The EUR/USD currency pair was trading down on Tuesday. The fall began at night and persisted throughout the day. Thus, we can even conclude that the euro currency has grown too much in the short term, so now a downward correction is required to possibly resume moving northward. Recall that many factors are currently working against the European currency. In particular, geopolitical and fundamental, at least. The macroeconomics alternately support the euro and the dollar. Nevertheless, the key issues for the European economy remain in a very difficult state. First, these are the sanctions of Europe itself against the Russian Federation. As we have already said, sanctions never work in one direction. If the European Union refuses, for example, to buy oil in Russia, then this leads to an increase in prices for "black gold", a shortage of oil in the European Union itself, and an increase in prices for almost all goods used in the production or transportation of fuel or oil. Thus, by imposing such sanctions, the European Union harms itself and its economy in the first place. Therefore, any sanctions against the Russian Federation are a blow to the European economy. Let it not be a strong blow, but a blow. And considering how many of these sanctions have already been imposed, there are not many such strong blows. Second, it is the geopolitical conflict in Ukraine.

With the fundamental background, everything is very simple, since it has not changed for a very long time. The ECB is still thinking about raising the rate in 2022, and at the same time, the Fed is ready to raise its rate to 2% at the next two meetings. This means that the yield of US Treasury bonds will rise, while similar EU bonds will remain low. Consequently, there is a flow of capital from the EU to the US and an increase in demand for the dollar. This is the most banal chain that shows why the rate increase favorably affects the national currency. And there are a lot of such moments. If the euro can still count on growth, it is only technical. After all, this currency has been falling for a very long time and very much, so you can also count on a strong correction.

New sanctions have arrived. And among them are sanctions on oil.

Meanwhile, the European Union did not "babysit" Hungary, which is single-handedly blocking a package of sanctions against the Russian Federation, which were approved by 26 other members of the alliance. Yesterday, it became known that the European Union will refuse 2/3 of oil imported from Russia, but the embargo will only apply to oil delivered by sea and will not affect oil pipelines. "The agreement banning the export of Russian oil to the EU reduces a huge source of funding for the Kremlin's military machine. This is maximum pressure on Russia to end the war," said the head of the European Council Charles Michel. It is worth noting that the oil from the pipelines has been decided to leave for now, since Hungary receives the "black gold" through the Druzhba oil pipeline. Through an oil pipeline that runs through Ukraine.

It is also reported that Poland and Germany will completely abandon any Russian oil by the end of the year and about 90% of the current import volumes from Russia will be banned. In addition, the largest Russian bank Sberbank is disconnected from the SWIFT system, and the broadcasting of three Russian state media is prohibited in the EU. Charles Michel also pointed out that the decision to leave oil from pipelines is temporary and the Alliance will continue to work to completely abandon supplies from the Russian Federation. Thus, even without Hungary's consent, the European Union can be said to have imposed an embargo on Russian oil. Even if Budapest continues to import hydrocarbons from the Russian Federation, it is still only a small part of the volume that the entire European Union imports. It is difficult to say whether it would be advisable to use the pipeline system for oil supplies to Hungary alone. Viktor Orban may have achieved his goal, but he definitely could not block the initiative of the entire European Union, as well as negotiate better conditions for himself. In addition, some media outlets are already writing that Orban's position is too different from that of other European leaders, clearly hinting at Hungary's possible exit from the EU.

