The Bank of Canada management is widely expected to decide at today's meeting to raise interest rates to 1.5% from the current 1.0%. In normal economic conditions, this is a bullish factor for the national currency. However, now the situation in the world and, in particular, in the Canadian economy cannot be called normal. Inflation is accelerating at a significant pace, while the global economy is facing such negative factors as the consequences of the coronavirus pandemic and heightened geopolitical risks.

Therefore, the reaction of the market to the decisions of central banks is sometimes unpredictable.

Today, volatility in financial markets, especially in CAD quotes, may rise sharply at 14:00 GMT, especially if unexpected statements are received from the Bank of Canada regarding the prospects for the bank's monetary policy.

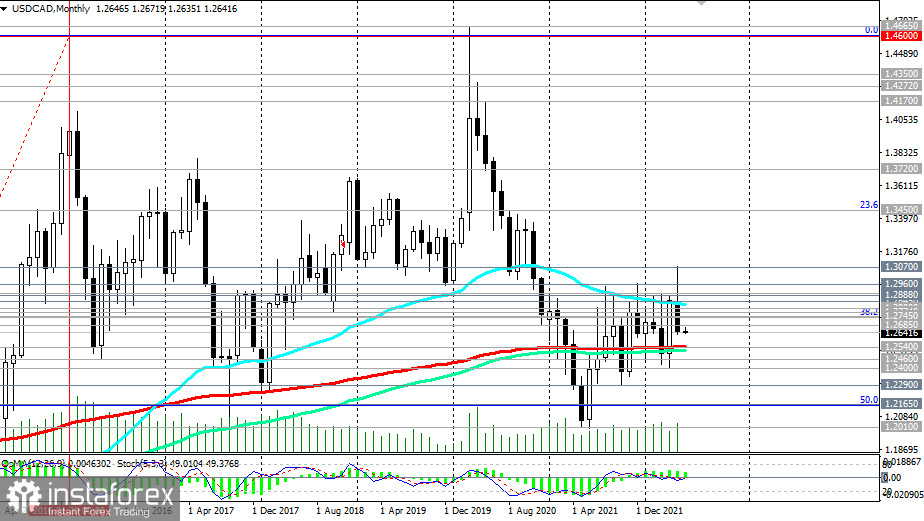

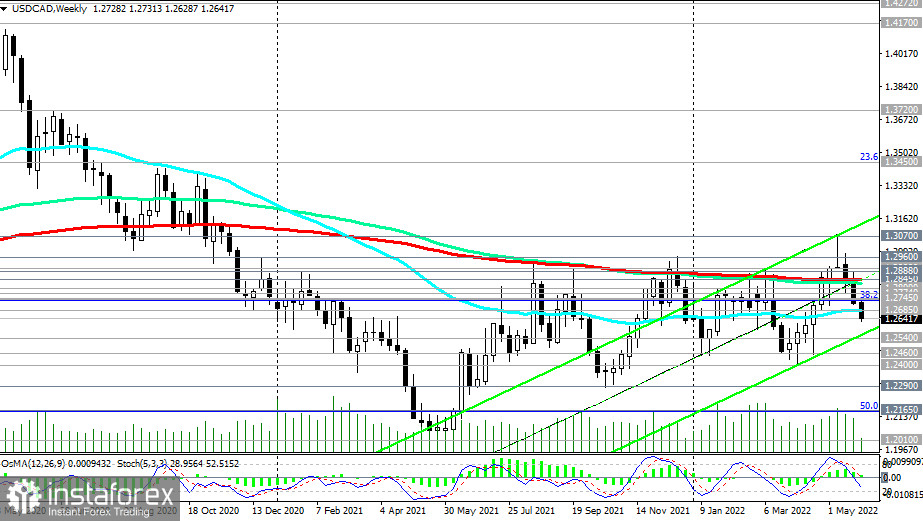

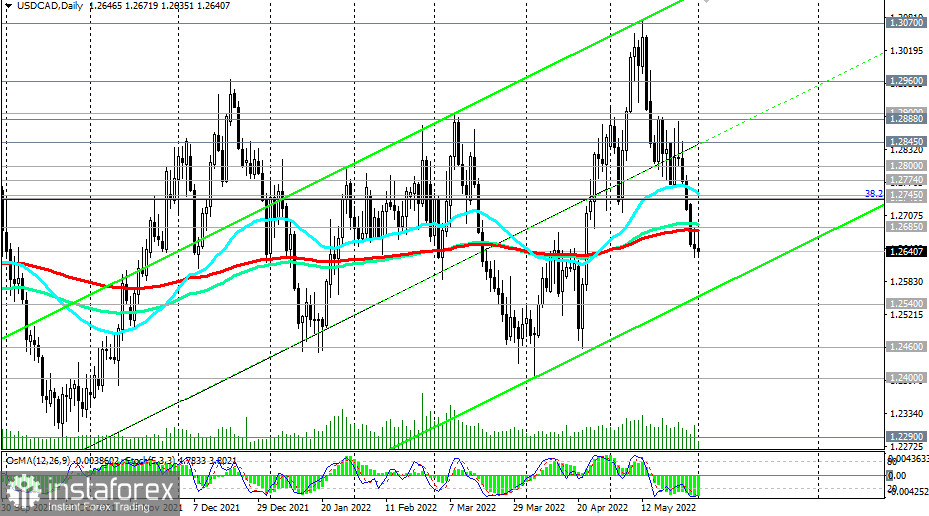

Meanwhile, USD/CAD is currently trading near 1.2640, below the important long-term resistance levels 1.2685 (200 EMA on the daily chart) and 1.2845 (200 EMA on the weekly chart). The price has 100 points to go to the key long-term support level of 1.2540 (200 EMA, 144 EMA on the monthly chart), which separates the long-term bull market from the bear market. Given the pair's average daily volatility of 100–130 pips, the price can go this way within one day.

Considering the currently prevailing negative dynamics of the pair, we should expect its continuation and further decline. In this case, it is possible to enter short positions both on the market and on a pending Stop order below yesterday's local low of 1.2628. Stop-loss should be placed above the resistance level of 1.2685.

In an alternative scenario, a signal for buying will be a breakdown of the resistance level of 1.2685 with the nearest target at the resistance level of 1.2745 (50 EMA on the daily chart and the 38.2% Fibonacci retracement in the USD/CAD growth wave from 0.9700 to 1.4600).

Breakdown of resistance levels 1.2774 (200 EMA on the 4-hour chart) and 1.2800 will provoke further growth of USD/CAD within the ascending channel on the weekly chart, the upper limit of which is currently passing through 1.3100.

In any case, the USD/CAD pair will continue to have a high level of volatility, providing a lot of trading opportunities.

Support levels: 1.2628, 1.2600, 1.2540, 1.2460, 1.2400, 1.2290, 1.2165, 1.2010, 1.2000

Resistance levels: 1.2685, 1.2745, 1.2774, 1.2800, 1.2845, 1.2888, 1.2900, 1.2960, 1.3000, 1.3070, 1.3100

Trading Tips

Sell Stop 1.2620. Stop-Loss 1.2710. Take-Profit 1.2600, 1.2540, 1.2460, 1.2400, 1.2290, 1.2165, 1.2010, 1.2000

Buy Stop 1.2710. Stop-Loss 1.2620. Take-Profit 1.2745, 1.2774, 1.2800, 1.2845, 1.2888, 1.2900, 1.2960, 1.3000, 1.3070, 1.3100