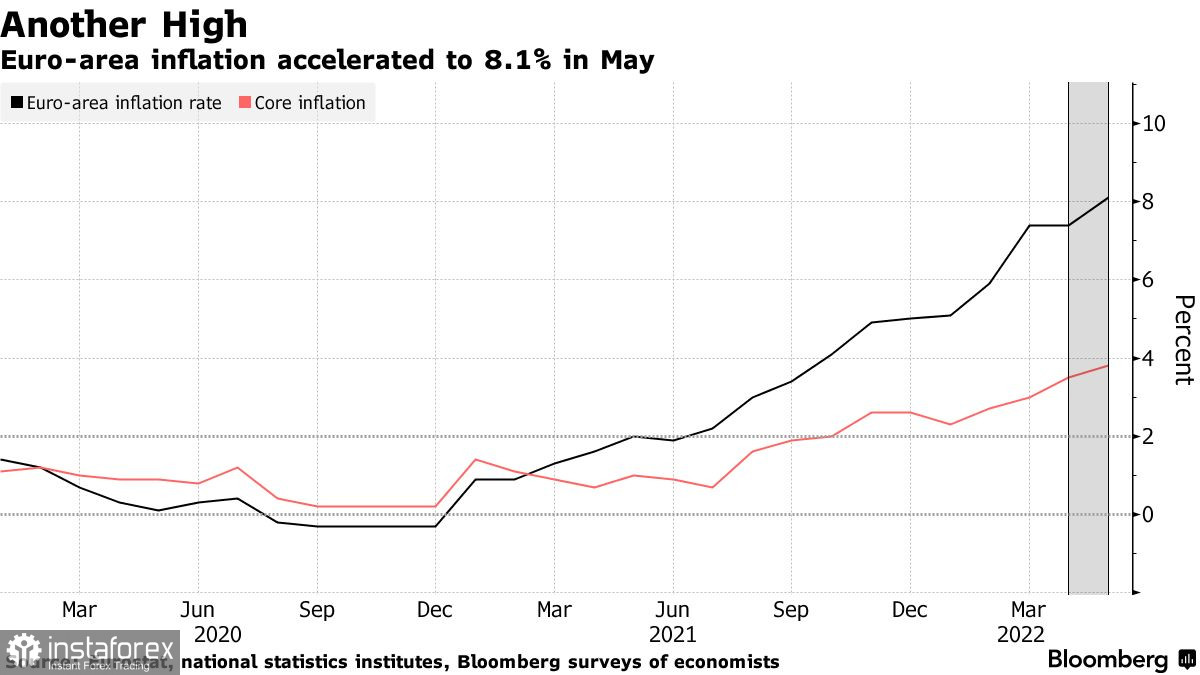

According to the recent data, consumer prices in the eurozone surged to 8.1% in May this year compared to the same period a year earlier. The reading came in much worse than expected as analysts predict a rise to 7.7%. A spike in inflation has been driven by soaring food and energy prices. The EU officials put the blame on Russia and its special operation in Ukraine which sent commodities prices soaring. As for core inflation, which excludes highly volatile goods, it increased to 3.8% which is still higher than the ECB target of 2.0%.

As I have mentioned above, the ECB is going to follow the lead of the US and UK and raise borrowing costs for the first time in more than a decade. All members of the block, which consist of 19 countries, approve of this move. ECB President Christine Lagarde announced last week that the regulator was ready to raise the rate by a quarter percentage point at its next meetings in July and September. Philip Lane, the chief economist of the European Central Bank, supported the plan saying that this will be its "benchmark pace" in the course of ending the stimulus program that included bond purchases.

Some ECB policymakers called on the regulator to raise the rate by 50 basis points at a time, just like the US Federal Reserve did. For instance, Klaas Knot, the Dutch Central Bank President and the member of the ECB's governing council, advocates for such a pace of monetary tightening.

However, others opposed such aggressive measures. Thus, Ignazio Visco, Governor of the Bank of Italy, said that the ECB must proceed in an orderly manner to avoid potential turbulence in the bond market. His French counterpart, Francois Villeroy de Galhau, also thinks that despite the need to promptly curb rising prices, the normalization of monetary policy should be done in a gradual manner.

Despite the continued surge in inflation, the ECB is unlikely to accelerate the pace of monetary tightening. To make a decision, the EU will probably rely on the actual macroeconomic data without looking too far ahead, as in the case of the United States. Yet, even if there is no interruption in Russian oil and gas supplies and the year-on-year increase in energy prices falls significantly, the inflation rate will probably still be around 6% by the year-end. This will be another reason for the ECB to resort to more aggressive measures.

Some of the eurozone countries have already recorded a rapid jump in consumer prices. Thus, inflation in Spain rose, denting hopes that the eurozone's rapid price surge has reached its peak. In May, prices accelerated to 8.5% from 8.3% in the previous month. The increase came due to the rise in fuel costs which offset a decline in electricity prices. This resulted in the record inflation rate across the continent. Core inflation, which does not take into account such volatile items as food and energy, reached the level of 4.9%.