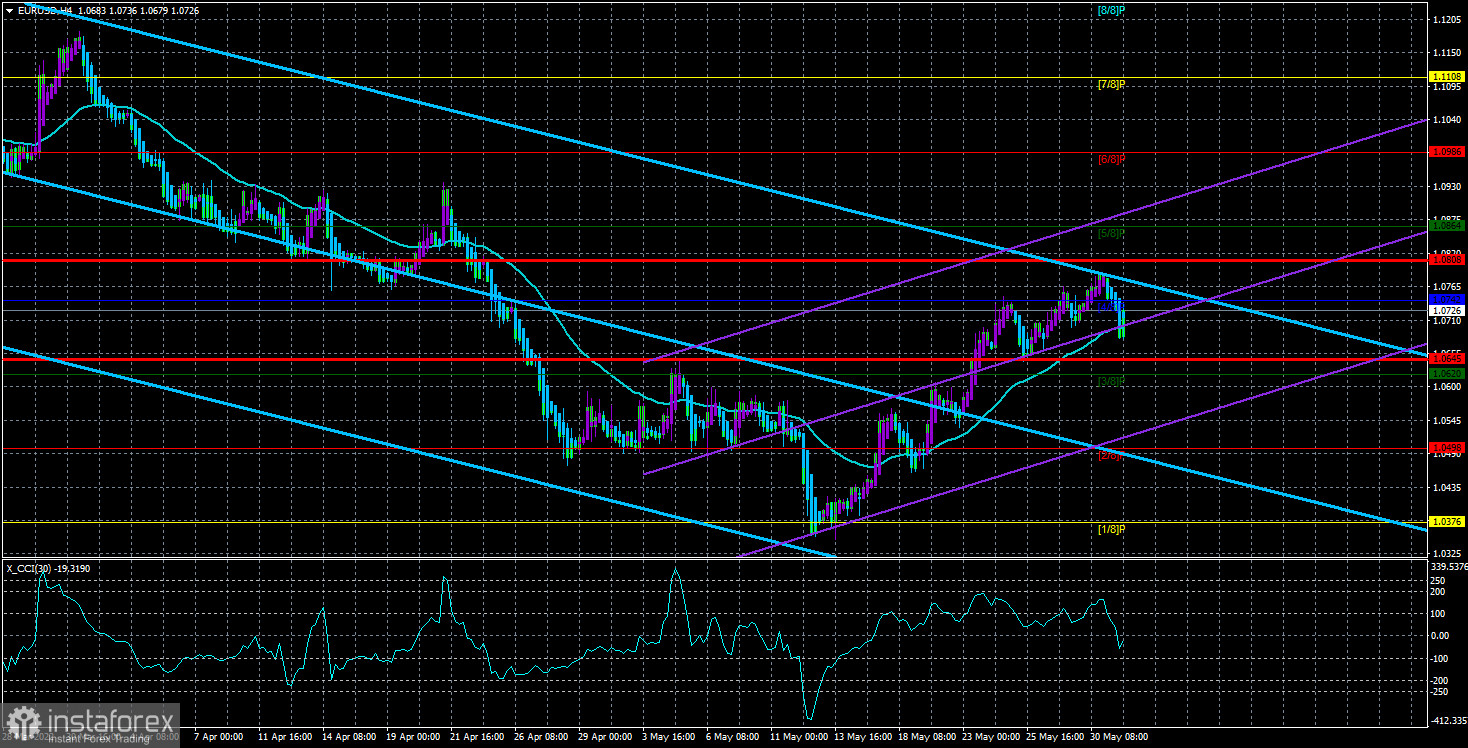

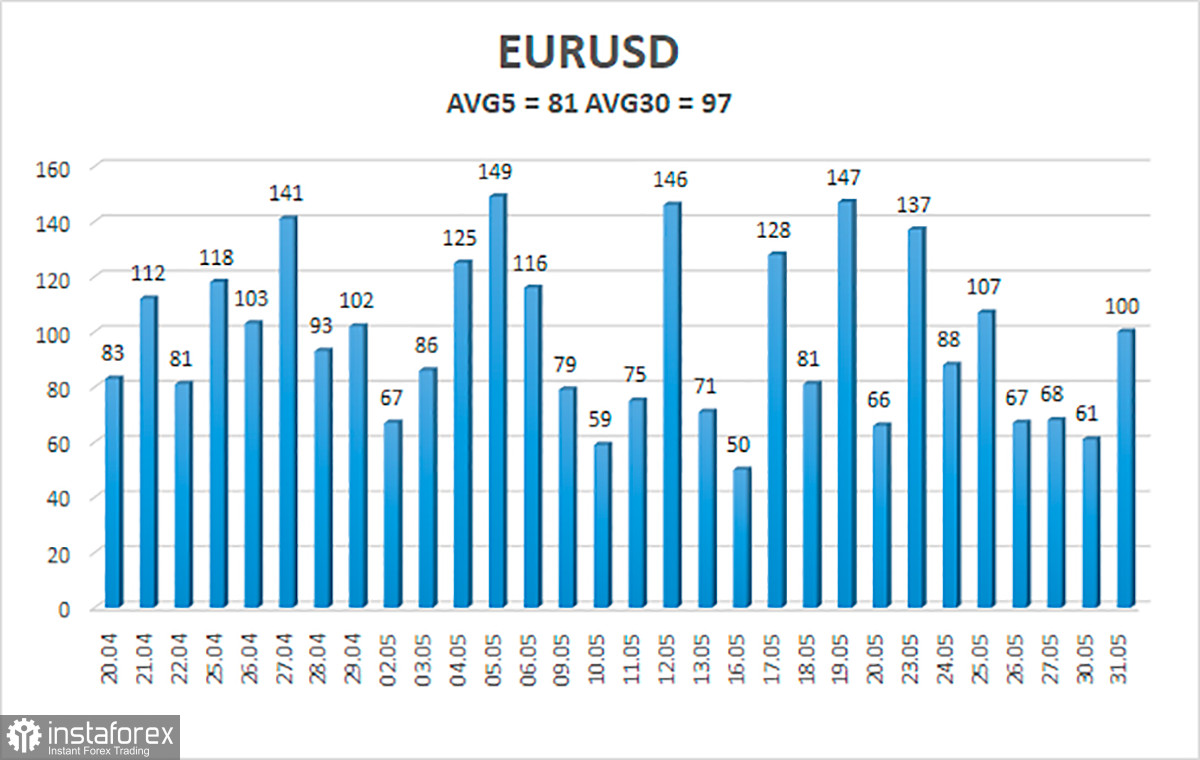

The average volatility of the euro/dollar currency pair over the last 5 trading days as of June 1 is 81 points and is characterized as "average". Thus, we expect the pair to move today between the levels of 1.0645 and 1.0808. The upward reversal of the Heiken Ashi indicator will signal the resumption of the upward movement.

Nearest support levels:

S1 – 1.0620

S2 – 1.0498

S3 – 1.0376

Nearest resistance levels:

R1 – 1.0742

R2 – 1.0864

R3 – 1.0986

Trading recommendations:

The EUR/USD pair continues to be located above the moving average and continues to form an upward trend. Thus, now we should consider new long positions with targets of 1.0808 and 1.0864 as the price bounced off the moving average. Short positions should be opened with targets of 1.0620 and 1.0498 if the price is fixed below the moving average line.

Explanations of the illustrations:

Linear regression channels - help determine the current trend. If both are directed in the same direction, then the trend is strong now.

Moving average line (settings 20.0, smoothed) - determines the short-term trend and the direction in which trading should be conducted now.

Murray levels - target levels for movements and corrections.

Volatility levels (red lines) - the likely price channel in which the pair will spend the next day, based on current volatility indicators.

CCI indicator - its entry into the oversold area (below -250) or into the overbought area (above +250) means that a trend reversal in the opposite direction is approaching.