Rumors of a September pause in the Federal Reserve's monetary policy tightening and a slowdown in US inflation have revived hope among gold fans. Nevertheless, the words of FOMC member Christopher Waller about his readiness to vote for a 50 bp increase in the federal funds rate at every Committee meeting until the PCE returns to 2%, have turned it into a lost illusion. The precious metal again went to $1800 per ounce, and its correction allowed us to successfully form short positions.

Markets are growing on rumors, and the reason for the rumors are the comments of the envoys of the central banks. If Atlanta Fed President Rafael Bostic talks about a halt in the campaign towards a neutral rate, this does not mean that all other members of the FOMC share his opinion. Yes, in April the growth rate of the personal consumption spending index slowed down, but the Fed's preferred inflation rate remains at elevated levels. And after the introduction of the EU embargo on Russian oil, most likely, it will continue to remain there for a very long time. Together with hawkish dominance within the Open Market Committee, this suggests that Treasury yields and the US dollar will not fall too low. Bad news for XAUUSD bulls.

Inflation dynamics and US bond yields

In fact, the Fed is not going to retreat from its plans to aggressively tighten monetary policy. And this idea is supported in the White House, as evidenced by the meeting between US President Joe Biden and Fed Chairman Jerome Powell. The words of Treasury Secretary Janet Yellen indirectly speak of carte blanche on the part of Biden, that she was wrong in 2021, considering high inflation to be a temporary phenomenon. If it is long-term, the central bank will have to raise the rate at every FOMC meeting. And expectations of its growth by 250 bp until the end of 2022 from the derivatives market are reasonable.

No matter how much they say that gold is a tool for hedge inflation and its continued presence at elevated levels guarantees its return above $2,000 per ounce, I fundamentally disagree with this. The precious metal is reacting to the Fed's monetary policy, which determines the fate of the yield of Treasury bonds and the US dollar. And their outlook looks bullish so far. As for the recession that Bank of America is talking about in the event of a loss of Russian oil of more than 2 million b/d, in my opinion, even that will not stop the Fed. As a result, XAUUSD will continue to be in the black, even if the data on the US labor market for May will bring disappointment.

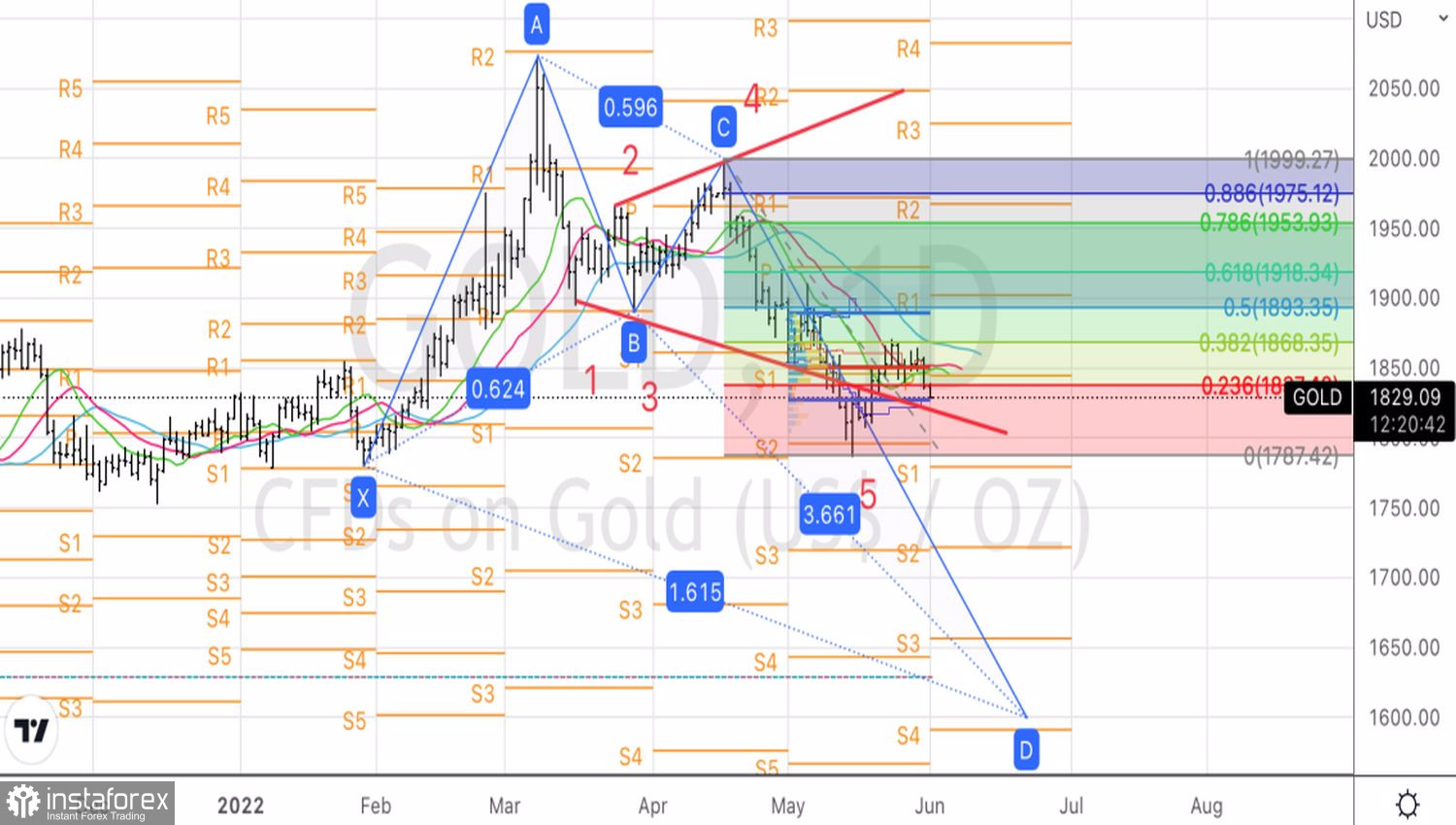

Technically, on the daily chart of gold, the Expanding Wedge pattern is clearly playing out. Its timely identification allowed us to form shorts from $1869 and $1838 an ounce. The recommendation is to keep and periodically build up on pullbacks.

Gold, daily chart