Germany, Europe's leading economy, also recorded an all-time increase in prices. According to the report, a rapid surge in food and energy costs has driven inflation to new peak levels. Consumer prices in the block's leading economy jumped to 8.7% in May compared to the same period last year, while analysts predicted a rise to 8.1%.

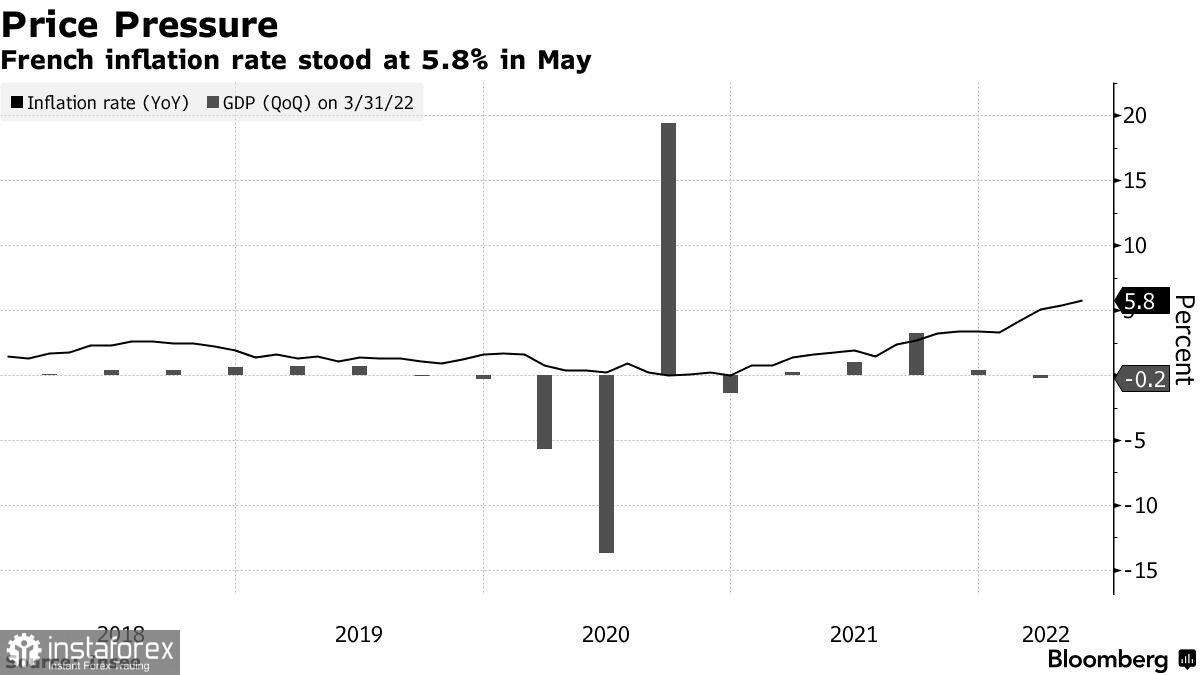

The fresh data showed that France is also facing a record-high level of inflation. Consumer prices in Europe's second-largest economy went up by 5.8% year-on-year, which come in line with the average estimate. Soaring food and energy prices were the main reason for a sharp rise.

After reaching a local high, the euro came under pressure again. Expectations of a more aggressive stance of the US Federal Reserve are limiting the upside potential of risk assets. In the short term, it is better to bet on the extended downward correction which takes place amid profit-taking at the end of the month. To stop the bearish trend, buyers will need to fight for the nearest support level of 1.0700. If they fail to do so, then bears will most likely push the instrument down to new lows of 1.0660 and 1.0630. The next target is found further at the support level of 1.0590. The growth of the euro is very possible, but traders need to act wisely. To resume the bullish trend, the price needs to climb above 1.0740. After that, a breakout of the 1.0790 level will be possible. This will pave the way towards the upper targets of 1.0820 and 1.0850.

As for the British pound, the situation is similar here. The downside correction may limit upside momentum and keep the pair in the sideways channel of 1.2550-1.2660. A lot will depend on the rhetoric of BoE's Governor Andrew Bailey. Most likely, he won't announce an increase in borrowing costs, especially amid a slowdown in the UK economy. Even if he will, the demand for the pound is unlikely to rise. Buyers of risk assets will defend the level of 1.2585. In case of its breakout, the price will head for 1.2550. The medium-term bearish trend is still in place, and the ongoing correction may quickly come to an end as soon as large sellers step in. A pause in the tightening cycle of the UK regulator due to a downturn in the economy may become one of such factors. In the short term, I recommend buying the pound on pullbacks as the bullish bias may strengthen. The nearest resistance is located at 1.2620. A breakout of this level will instantly push the price towards 1.2660 and 1.2690. If the quote breaks through 1.2550, this will strengthen the bear market and open the way to the levels of 1.2510 and 1.2480. The most distant target in the current conditions will be the support area of 1.2430. If the pair reaches this zone, this will limit the bullish potential in the near term.