In the eurozone, inflation soared to 8.0%. In this light, pressure on the ECB is likely to increase, leaving the regulator no other choice but to hike interest rates sooner than planned. In addition, the EU announced an embargo on Russian oil supplies, except for those coming in by pipelines. Against this backdrop, market volatility increased.

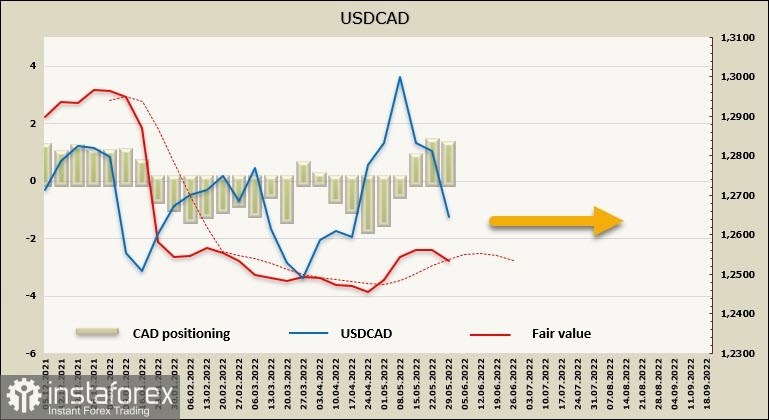

USD/CAD

Today, the Bank of Canada is expected to raise the interest rate by 50 basis points to 1.5%.

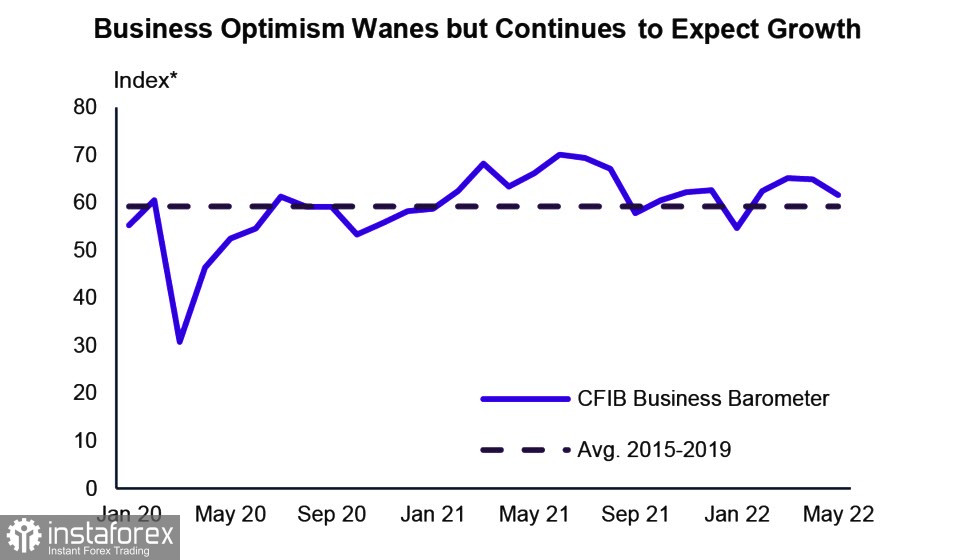

Although Canada's recent macroeconomic results turned out to be disappointing, they are unlikely to change the BoC's stance since inflation still requires immediate action. Thus, Canada's Q1 GDP missed the market forecast (+0.8%). Meanwhile, in April, the Canadian economy expanded by 0.2%. Retail sales in the country were unchanged from a month earlier (forecast: +1.4%), that is, household spending is noticeably lower than anticipated. Optimism among small businesses has dropped since March.

The net short position on CAD decreased by 142 million to -990 million. The price reversed down. It is now near the long-term average. Generally speaking, USD/CAD is likely to be bearish.

The pair may well react to the BoC's decision with a modest fall. A rate hike has already been priced in by the market. The price may descend to support around 1.2530/40 or to the channel's limit around 1.2470/80. In the case of dovish statements by the Bank of Canada, USD/CAD may rise in spite of a rate hike. However, such a scenario is highly unlikely to unfold.

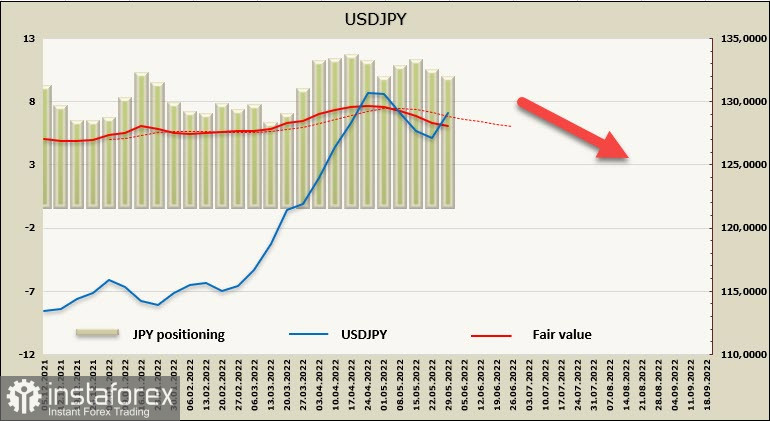

USD/JPY

In spite of the difference in the Fed's and the Bank of Japan's monetary policy stance, USD/JPY has limited growth potential.

The dollar has been strengthening versus the yen since the end of February when Russia started a military operation in Ukraine and the Fed took an aggressive stance on monetary policy. The first of these two factors is less prominent. It is clear now that the conflict is unlikely to end any time soon. In this light, uncertainty is increasing but volatility is decreasing. As for the second factor, the Fed is no longer anticipated to be as aggressive as it was in March and April.

The reason for a change in expectations is that the US economy could be heading for a recession already this year. Earlier, it was forecast that the US could enter a recession in 2023. Therefore, market sentiment has changed. Indeed, the regulator might not be able to raise rates at the same pace it did a month ago.

As for the Japanese yen, the price is below the long-term average, which suggests that USD/JPY is unlikely to resume growth.

On the way to the high of 131.31, the pair may slow down its growth. Should a sell-off begin in the 129/130 zone, the bullish impulse will lose its strength. If the price breaks through the high, the target will stand in the 132.00/50 zone. A new high will be formed there, and the quote will try to go down again.